- Zinc prices extend lower after Tuesday’s rise in LME stocks

Base metals

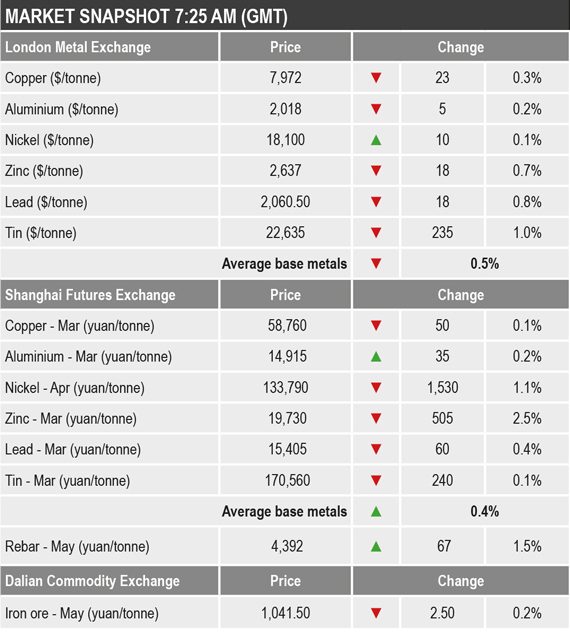

Three-month base metals prices on the LME were mostly down this morning; the exception was nickel ($18,100 per tonne), that was up by 0.1%, while the rest were down by an average of 0.6% – led by a 1% fall in tin to $22,635 per tonne. Copper was off by 0.3% at $7,972 per tonne, while zinc was down by 0.7% at $2,637 per tonne, which is now down 9.1% from the January 8 high at $2,897 per tonne. Tuesday’s 46,300-tonne rise in zinc stocks on the LME, has weighed on prices.

The most-traded base metals contracts on the SHFE were also mainly down this morning; March aluminium was up by 0.2%, while the rest of the metals were weaker. March zinc led on the downside with a 2.5% fall, March tin and March copper were both down by 0.1%, with the latter at 58,760 yuan ($9,233) per tonne, while April nickel was down by 1.1% and March lead was down by 0.4%.

Precious metals

Spot gold and silver were both down by 0.1% this morning, at $1,849.17 per oz and $25.40 per oz respectively, platinum was down by 0.4% at $1,095.50 per oz and palladium was little changed at $2,317.50 per oz.

Wider markets

The yield on US 10-year treasuries has edged higher this morning; it was recently quoted at 1.04%, compared with 1.03% at a similar time on Tuesday.

Asian-Pacific equities were mixed this morning: the Hang Seng (-0.05%), the Kospi (-0.57%), the ASX 200 (-0.65%), the CSI (+0.27%) and the Nikkei (+0.31%).

Currencies

The US Dollar Index started to edge higher on Monday but the rebound faltered on Tuesday and the index was recently quoted at 90.23 – this after a high of 90.62 on Tuesday.

The other major currencies were mainly consolidating this morning: the euro (1.2154), the yen (103.67) and the Australian dollar (0.7737), but sterling (1.3749) was stronger.

Key data

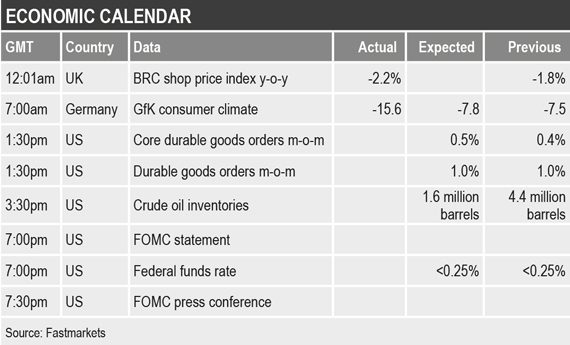

Key data already out on Wednesday showed Germany’s GfK consumer climate index fell to 15.5 in January, this after a reading of -7.5 in December.

Later there is US data on durable goods and crude oil inventories, which will be followed by the FOMC interest rate announcement, statement and press conference.

Today’s key themes and views

The metals continue to look mixed with tin looking the strongest, zinc looking the weakest and copper trading sideways in a narrow range.

Although we remain long-term bullish toward the base metals on account of expecting more infrastructure spending, we expect some countertrend moves along the way, especially because the metals have rallied so much since last March’s sell-off.

Gold prices remain in consolidation mode, capped by overhead resistance above $1,880 per oz, but with dips below $1,820 per oz attracting buying. We wait to see if the FOMC statement contains anything to provide gold with more direction.