The European Commission (EC) imposed definitive anti-dumping duties of 18.10-35.90% on HRC from China on April 6 this year and set fixed charges in the range of €17.60-96.50 ($20.99-115.09) per tonne as a definitive trade defense measure on imports from Russia, Ukraine, Iran and Brazil on October 6.

The trade defense measures were brought in to support domestic prices in Europe, reducing the number of non-EU suppliers active in the market.

At the time of the investigation into material from Russia, Ukraine, Iran and Brazil, the measures threatened to eliminate more than 80% of total HRC imports into the EU. But despite the imposition of duties, the EU market is not closed for imports.

“The mills [outside the EU] will not be too aggressive with prices, as the EC might take action against them,” a Northern European trader said. “But Europe is not completely shielded from outside influence. It will continue to move in the same direction as the international market.”

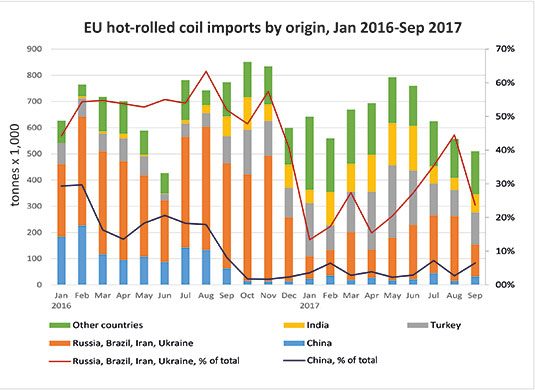

The trade defense measures have not resulted in a significant drop in steel import volumes but have, instead, led to an increased market share for alternative suppliers.

The EU imported 5.81 million tonnes of HRC in January-September 2017. This compared with 6.13 million tonnes in the corresponding period of 2016, according to data released by European steel association Eurofer.

Increased HRC deliveries from alternative suppliers could fulfil the growing demand in Europe. EU apparent steel consumption rose by 3.30% year-on-year in 2016, and is expected to grow by another 2.30% in 2017 and by a further 1.70% in 2018, according to Eurofer.

Market sources are also concerned that if domestic prices in the EU rise too quickly, the result will be an increased flow of imports from Asia, India or Turkey, or that suppliers involved in the trade case will return to the market.

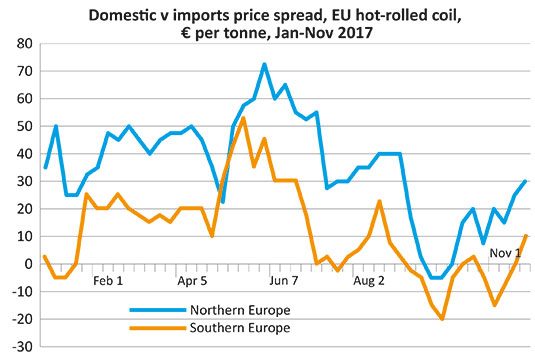

European buyers usually make a significant move toward imports when the gap between domestic and import prices reaches €40-50 per tonne.

The spread between domestic and imported HRC prices on November 22 this year was €20-30 per tonne in Northern Europe and €10 per tonne in Southern Europe.

“Prices of imported material [have been] at a level very close to EU prices [in the past month] ,” a second source from the region said.

“The difference is not enough to be attractive [to importers] but, at the same time, EU mills cannot sell at higher prices because that would attract other countries to export to the EU – or even offset the positive effect from [the anti-dumping] duties,” he added.

“We still have material coming from Turkey and India, at workable prices,” an Italian source said. “But sources of the material are limited, and the lead time is longer. So buyers have to look for material in the EU, to get it in time.”

While China has almost entirely stopped HRC exports to Europe, the effect of the anti-dumping measures on imports from Russia, Ukraine, Iran and Brazil has not become fully apparent. But deliveries from those countries are expected to drop to a minimum, according to trading and producing sources.

The market share of the suppliers involved in the case has been largely absorbed by mills from Turkey and India. And those two countries are expected to deliver more to the EU, according to market sources.

“Total import volumes will not grow but Turkey and India are going to try to sell more to Europe, because it is a great opportunity for them after the EC made its decision in the [anti-dumping] case,” a German source said.

While Turkey used to ship its HRC mainly to Southern Europe, due to the lower freight cost, in the past couple of months it has been targeting more sales to Antwerp in Belgium, according to market sources.

Apart from India and Turkey, suppliers from South Korea, Taiwan and Egypt increased their deliveries to Europe by 104.09% year-on-year to 1.19 million in the first nine months of 2017, according to Eurofer.

“Buyers expect to see more material coming from India and Turkey. [These two countries] will try to sell more to Northern Europe, where they have not been particularly active in the past. Apart from regular suppliers, Indonesia is also entering the market,” a Southern European trader said.

In addition, Serbia’s sole steelmaker, Železara Smederevo, which is owned by Chinese steel company Hesteel, will also further increase deliveries to the EU. It made plans to focus its attention on the EU coil market after the EC first announced a preliminary decision against applying duties to Serbian material.

The EC excluded Serbia from its anti-dumping HRC measures, despite having determined during the investigation that the country had been trading HRC material at dumped prices, The EC decided to terminate the investigation into imports from Serbia because the volumes were found to be negligible.

Eurofer was not satisfied with the decision to impose a fixed duty per tonne on HRC imports from Russia, Ukraine, Brazil and Iran, because it was concerned that this will not protect the EU market from imports from these countries.

Russian steelmaker Severstal has resumed trading HRC to the EU even though it has been subject to an anti-dumping duty since late October. The duty the EC set for Severstal’s material was the lowest in the range – €17.60 per tonne.

But since making a couple of deals in October, Severstal has not been making any new offers, according to market sources.

“Severstal is likely to keep volumes supplied to Europe at a certain level, so as not to get into trouble. But the situation might change if [domestic] prices in Europe move significantly upward,” a German trader said.

Ukrainian steelmaker Metinvest is “highly likely” to continue supplying HRC to the EU despite the introduction of fixed import charges, as it considered the duty to have been imposed at a rate that was “acceptable”.

The EC is now considering the Ukrainian government’s request for a review of the protection measures against Metinvest’s HRC on the basis of the Ukraine-EU Association Agreement. This general trade deal came into force on September 1 this year and is a possible first step toward EU membership for Ukraine.

“Any exporter involved in the trade case [in the EU] can apply for review of the decision only, in a one-year period after the final decision was announced,” a trade lawyer said. “But the decision could be challenged in the European court in Luxembourg.”