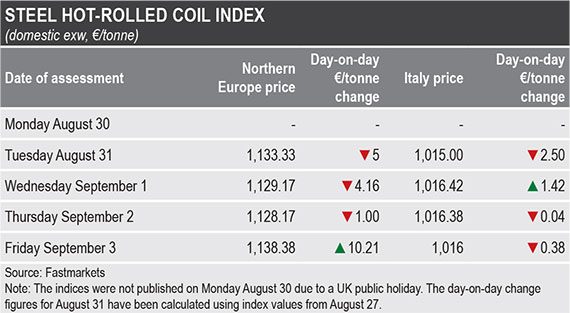

Fastmarkets calculated its daily steel hot-rolled coil index, domestic, exw Northern Europe, at €1,138.38 ($1,352.19) per tonne on Friday, up by €10.21 per tonne from €1,128.17 per tonne on Thursday.

The index was up by €0.05 per tonne week on week but down by €7.25 per tonne month on month.

Friday’s index was based on official mill offers reported at €1,150-1,190 per tonne ex-works, and workable prices indicated by buyers at €1,110-1,140 per tonne ex-works.

Fastmarkets calculated its corresponding daily steel hot-rolled coil index, domestic, exw Italy, at €1,016.00 per tonne on Friday, down by €0.38 per tonne day on day from €1,016.38 per tonne.

The index was down by €1.50 per tonne week on week and by €31.50 per tonne month on month.

The index was based on offers heard at €1,010-1,030 per tonne ex-works and achievable prices indicated at €1,000-1,020 per tonne ex-works.

Trading activity in the European hot-rolled coil market remained rather limited during the week, with both producers and buyer preferring to stay away from the market, assessing its likely direction in the post-holiday period.

Buyers were expecting HRC prices to drop in September, considering the fall in demand from the key consumer, the automotive industry.

A persistent shortage of semiconductors has been limiting manufacturing rates among carmakers and has had a corresponding negative effect on steel demand, sources said.

The availability of cheap import offers and decreased raw materials costs was adding further pressure to the picture, souring the mood among buyers.

The producers, in their turn, showed no intention of cutting their HRC price, citing good order books, with some even claiming to be sold out through the first quarter of 2022.

In any case, producers were putting their hopes on a positive resolution of the US-EU steel tariff dispute before November 1. The removal of the US’ Section 232 tariffs for EU-origin materials would pave the way for European mills to export HRC to the US, aggravating the acute shortage in the EU domestic market and supporting prices.