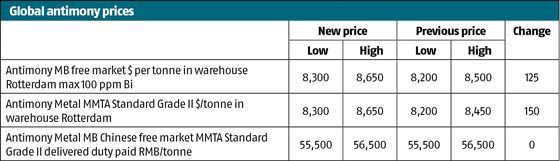

Metal Bulletin assessed MMTA Standard Grade II antimony, in-warehouse Rotterdam prices at $8,300-8,650 per tonne on August 18, up 1.8% from the previous assessed price of $8,200-8,450 per tonne on August 16.

Meanwhile, trioxide grade antimony prices, in-warehouse Rotterdam stood at $8,300-8,650 per tonne, up 1.5% in the same comparison.

Offers were heard as high as $9,000 per tonne for trioxide grade.

“Prices are moving up very quickly. The tightness in the market continues,” one trader said.

“I won’t sell anything below $8,600 per tonne right now,” a second trader said.

“It will be interesting to see what happens next week when the big European buyers reopen after their holidays, as rumour is they will be short of material,” the second trader added.

“The two grades are at parity now as there seems to be no trioxide material in stock; I don’t think anyone has any trioxide grade in stock in Rotterdam,” a third trader said.

“I’m not offering any material at the moment… I’m waiting. I don’t want to sell out prompt material in stock. My forecast is for the prices to hit $10,000 by the end of this year,” a fourth trader said.

In the Chinese market, antimony prices roughly stabilised, dragged by the sluggish demand in the downstream antimony trioxide market, though low operation rates in antimony blast furnaces continued.

Metal Bulletin assessed China domestic MMTA Grade II delivered duty paid antimony prices at 55,500 – 56,500 yuan ($8,318-8,468) per tonne on Wednesday August 16, unchanged from one week ago.

“Buying interest is low in the physical market and suppliers in Lengshuijiang are not offering,” a source in the Lengshuijiang area of China’s Hunan province said.

“We are selling at 55,500 yuan now, while trioxide producers are not active in replacing owing to feeble demand for antimony trioxide,” a second Hunan-based source said.

In the Chinese spot market, the price of antimony trioxide 99.8% was pegged at around 50,000-51,000 yuan per tonne last week, while antimony concentrates 45% traded at 41,500-42,000 yuan per tonne, Metal Bulletin has learned.

Owing to low production rates at blast furnaces, the market has not seen much buying activity for antimony concentrates over the past several months, so supply of the material is adequate and prices continue to hover at low levels.

Read also:

FORECAST: Antimony prices could rise in Q3 if production halts continue in China