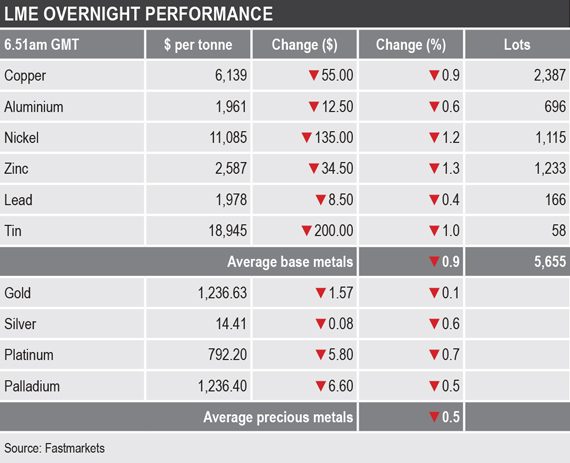

Three-month zinc and nickel prices led the declines with drops of 1.3% and 1.2% respectively, while the three-month copper price was down by 0.9% at $6,139 per tonne.

Volume across the complex has been average with 5,655 lots traded as at 6.51am London time.

The precious metals were weaker on Thursday, with the complex down by an average 0.5%, with the gold price at $1,236.63 per oz.

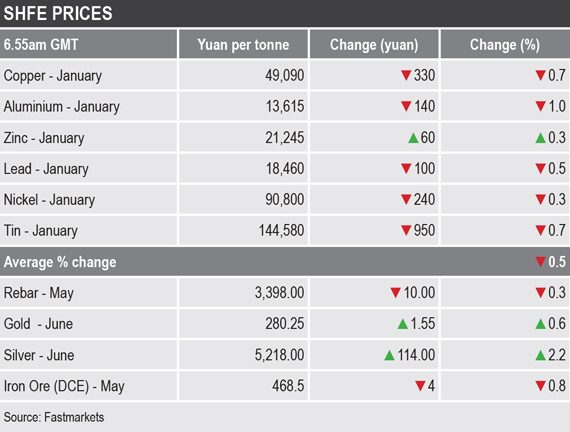

In China this morning, January contract prices for base metals on the Shanghai Futures Exchange were for the most part weaker, the exception being zinc that was up by 0.3%; aluminium was down by 1%, copper was off by 0.7% at 49,090 yuan ($7,156) per tonne and the rest were down by an average of 0.5%.

Spot copper prices in Changjiang were down by 0.3% at 49,210-49,520 yuan per tonne and the LME/Shanghai copper arbitrage ratio was firmer at 7.99, compared with 7.97 on Wednesday, this suggests Chinese copper prices have not pulled back to the same extent as LME copper prices.

In other metals in China, the May iron ore contract on the Dalian Commodity Exchange was down by 0.8% at 468.50 yuan per tonne. On the SHFE, the May steel rebar contract was down by 0.3%.

In wider markets, spot Brent crude oil prices were weaker, off by 0.61% at $61.13 per barrel – the recent low being $57.52 per barrel. The yield on US 10-year treasuries was weaker at 2.8963% and the yield on the US 2-year and 5-year treasuries were at 2.7824% and 2.7684% respectively. The German 10-year bund yield was little changed at 0.2600%. The weaker yields suggest investors expect the US Federal Reserve to slow the pace of interest rate rises, but the inverted yield curve is seen as a warning that an economic slowdown may be on the way.

Asian equity markets on Thursday remain weak: the Nikkei (-1.91%), the CSI 300 (-1.95%), the ASX 200 (-0.19%), the Kospi (-1.55%) and the Hang Seng (-2.88%). The arrest of Huawei’s chief financial officer in Canada following a US extradition order has raised trade tensions again.

This follows further weakness in Europe on Wednesday when the Euro Stoxx 50 was down by 1.22% at 3,150.27.

The dollar index is climbing again and was recently quoted at 97.17 – the stronger dollar and weaker US Treasury yields do not go hand-in-hand, suggesting the dollar was up for safe-haven reasons. The other major currencies we follow are either consolidating or are weaker: euro (1.1329), sterling (1.2710), the Australian dollar (0.7228) and the yen (113.10).

The rebound in the yuan seen on Monday and Tuesday has halted for now, with the currency recently quoted at 6.8876, while the other emerging market currencies we follow are weaker.

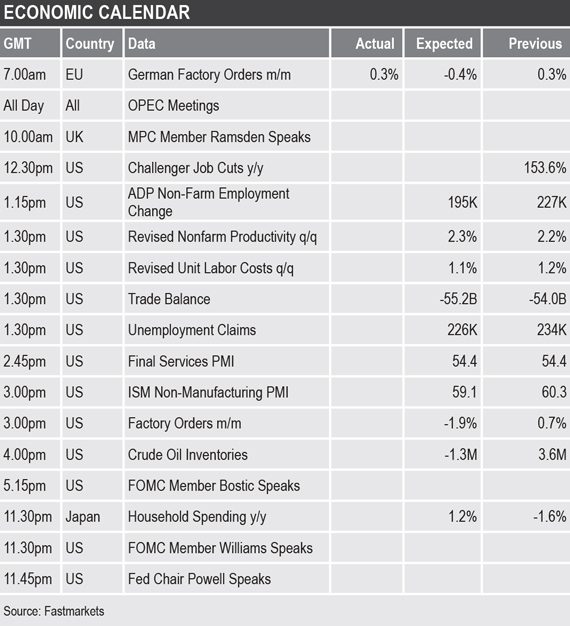

In data already out on Thursday, German factory orders were up by 0.3%, which was unchanged from the previous reading. Data out later is focused on the US and includes: Challenger job cuts, ADP non-farm employment change, non-farm productivity, unit labor costs, trade balance, initial jobless claims, final services purchasing managers index (PMI), ISM non-manufacturing PMI, factory orders and household spending. In addition, Federal Open Market Committee members Raphael Bostic and John Williams and Federal Reserve chair Jerome Powell are speaking.

The base metals prices have lost the shine they garnered in the aftermath of the positive trade developments seen at this past weekend’s Group of Twenty (G20) meeting, but most are holding up in or near recent high ground – the exception being copper that has given back all of its post-G20 gains. We still feel that the trade truce offers an opportunity for stronger growth but it looks as though the market is waiting for evidence of this before it restocks.

Gold prices have pulled back from Tuesday’s highs and prices are consolidating, but the uptrend seems intact and the market looks well placed to push higher. With the US treasury yields falling we expect the dollar to head lower and that in turn is expected to support a firmer gold price.