- Battery-grade lithium carbonate price rangebound at current level.

- Technical and industrial-grade carbonate prices drifted lower.

- Lithium hydroxide prices weak on continually weak downstream demand.

- Asia battery-grade lithium prices remain at their current level in flat market.

China’s domestic battery-grade lithium carbonate market has temporarily stabilized at its current level with below 58,000 yuan per tonne ($8,107) rarely reported on the spot market, while downstream buyers were still cautious of buying in fear of further price decreases.

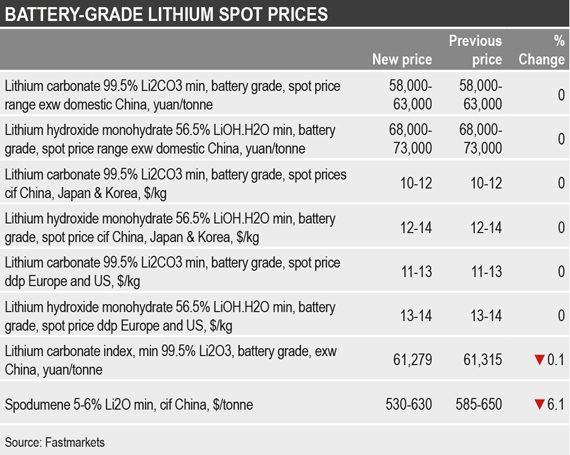

Fastmarkets last assessed the lithium carbonate, 99.5% Li2CO3 min, battery grade, exw domestic China spot price at 58,000-63,000 yuan per tonne on Thursday August 29, unchanged from the previous week.

Most big producers concluded deals between 60,000 yuan per tonne and 63,000 yuan per tonne this week, while some smaller producers and traders sold at lower prices at around 58,000 yuan per tonne.

“Lithium prices are still poor and I purchased a small quantity of battery-grade lithium carbonate this week with concluded prices of 60,000 yuan per tonne,” a cathode maker told Fastmarkets.

Technical and industrial-grade lithium carbonate prices drifted lower this week while downstream demand stayed weak, with most deals concluded at the low end of the range around 50,000 yuan per tonne.

“It is hard to sell material under a flat market and higher prices for industrial-grade lithium carbonate are unacceptable for most buyers, so we sold at around 50,000 yuan per tonne this week,” a trader said.

The China battery-grade lithium hydroxide market remained flat with limited transactions on the spot market. Although some producers offered lower prices, buyers have no immediate need to procure.

Fastmarkets last assessed the lithium hydroxide monohydrate, 56.5% LiOH.H2O min, battery grade, ex-works spot price at 68,000-73,000 yuan per tonne on Thursday August 29, unchanged from the previous week.

Seaborne Asian lithium market weak

The seaborne Asian battery-grade lithium spot market remained sluggish over the week, with prices range bound despite lower offers heard and limited deals concluded on the spot market.

Fastmarkets last assessed the lithium carbonate, 99.5% Li2CO3 min, battery-grade spot price at $10-12 per kg on a cif China, Japan and Korea basis, and the lithium hydroxide monohydrate, 56.5% LiOH.H2O min, battery-grade spot price at $12-14 per kg cif China, Japan and Korea, on Thursday, both unchanged from previous week.

“I heard some lower offering prices for lithium, but limited deals have been seen because the spot market remains quiet with most customers still on holiday. I hold a watchful attitude on the market for the coming month,” a distributor in South Korea said.

Steady European and US price

The European and United States’ battery-grade lithium carbonate and hydroxide spot prices were also unchanged week on week due to slow trading activity. Most market participants remain away on holiday while active producers and consumers are mostly interested in starting conversations for next year’s contract prices.

Fastmarkets assessed the lithium carbonate 99.5% Li2CO3 min, battery grade, spot price at $11-13 per kg, and the lithium hydroxide monohydrate 56.5% LiOH.H2O min, battery grade, spot price at $13-14 per kg, both on a ddp Europe and US basis, both on Thursday August 29 and unchanged from the previous week.

“We sold some carbonate this week but things remain very slow due to the holiday period,” a lithium producer told Fastmarkets. “Prices will probably remain unchanged in the coming days and we would expect more activity by the end of September.”

“We were offered material on a spot basis this week but have not accepted yet,” a consumer told Fastmarkets. “We are more interested in locking in a long-term contract price to build the relationship with our supplier but with such low prices we might wait before deciding whether to buy or not on a spot basis.”

Fastmarkets’ trade log for battery-grade lithium carbonate in China for August includes all trades, bids and offers reported to Fastmarkets.

Learn more about Fastmarkets’ lithium pricing methodology here and read the latest lithium price spotlight here.

All lithium carbonate, hydroxide and spodumene prices are available in our Battery Raw Materials Market Tracker. Get a sample of the report here.