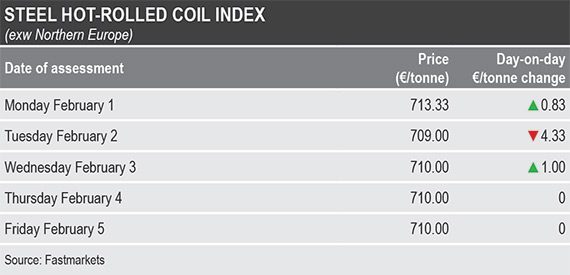

Fastmarkets calculated its daily steel hot-rolled coil index, domestic, exw Northern Europe, at €710.00 ($855.36) per tonne on Friday, down by €2.50 per tonne week on week, but up by €43.75 per tonne month on month.

The calculation of Friday’s index was based on achievable prices heard at €700-730 per tonne ex-works.

ArcelorMittal increased its official offers for HRC to €750 per tonne ex-works across the EU, up by €20 per tonne compared with previous offers. And Swedish steelmaker SSAB has been targeting a €40-per-tonne price increase.

Fastmarkets’ price assessment for steel HRC, domestic, exw Southern Europe, was €700-710 per tonne ex-works on February 3, unchanged week on week.

The assessment was based on deals and achievable prices heard in the market as well as the lower end of official offers heard at €710-730 per tonne ex-works.

Bullish sentiment among European steelmakers has been supported by good order books and, therefore, long lead times and limited supplies of coil.

Producers in the North have been reported to be offering either late-second-quarter-rolling HRC or to be completely sold out for second-quarter production. Italian steelmakers, in the meantime, have been offering and trading April-May rolling coil, according to market sources.

As a result, buyers have to pay higher prices for HRC if they need material with shorter lead times.

Market sources believed that domestic HRC prices across Europe were likely to remain fairly stable for at least a month, fluctuating in the range of €700-720 per tonne ex-works. The outlook for the longer term, however, was negative due to a decline in the international finished steel and raw materials markets, sources said.

Buyers have been cautious in their purchases because they believed that prices might start to decline in about one month.

Reduced availability of HRC in Europe has been one of the key drivers of a domestic price rise in the fourth quarter of 2020 and into the start of 2021.

More EU mills have been increasing output, market sources said. ArcelorMittal Ghent in Belgium is planning to restart blast furnace B by the middle of February, and US Steel Kosice in Slovakia has also restarted a blast furnace. In addition, ArcelorMittal Italia has resumed operations at blast furnace No2 and coke battery No9 at its Taranto steel plant in the south of Italy.