From former President Barack Obama’s “shovel-ready” initiatives to Donald Trump’s “trillion-dollar plan,” Americans have yet to see any real action to improve the country’s decaying infrastructure. In an attempt to sway Washington into action, the Metals Service Center Institute (MSCI) launched its “Build Now” campaign in February 2021.

The campaign encourages businesses and members of the public to share images of bridges, train lines, hospitals and roads in need of replacement or repair.

The MSCI, which represents both steel and aluminium distributors and processors, believes the US has significantly under-invested in infrastructure for decades, and it’s time for a change.

Is the new US administration set for a change?

To strengthen America’s global competitive edge, investing in infrastructure and combating climate change are both critical. And it seems that President Joe Biden’s administration could deliver a climate-focused infrastructure plan. Speculation around a $2-trillion infrastructure plan could signal buoyant demand for steel and non-ferrous metals in the medium term.

The Build Now campaign shows that many roads, bridges and physical structures are in a state of decay, and have been for decades. It could take an investment of nearly $4.59 trillion over the next five years to rectify, MSCI has speculated.

Most traditional infrastructure projects heavily consume multiple steel products, including reinforcing bar (rebar), structural and rail. But with the growing decarbonization pressure, it is safe to say that any pending plans will fall in line with the green agenda.

What happens next?

Infrastructure is an evident focus when recovering from a global crisis. Strategic investment in infrastructure will enrich the job market and stimulate economic growth. A focus on traditional infrastructure could boost non-residential construction over time and likely prompt demand across the steel supply chain.

Impact on long steel

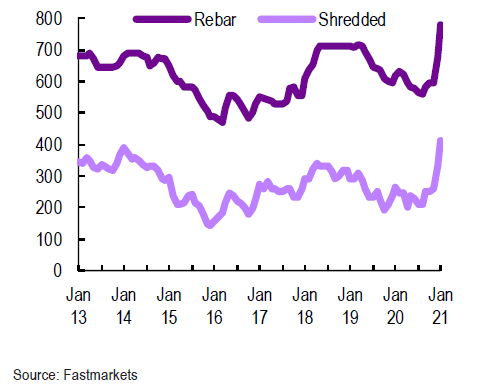

US rebar prices have skyrocketed over the past few months, reaching $835 per short ton in early March. Steady construction demand in some states in the US South supported this uptick, although it is unclear how long this renewed demand will hold up. A recent forecast from the American Institute of Architects (AIA) indicates that non-residential construction spending could fall by 5.7% in 2021. This potential decline takes into account that Biden’s infrastructure plan will take some time to make an impact.

Steel over scrap

Obsolete scrap, shredded in particular, rebounded by $50 per gross ton in March after tumbling by $60 per ton in February. The rise in March is supported by increased electric-arc furnace output.

Once issued in the US, infrastructure plans have the potential to further boost long steel and scrap prices in the coming years.

To understand some of the implications that infrastructure investments could have on the US steel market, read our full report on US infrastructure fevelopments and steel demand.

You should also join our free to attend virtual event – Scrap, DRI and Mini-Mills 2021 – to explore the emerging opportunities across the steel and scrap supply chain throughout 2021.