- Battery-grade lithium hydroxide prices move down slightly on slow buying

- Lithium carbonate prices in China flat week on week.

- Rest of the world prices trade sideways

The battery-grade lithium hydroxide market came down this week on slow consumption, while suppliers kept lowering prices to boost cash flow under the current sluggish market.

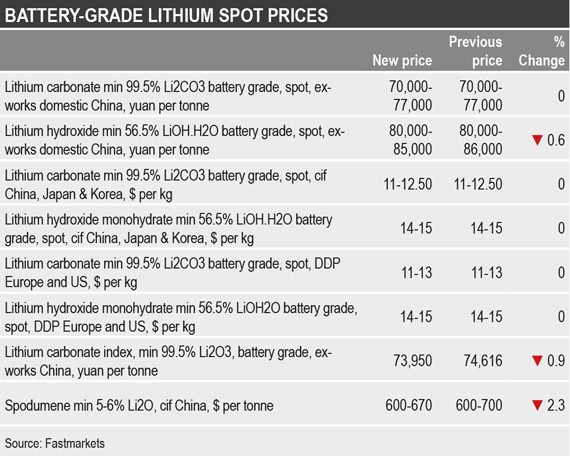

Fastmarkets’ assessment of the battery-grade lithium hydroxide monohydrate (min 56.5% LiOH.H2O) spot price was at 80,000-85,000 yuan per tonne on Thursday June 20, down from 80,000-86,000 yuan per tonne the previous week.

“Demand for lithium is becoming weaker ahead of July, when the downstream sector enters a period of lower levels of activity and production,” a battery maker told Fastmarkets, “I think lithium prices will remain under downward pressure in the coming month and possibly move down again.”

Moreover, the battery-grade lithium carbonate market moved sideways due to most buyers purchasing on a hand-to-mouth basis, cautious of any further decreases in prices in the coming weeks. Some producers have sold material at the low end of the current price range to encourage sales in fear of further prices decline in the second half of this year, Fastmarkets was told.

Fastmarkets’ last assessed the Chinese domestic spot battery-grade lithium carbonate price (min 99.5% Li2CO3) at 70,000-77,000 ($10,136-11,150) yuan per tonne on Thursday June 20 on an ex-works basis, unchanged from week on week.

Technical and industrial-grade lithium carbonate prices were also flat week on week but there the price gap between the battery-grade lithium carbonate compounds has been tightening after the use of technical-grade material in lithium-iron-phosphate (LFP) and lithium-manganese-oxide (LMO) production in China has increased demand for this type of material.

Fastmarkets assessed the technical and industrial lithium carbonate price (min 99% Li2CO3) at 63,000-67,000 yuan per tonne on an ex-works basis on Thursday, unchanged from the previous week.

Typically, tech-industrial grade material trades at a discount of 5,000-10,000 yuan per tonne compared with battery grade material.

Seaborne Asian prices see no change

The seaborne spot market prices for Asian battery-grade lithium carbonate and hydroxide showed limited fluctuation this week amid a quiet market.

Fastmarkets’ assessment of the price for battery-grade lithium carbonate (min 99.5% Li2CO3) was at $11-12.50 per kg on Thursday June 20, flat week on week.

Fastmarkets’ assessment of the lithium hydroxide (min 56.5% LiOH.H2O) price was at $14-15 per kg on a cif China, Japan and Korea basis on Thursday, also unchanged from the previous week.

“The seaborne market is moving sideways and at a slow pace, despite bids and offers highlighting that it will soon move down to catch up with the lower prices in China,” a lithium producer told Fastmarkets. “The price was stable this week but could weaken in the coming weeks.”

Slow European and US market

European and United States’ battery grade lithium carbonate and hydroxide spot market prices moved sideways over the week to Thursday June 20 on sluggish market activity.

Fastmarkets assessed the battery-grade lithium carbonate (min 99.5% Li2CO3) spot price at $11-13 per kg on June 20, delivered duty-paid in Europe and US, stable week on week.

Fastmarkets’ assessment of the lithium hydroxide monohydrate (min 56.5% LiOH.H2O) spot price, on a delivered duty-paid basis in Europe and the US, was at $14-15 per kg on June 20, also unchanged over the week.

“We have seen a very flat market this week [and have been] mostly negotiating our contract prices,” a second lithium producer told Fastmarkets, “This is typically a very slow spot market and the conversations point to an unchanged market this week.”

Fastmarkets’ trade log for battery-grade lithium carbonate in China for June includes all trades, bids and offers reported to Fastmarkets.

Learn more about Fastmarkets’ lithium pricing methodology here and read the latest lithium price spotlight here.

All lithium carbonate, hydroxide and spodumene prices are available in our Battery Raw Materials Market Tracker. Get a sample of the report here.