At the end of last week, ArcelorMittal increased its offer prices further, up by €50 per tonne in Northern Europe to €850 ($1,012) per tonne ex-works, and up by about €30-40 per tonne to €820 per tonne ex-works in Italy.

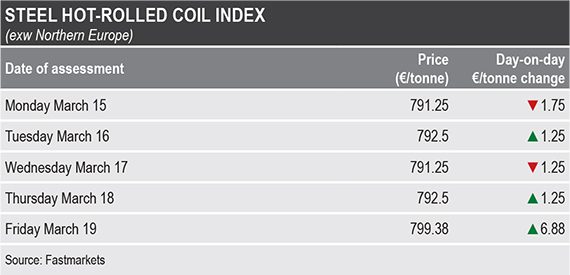

Fastmarkets calculated its daily steel hot-rolled coil index, domestic, exw Northern Europe, at €799.38 per tonne on March 19, up by €6.38 per tonne week on week and by €75.63 per tonne month on month.

The calculation of Friday’s index was based on achievable prices evaluated by market participants at €790-800 per tonne ex-works.

Fastmarkets calculated its daily steel hot-rolled coil index, domestic, exw Italy, at €786.67 per tonne on Friday, up by €13.34 per tonne day on day. The index was also up compared with the weekly price assessment of €730-770 per tonne ex-works on March 10.

The index was based on achievable prices estimated by market sources at €770-800 per tonne ex-works.

Availability of material in the European market has been extremely limited from domestic mills, market sources said. As a result, buyers expect transaction prices to rise, given the increases in offers.

The majority of European steelmakers had not been offering coil to the market. Some sources expected them to return with fresh offers by the end of the month, after they evaluated the volumes they had available for the spot market.

As a result, domestic prices were fairly stable in the first half of the week, but started to rise in the second half.

European mills have been delaying delivery of orders for as long as six weeks, according to sources. The earliest shipment available was September, and for specific grades of coated coil, some mills were even offering December delivery.

The new offers have been theoretical because there are almost no volumes available, buyers told Fastmarkets. As a result, any material appearing in the market was sold almost instantly, despite the high prices, because distributors and end-consumers both had low stocks.

There were also concerns that the situation in the market would not allow them to build any stocks over the coming months.

Some sources said that buyers have been negotiating for volumes without a price being agreed.

Buyers have been unable to source sufficient volumes from overseas suppliers due to a combination of high prices and the effects of Europe’s anti-dumping and safeguard measures. Scheduling delivery of non-European coil has been challenging due to freight problems, sources said, adding that these orders might also be delayed.

Fastmarkets’ weekly price assessment for steel HRC, import, cfr main port Southern Europe, was €740-770 per tonne on March 17, up by €35-40 per tonne from €705-730 per tonne a week earlier.

The assessment was based on offers of material from Turkey, India, Russia and Vietnam.

By the end of the week, offers of HRC to Italy increased to €780-805 per tonne cfr.

The corresponding weekly price assessment for steel HRC, import, cfr main port Northern Europe, was €760-770 per tonne on March 17, up by €45-60 per tonne week on week from €700-725 per tonne.

The assessment was based on deals and achievable prices heard in the market.