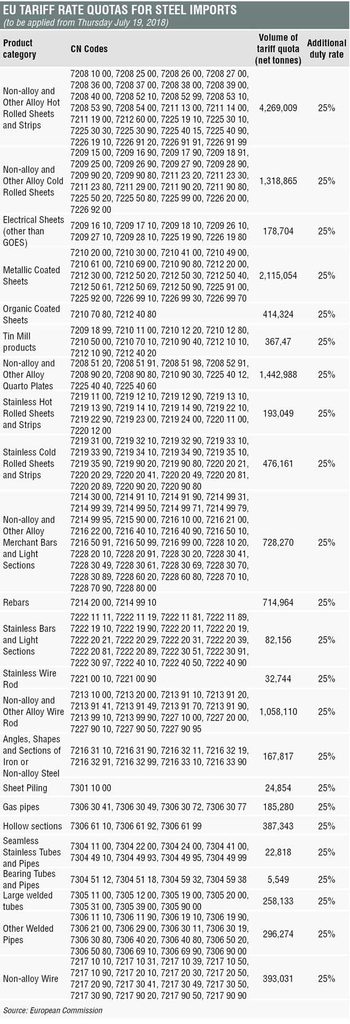

The provisional measures will take the form of a Tariff Rate Quota (TRQ) for each of the 23 categories of product. Tariffs of 25% will only be imposed once imports exceed the average of imports over the past three years.

The quota will be allocated “on a first come, first served basis, thus at this stage not allocated by individual exporting country,” the EC said.

The safeguard measures will come into effect on July 19.

The EC opened an investigation into 26 steel products in late March, in an attempt to prevent steel shipments being redirected to the EU as a result of the Section 232 import tariffs imposed by the United States. Two more products were added to the list in late June.

“The US tariffs on steel products are causing trade to be diverted, which may result in serious harm to EU steelmakers and workers in this industry,” European Commissioner for Trade, Cecilia Malmström, said.

“We are left with no other choice than to introduce provisional safeguard measures to protect our domestic industry against a surge of imports,” she added.

“These measures [will] ensure that the EU market remains open, and will maintain traditional trade flows,” she said. “I am convinced [they will] strike the right balance between the interests of EU producers and users of steel, such as the automotive industry and the construction sector, which rely on imports. We will continue to monitor steel imports [before making] a final decision by early next year, at the latest.”

The measures are to be imposed against all countries, with the exception of some developing countries which have limited exports to the EU, the EC said. And due to the close economic links between the EU and countries in the European Economic Area (EEA), Norway, Iceland and Liechtenstein have also been exempted from the measures.

The provisional safeguard measures can remain in place for a maximum of 200 days. A definitive decision in the case will be made at the latest by early 2019.

Twelve steel products covered by the current provisional safeguard measures are also subject to anti-dumping and countervailing duties in the EU. Therefore, the EC is going to consider whether the accumulation of the existing trade defense measures with the safeguard measures “would not lead to a greater effect than desirable,” the EC said.

To avoid the imposition of ‘double remedies’, whenever the tariff quota is exceeded, existing anti-dumping and countervailing duties will be suspended or reduced to ensure that the combined effect of the measures does not exceed the highest level of the safeguard, anti-dumping or countervailing duties in place, the EC said.