Fastmarkets indices

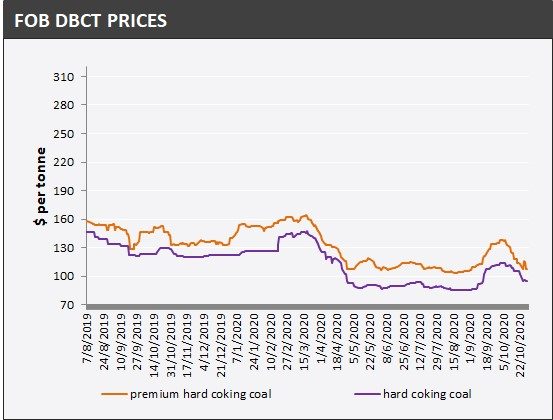

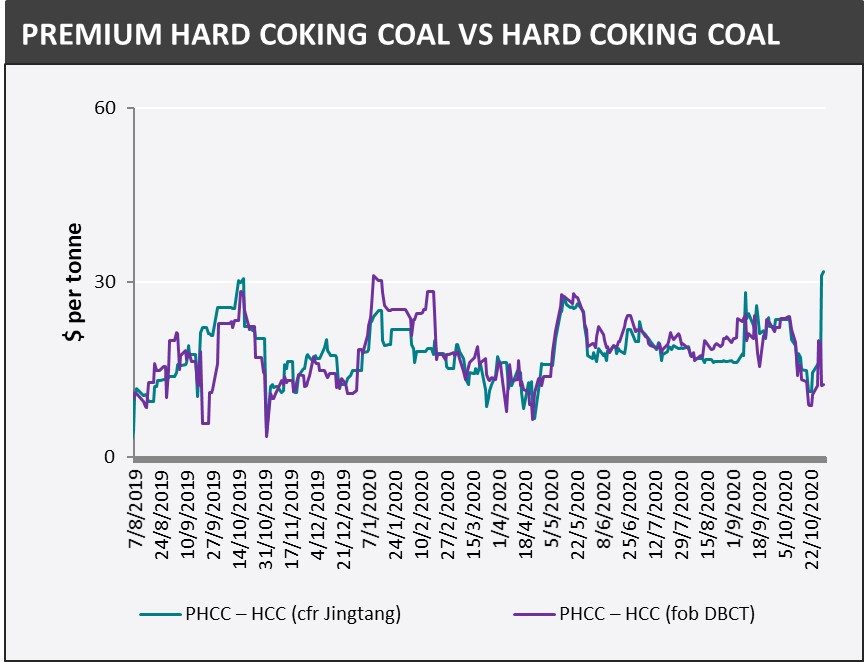

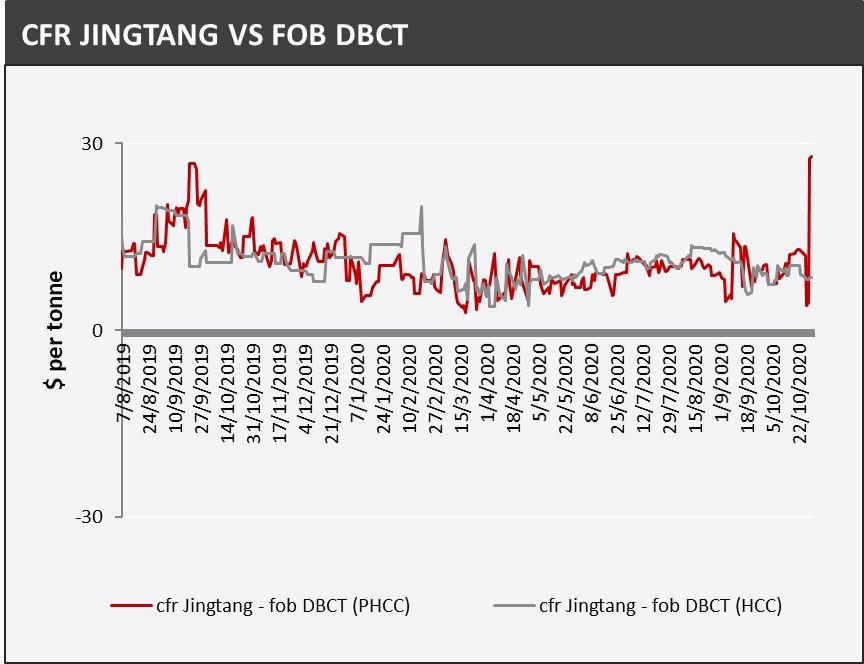

Premium hard coking coal, fob DBCT: $107.94 per tonne, up $0.20 per tonne

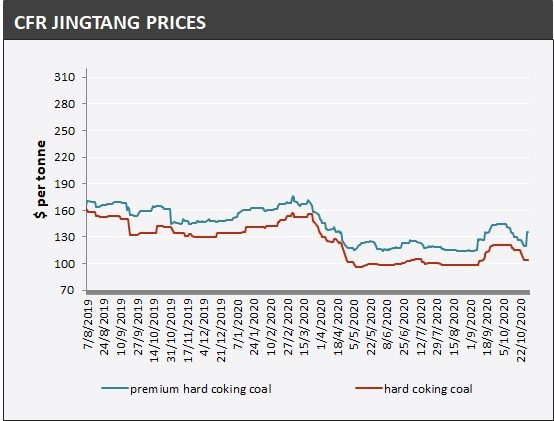

Premium hard coking coal, cfr Jingtang: $135.80 per tonne, up $0.54 per tonne

Hard coking coal, fob DBCT: $95.52 per tonne, unchanged

Hard coking coal, cfr Jingtang: $104.01 per tonne, unchanged

An 85,000-tonne cargo of premium low-volatility hard coking coal, with December 1-10 laycan, was traded at $110 per tonne fob Australia on Friday October 30, sources told Fastmarkets.

“The transaction indicated that some traders were taking a position when seaborne premium hard coking coal prices were at a relatively low level, therefore, the seaborne fob market has gained some support,” a Singapore-based trader said.

Another trader source heard that the recent two cargoes of premium low-vol hard coking coal were procured by traders from China who expect the ongoing restriction on Australian coking coal to be loosened next January, when import quotas for 2021 are allocated to end users.

“Whether it will be allowed to import Australian coal remains uncertain though,” the trader source said.

One buyer source from India said that Indian steel mills were willing to pay around $107.50 per tonne fob Australia for premium low-vol hard coking coal and would pay around $105.50 per tonne fob Australia for premium mid-vol material.

“Buyers from India are likely to procure some seaborne materials today,” the buyer predicted.

Dalian Commodity Exchange

The most-traded February coking coal futures contract closed at 1,322 yuan ($196.86) per tonne on Friday, down by 0.50 yuan per tonne.

The most-traded January coke contract closed at 2,189 yuan per tonne, up by 19.50 yuan per tonne.

Sign up here for Fastmarkets’ free webinar on November 4, 2020, beginning at 9am GMT: ‘European flat steel market – on the mend after the Covid-19 fallout?’

– Overview of EU flat steel price developments in 2020 so far

– Suppliers’ response to the drop in demand

– Fortress Europe? Toughening of trade defense measures

– The survival of European steelmakers facing high raw material costs

– Demand contraction and a slow path to recovery

– Near-term price outlook.