Sentiment remained bullish due to a combination of persistent material shortages and strong demand.

Some European mills increased their prices, while the others stayed away from the spot market, sources said.

At the end of last week, ArcelorMittal increased its official HRC offers by €30 ($36) per tonne to €1,050 ($1,277.06) per tonne ex-works, but the producer kept official offers of downstream coil products unchanged at €1,200 per tonne ex-works.

Central European suppliers were reported to be seeking similar prices for HRC.

Those mills that remain active in the market have limited volumes for spot buyers and lead times are long. Most suppliers have been offering late third-quarter shipment coil, while for downstream products, some suppliers said that they are already sold out for the rest of 2021.

Due to the domestic shortage and lack of overseas alternatives, buyers have been struggling to obtain the required volumes of coil. As a result, market sources said that stocks at end consumers and distributors remain low.

Demand for flat steel from the automotive industry remains strong, although the shortage of semiconductors might result in lower car manufacturing rates and, consequently, lead to a decrease in steel consumption. In the meantime, lower steel availability remains in balance with the semiconductor supply, sources said.

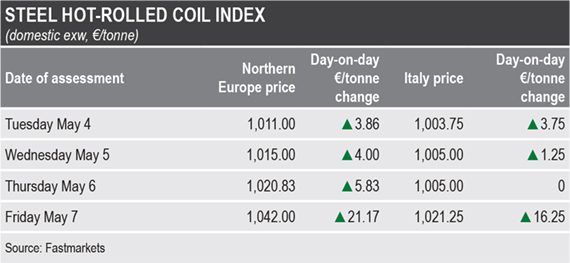

Fastmarkets calculated its steel hot-rolled coil index, domestic, exw Northern Europe at €1,042.00 per tonne on May 7, up by €34.86 per tonne week on week and by €148.00 per tonne month on month.

Friday’s index was based on transactions reported at €1,030-1,040 per tonne ex-works, achievable prices estimated by market sources at €1,030-1,050 per tonne ex-works and offers heard at €1,050 per tonne ex-works.

And Fastmarkets calculated its corresponding steel hot-rolled coil index, domestic, exw Italy at €1,021.25 per tonne on May 7, up by €21.25 per tonne week on week and by €135.00 per tonne month on month.

The index was based on a transaction heard at €1,015 per tonne ex-works, achievable prices estimated by market sources at €1,000-1,020 per tonne ex-works and offers reported at €1,050 per tonne ex-works.

Access to overseas material has been limited due to the impact of European Union safeguard measures. In addition, global steel prices continue to rise, with imported prices in the EU comparable to those from domestic mills.

European buyers have also exhausted the country-specific and supplementary second-quarter quota for HRC from India, which means that any volumes arriving from the country before June 30 will be subject to a 25% tariff.

European buyers are also concerned that the rising number of Covid-19 cases in India might also result in delivery delays.

The latest offers of HRC to Northern Europe were heard “slightly below €1,000 per tonne cfr” Antwerp.

Offers of HRC from Taiwan to Italy were heard at €980 per tonne cfr.

And supplier from Turkey was reported to have sold HRC to Italy and Spain at $1,090-1,100 per tonne fob.