- Chrome ore prices steady despite thin trading

- Alloy prices stable in China on firm producer offers

- Alloy prices hold in Japan, South Korea

- European alloy prices tick up on tighter supply

- US prices edge up while traders look to restock

Ore and alloy markets held in China on Friday October 11 amid limited demand after the country’s week-long National Day holiday (October 1-7).

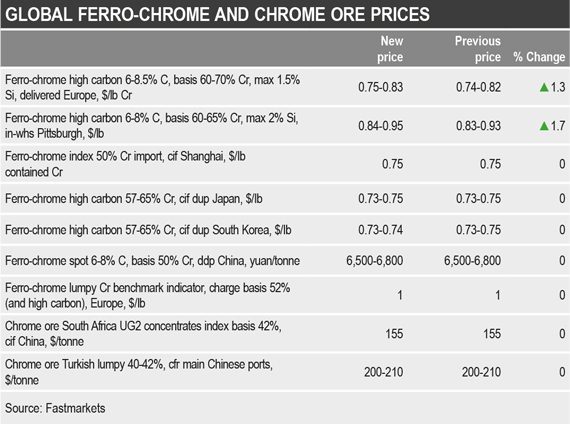

Fastmarkets’ chrome ore, South Africa UG2 concentrates index, basis 42%, cif China held at $155 per tonne on October 11, unchanged from previous week.

Ore prices are expected to remain stable in the near term, market participants told Fastmarkets, noting that many consumers bought material before the holiday.

An absence of buying interest among traders, as well as high port inventories will undermine any upturn, participants predicted.

It is also unlikely that offer prices will be reduced, despite the fact that consumers are not making margins converting ore to ferro-chrome, one ferro-chrome smelter source said.

“Though current raw materials procurement costs still put a lot of pressure on smelters, smelters will take units if they have to. Ore suppliers, meanwhile, are less likely to lower their offer prices,” the smelter source said.

Meanwhile, a post-holiday weakening of port ore prices means seaborne cargoes will look less attractive, market sources said.

Port cargoes in China were offered at about 31 yuan ($4.39) per dry metric tonne unit (dmtu) last week, compared to about 31.5 yuan per tonne ahead of holiday, according to market participants.

Fastmarkets assessed chrome ore inventories at the main Chinese ports of Tianjin, Qinzhou, Lianyungang and Shanghai at 2.85-2.97 million tonnes on October 14, up from 2.55-2.62 million tonnes on October 7.

Import traders, who have been losing money in recent months due to negative arbitrage between seaborne and port prices, are likely to reduce their purchasing in the coming weeks.

“Alloy tender prices haven’t met with market’s expectation, so traders, who have been under great capital pressure, won’t be interested in building positions,” a trader source said.

Downstream, spot domestic Chinese and imported ferro-chrome prices held due to stable offer prices from producers.

Fastmarkets’ price assessment for ferro-chrome spot 6-8% C, basis 50% Cr, ddp China was 6,500-6,800 yuan per tonne on October 11, unchanged week on week.

Fastmarkets’ ferro-chrome index, 50% Cr, import, cif China was also unchanged week on week at $0.75 per lb on October 11.

“Prices have been stable this week. Some Chinese smelters have not restarted because tender rates are not higher, so there is more interest in imported ferro-chrome than there would have been otherwise, but the market is still nervous,” a ferro-chrome producer source said.

Elsewhere in East Asia, imported high carbon ferro-chrome prices were stable amid limited spot demand.

Fastmarkets’ fortnightly price assessment for ferro-chrome high carbon 57-65% Cr, cif dup South Korea held at $0.73-0.74 per lb on October 10.

Fastmarkets’ price assessment for ferro-chrome high carbon 57-65% Cr, cif dup Japan was unchanged at $0.73-0.75 per lb on the same day.

Tightening supply buoys European alloy market

The European ferro-chrome market ticked up in response to tightened supply since prices hit 10-year lows of $0.70-0.80 per lb on August 30.

Fastmarkets’ price assessment for ferro-chrome, high carbon 6-8.5% C, basis 60-70% Cr, max 1.5% Si, delivered Europe rose by 1 cent per lb to $0.75-0.83 per lb on October 11.

“We are seeing increased activity as some producers have left the spot market,” a European producer source said.

Still, price recovery has been modest from its recent historic low because of weak demand from end-consumers.

“The improvement in demand has been slower than anticipated, we had expected it to rise more quickly,” a second trader source said.

And there were concerns about the outlook of the stainless steel market and the repercussions for alloy prices.

“Demand for stainless steel is so subdued that ferro-chrome prices could soften further,” a steel producer source said.

The steel producer source reported holding back from buying more alloy than required in anticipation of further ferro-chrome price weakness.

US market stages slight recovery

Meanwhile, the US high carbon ferro-chrome market firmed slightly last week despite sporadic spot market demand over the period.

Fastmarkets’ price assessment for ferro-chrome high carbon 6-8% C, basis 60-65% Cr, max 2% Si, in-whs Pittsburgh was $0.84-0.95 per lb on October 10, up 1.7% from $0.83-0.93 per lb previously.

While consumers were not plentiful in the market, traders looking to restock were met with firmer offering prices.

“We were looking to restock, and we were not able to find anything cheap around,” a US trader source said.

“I am not sure how extra much material is sitting around at this point. We aren’t seeing soft numbers when we are looking to add stock,” a second US trader source told Fastmarkets.

Market participants expect prices will remain steady in the near term.