At the end of last week, ArcelorMittal pushed its official offers for downstream products up by €20 ($24) per tonne, but kept offers for HRC unchanged at €750 ($905) per tonne ex-works.

Some sources, however, had heard HRC offers of €780 per tonne ex-works from other mills.

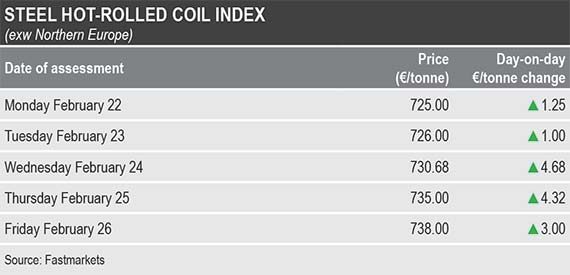

Fastmarkets calculated its daily steel hot-rolled coil index, domestic, ex-works Northern Europe. at €738.00 per tonne on February 26, up by €14.25 per tonne week on week and by €27.00 per tonne month on month.

The calculation of Friday’s index was based on achievable prices heard at €730-750 per tonne ex-works and offers reported at €750 per tonne ex-works.

Fastmarkets’ corresponding price assessment for steel HRC, domestic, exw Southern Europe, was €700-720 per tonne ex-works on February 24, compared with €700-710 per tonne a week earlier.

The assessment reflected average achievable prices heard in the market. One Italian buyer estimated “workable” prices at €690-700 per tonne ex-works, but the lower end of the range was not confirmed by other sources.

Prices in Spain, in the meantime, were heard at €720-730 per tonne ex-works, but the majority of sources said that prices were closer to the lower end of that range.

By the end of last week, prices in Italy had moved to €720 per tonne ex-works, market sources said.

Producers in Southern and Northern Europe were reported to be sold out of second-quarter-production coil and had started to offer and trade third-quarter-rolling material.

Import offers were limited and buyers were being cautious about booking coil from overseas due to long lead times and the effects of safeguards and other trade measures. In addition, prices for overseas coil had started to rise, sources said.

Fastmarkets’ weekly price assessment for steel HRC, import, cfr main port Southern Europe, was €670-680 per tonne on February 24, compared with €660-680 per tonne a week earlier.

The assessment was based on transactions and offers of material from Turkey and India heard in the market.

Two sources also said that a big Italian HRC importer had booked about 100,000 tonnes of material from India. The price was below the average market level, according to the sources.

One said that the price was “closer to transaction prices from India to the East Asian markets.”

The deal tonnage exceeded Fastmarkets’ specifications, however, so it was not included in the assessment.

European buyers also said that they faced risks when making deals with overseas suppliers, because import quotas could be filled quickly by big buyers acquiring substantial lots.

Fastmarkets’ weekly price assessment for steel HRC, import, cfr main port Northern Europe, was €675-695 per tonne on February 24, up by €5-15 per tonne week on week from €670-680 per tonne.

The assessment was based on offers heard in the market of material from Russia, India and Turkey.

The European Commission announced on February 26 that it had started an investigation into the possible extension of existing safeguard measures imposed on imports of 26 steel product categories beyond June 30 this year.

Uncertainties related to output from ArcelorMittal Italia have also made buyers concerned that supply could be reduced further.

On February 13, an Italian court ordered ArcelorMittal Italia to close the hot area of its Taranto plant within 60 days. On February 18, ArcelorMittal Italia said it had submitted an appeal to the council of state in Rome. Italian authorities should decide on the case on March 13, according to market sources, but a conclusion to the matter could come as late as mid-May this year.

Market participants expected the steelmaker to keep its output low and that it would not be able to follow its plan to increase production this year.

Elsewhere, Germany’s Thyssenkrupp will stop a blast furnace for scheduled maintenance in the third quarter. As a result, market sources believed that availability of HRC was unlikely to increase in July-September, keeping domestic prices high.