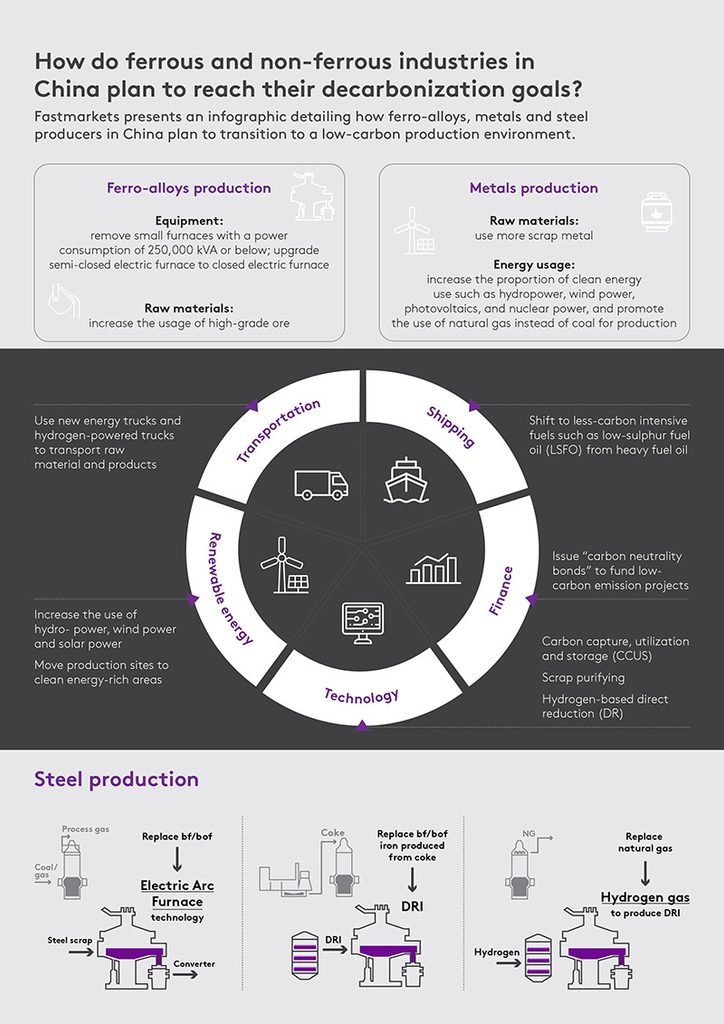

Fastmarkets takes a look at how producers of ferro-alloys, metals and steel in the country plan to transition to a low-carbon environment from several perspectives – the consumption of raw materials and energy, production technique, transportation and financing – following the announcement of various action plans in October to achieve that goal.

Ferro-alloys

The production of ferro-alloys is considered as energy intensive due to its heavy reliance on electricity during the smelting process. For instance, producing one tonne of ferro-silicon typically requires 8,000-9,000 kWh of electricity in China, while around 3,800 kWh/t of electricity is needed to produce a tonne of silico-manganese, according to market participants.

Measures to lower electricity consumption by this sector have been primarily based on policy. No new capacity will be approved from 2020, market participants told Fastmarkets.

Production heartlands such as Inner Mongolia, Ningxia and Guangxi autonomous regions have set stricter measures for ferro-alloy production capacity, electricity usage and furnace requirements.

Electricity limits have affected producers’ raw material consumption patterns. Many have turned to more high-grade ore to lower the amount of energy consumed for each tonne of production, Fastmarkets understands.

For example, high-grade manganese ore such as Australia lumpy experienced a higher take-up rate among silico-manganese producers especially in the third quarter when China’s electricity supply was severely affected by a coal shortage. Profit margins for alloy producers also widened amid soaring prices caused by a supply tightness.

Metals

Increased environmental scrutiny and the phasing out of old facilities are two trends that have emerged in the metals production sector this year.

Meanwhile, metals producers have put a higher consumption of metal scrap, the production of low-carbon metal and energy consumption on top of their decarbonization agenda.

For example, several aluminium producers are planning to move their production sites to regions with an abundance of clean energy, such as Yunnan and Sichuan provinces, which are rich in hydropower – an environmentally friendlier alternative to traditional coal.

To increase investment in low-carbon technology, a few leading industrial companies have this year issued a first batch of yuan-denominated carbon neutral bonds, a green debt instrument to raise finance for projects to reduce emissions.

In April, Zijin Mining Group issued carbon neutral bonds worth a total of 300 million yuan ($47 million) with a three-year maturity period at a rate of 3.71%. The funds raised will go toward the construction of a solar power station, the company said.

Steel

China – the world’s biggest producer of steel – produced 1.05 billion tonnes of crude steel in 2020. The steel industry’s carbon emissions – which account for around 15% of total emissions from the Chinese manufacturing sector – were the largest among 31 manufacturing categories, according to data released by the country’s National Bureau of Statistics.

In addition to strict capacity and output controls, China will impose a set of energy consumption standards for iron and steelmaking from 2022.

One way to meet the standard is to optimize raw materials consumption in steelmaking, according to market participants.

The sector’s energy-intensive characteristics are the result of the traditional method of making steel by smelting raw materials at extremely high temperatures.

The challenge for steelmakers now is to maximize their consumption of scrap and minimize that of hot metal in their blast furnaces (BFs) or basic oxygen furnaces.

China aims to increase its scrap usage in the steel sector to 320 million tonnes by 2025, from 260 million tonnes in 2020, according to the country’s 14th five-year plan for a circular economy issued by the National Development & Reform Commission (NDRC) in July.

For BFs, a higher consumption rate of iron ore pellets – as opposed to fines – and a lower rate for coke help to reduce carbon emissions.

Meanwhile, replacing the iron produced in BFs using coke with direct-reduced iron (DRI) and increasing the ratio of higher-grade iron ore products in the steelmaking process are also considered as “greener” ways to make steel.

China has also been promoting a switch from BFs to electric-arc furnaces (EAFs) among mills and encouraging them to adopt technologies that take emissions to ultra-low levels.

Large BFs rely on metallurgical coal to reduce iron ore into liquid iron, which is then refined into steel, while EAF producers use steel scrap or DRI as their raw material.

BF steelmaking emits 2 tonnes of carbon dioxide (CO2) per tonne of crude steel produced, while EAF steelmaking emits 0.6 tonnes of CO2 per tonne of crude steel, according to the China Metallurgical Industry Planning & Research Institute (MPI).

China aims to increase the proportion of EAF steel output in China to 15-20% of total crude steel output by 2025, according to the NDRC plan released in July.

MPI data shows that EAFs accounted for only 10.4% of total crude steel output in China in 2020, which lags far behind a global average of 30%. In the Unites States, EAFs account for some 70% of total steel output.

Meanwhile, steelmakers in China are looking to replace the natural gas used to produce DRI and the coal used to generate electricity with renewable energy sources.

In the longer term, market participants believe that low-carbon technologies such as hydrogen-based smelting would be implemented on a large scale.

The Chinese steel industry is also witnessing collaboration between leading companies to improve their environmental footprint across the steel value chain.

Brazilian iron ore producer Vale and Chinese steel giant Baowu Steel Group have entered into a memorandum of understanding to develop green steelmaking solutions.

This adds to a partnership that Baowu entered into in December 2020 with iron ore miner Rio Tinto to research low-carbon steelmaking projects and research over a two-year period.

Rio Tinto pledged a $10-million investment in the pact, which will go toward funding a Low Carbon Raw Materials Preparation R&D Centre, which will initially prioritize the development of lower-carbon ore preparation processes.

Sybil Pan in Shanghai contributed to this story.