- The spread of the Covid-19 pandemic is becoming polarized on a regional basis…

- …this could threaten the global recovery and travel

- Tension rises on Russia-Ukraine border

Base metals

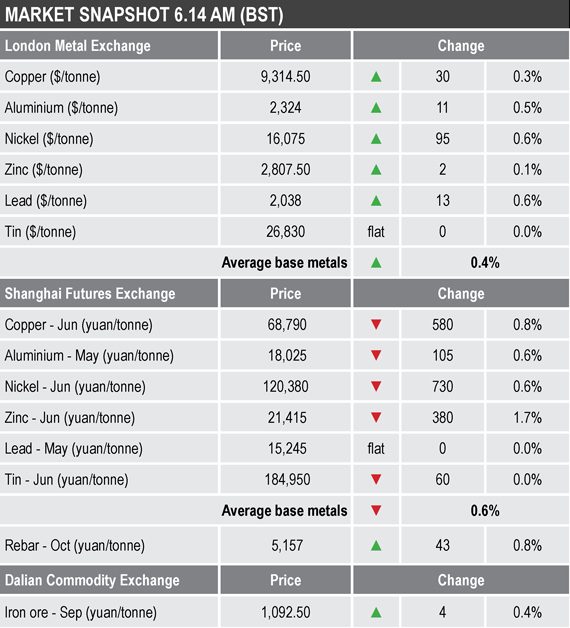

LME three-month base metals prices were up by an average of 0.3% this morning, but this was in response to a down day on Tuesday, when the complex closed down by an average of 0.7%. Zinc and tin were little changed, while the rest were up between 0.3% and 0.5%, with copper up by 0.3% at $9,314.50 per tonne.

While the LME metals were firmer, the most-active base metals contracts on the SHFE were more down than up, with June copper, nickel and zinc and May aluminium down by an average of 0.9%, led by a 1.7% fall in zinc prices, with copper was off by 0.8% at 68,790 yuan ($10,580) per tonne. May lead and June tin were little changed.

Precious metals

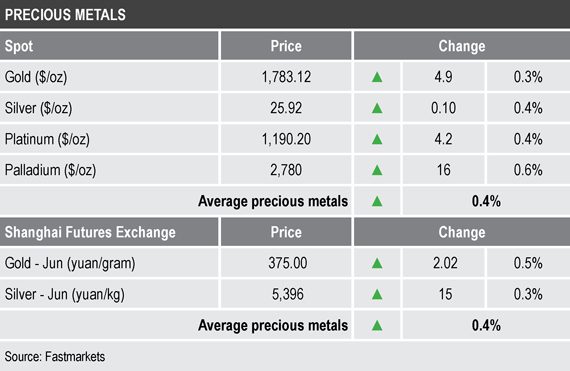

Spot gold prices were up by 0.3% at $1,783.12 per oz from Tuesday’s close ($1,778.20), but up from $1,771.99 per oz at a similar time on Tuesday. Silver ($25.92 per oz), platinum ($1,190.20 per oz) and palladium (2,780.00 per oz) were up by an average of 0.4%.

Wider markets

The yield on US 10-year treasuries has slipped again this morning and was recently quoted at 1.56%, this after 1.62% at a similar time on Tuesday.

Asian-Pacific equities were mainly weaker on Wednesday: the CSI 300 (+0.27%), the Hang Seng (-1.8%), the Kospi (-1.37%), the ASX 200 (-0.58%) and the Nikkei (-2.14%).

Currencies

The US Dollar Index was getting some lift this morning after extending lower on Tuesday, it was recently quoted at 91.20 after a low yesterday of 90.85.

The other major currencies were mixed, with the euro (1.2032), the Australian dollar (0.7715) and sterling (1.3933) consolidating/giving back some of gains seen on Monday and Tuesday, while the yen (107.97) continues to strengthen.

Key data

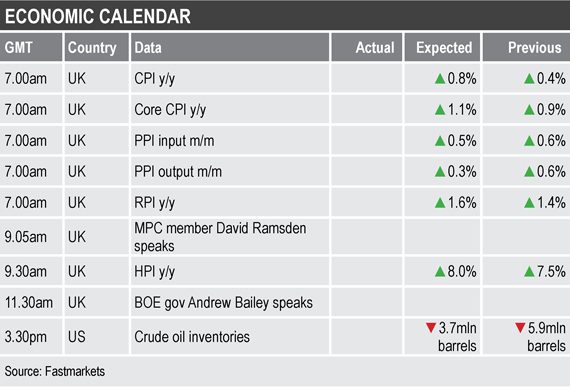

The economic agenda is mainly focused on price data out of the United Kingdom, with consumer prices (CPI), producer prices (PPI), retail prices (RPI) and house prices (HPI). There is also data on crude oil inventories in the United States.

In addition, Bank of England governor Andrew Bailey and UK Monetary Policy Committee member David Ramsden are scheduled to speak.

Today’s key themes and views

Most of the LME metals encountered resistance while they approached former highs on Tuesday, but the dips were attracting buying this morning. Nickel prices remain the odd one out, because they are stuck sideways well below recent highs. With broader markets, especially the major Wall Street indices, turning lower in recent days, the LME metals may need to pull back to consolidate again. If resistance proves too strong then that opens the door for stale long liquidation.

While we have seen the path of least resistance in the metals as lying to the upside recently, we have also been mindful of the potential downside risks on the back of credit tightening in China, or as a result of a broader-based equity correction. The rapid pick-up in the spread of the pandemic in some countries, combined with the rise in geopolitical tensions with Russia, may act as a reminder that there is little room for complacency.

Gold prices are on the rise again after a brief pause on Monday – this, combined with the weaker US treasury yields and the firmer yen, suggest haven demand is picking up, which could be good for gold, but a headwind for other metals and markets.