In the second half of the week, Italians steelmakers made higher offers and achieved small price rises in transactions.

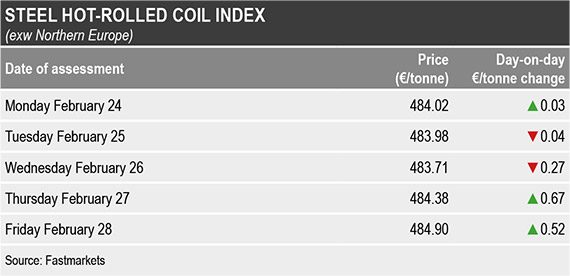

Fastmarkets’ daily steel hot-rolled coil index, domestic, ex-works Northern Europe, was €484.90 ($534.60) per tonne on February 28, up by €0.91 per tonne week on week from €483.99 per tonne on February 21.

The index was calculated based on deals and “workable” prices heard at €475-490 per tonne ex-works.

Market sentiment in Northern Europe was positive due to the long lead times from domestic mills and the lack of alternative non-EU material, market sources said.

Buyers have mainly been sourcing material from domestic mills due to the lack of “workable” import offers.

But the long delivery times from domestic producers, with some mills offering May-June shipment/delivery coil, have given mills leverage in negotiations with their customers to achieve price rises, according to market sources.

The latest import offers of Turkey-origin hot-rolled coil to Europe were heard at $500 per tonne fob. Taking into account an average freight rate of $20-25 per tonne, this price was equivalent to €471-476 per tonne cfr Antwerp, so it was in line with prices from domestic mills, when considering the additional transport costs.

Fastmarkets’ weekly price assessment for steel hot-rolled coil, export, fob main port Turkey, was $495-500 per tonne on February 28, narrowing upward from $475-500 per tonne on February 21.

In Southern Europe, Italian mills were trading HRC at €440-450 per tonne ex-works on Friday, up by about €10 per tonne week on week.

Demand for flat steel in Italy was expected to recover in a couple of weeks’ time, because distributors have been sitting on low stocks and will need to replenish their inventories soon, according to market sources.

This anticipated demand recovery was likely to support a domestic price rise, market participants said.

Coronavirus concerns

In the meantime, the outbreak of the 2019-nCoV coronavirus in Italy has so far failed to disrupt steel output or shipments, but market participants were concerned that it could have a negative effect on the wider economy and on steel demand, market sources said.

Because it is impossible to predict how the virus will spread, and what action the Italian authorities will take as countermeasures, buyers both in Italy and in the north of Europe were concerned that the distribution network might break down and that shipments would be delayed for an uncertain period, according to market participants.

Safeguard review

European steel producers, represented by regional steel association Eurofer, hope to achieve a further toughening of the region’s existing safeguard measures on steel product imports.

The EC initiated a second review of the safeguard measures into a variety of imported steel products in the middle of last month.

Among other changes, Eurofer proposed an end to the reallocation of unused quotas and a reduction in the per-country limits for HRC imports.

Under the current measures, quota allocations that are not used in any quarter will be transferred automatically to the next quota period. But Eurofer proposes that this transfer of volumes should be eliminated to prevent a rise in import volumes during specific periods of the year.

It has also suggested that this mechanism should apply only to material from specific countries.

At the moment, no country that exports hot-rolled (HR) flat steel into Europe is allowed to provide more than 30% of the total quota. Eurofer has proposed that this limit should be 20% instead.

Importers of hot-rolled flat steel, however, believed that reducing the limit for country-specific imports and stopping the reallocation of unused quotas could have a major negative effect on European distributors, particularly in the south, a region that has traditionally relied more on imports.