- The Chinese Lithium carbonate price fell on a weak demand outlook.

- Lithium hydroxide sellers to the domestic Chinese market said it was difficult to seal deals

- Asian cif China, Japan & Korean prices rangebound.

- Thin activity kept European and US price unchanged.

Both Chinese domestic spot lithium compound prices narrowed downward on Thursday October 17, with most downstream buyers saying they were in no hurry to purchase materials. Most producers and downstream buyers held bearish attitudes for the short-term market outlook.

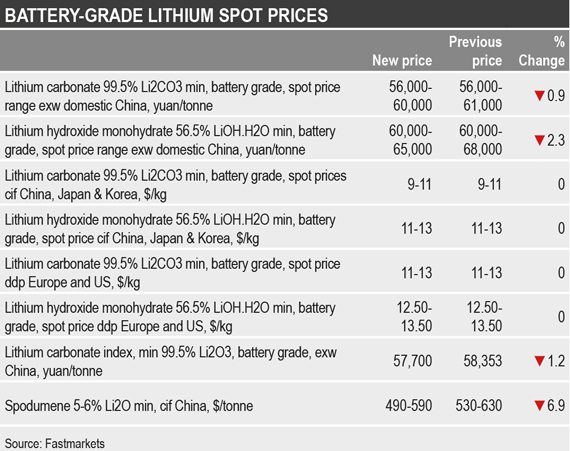

Fastmarkets assessed the lithium carbonate, 99.5% Li2CO3 min, battery grade, exw domestic China, spot price at 56,000-60,000 yuan ($7,859-8,560) per tonne on Thursday, down from 56,000-61,000 yuan per tonne in the previous week.

“Battery-grade lithium carbonate market remains under downward pressure on a lack of downstream buying and sufficient materials in the spot market. Output and sales of new energy vehicles [NEVs] saw their third consecutive month of negative growth in September, which is slower than expected, so this has provided less support for the raw materials market,” a buyer told Fastmarkets.

Most concluded deals for technical and industrial-grade lithium carbonate were in the range of 45,000-48,000 yuan per tonne this week.

The battery-grade lithium hydroxide market in China remained quiet too, with most deals reported at the lower end of the range. China’s domestic buying remains sluggish with limited transactions heard.

This pushed the Fastmarkets lithium hydroxide monohydrate, 56.5% LiOH.H2O min, battery grade, ex-works, spot price range down to 60,000-65,000 yuan per tonne on Thursday, from 60,000-68,000 yuan per tonne in the week.

“Most prices for battery-grade lithium hydroxide are at around 60,000-62,000 yuan per tonne this week and downstream buying remained slow without any improvements. I think prices are still under downward pressure,” a producer said.

Seaborne Asian lithium prices rangebound

The seaborne Asian battery-grade lithium spot market was rangebound this week and less spot buying was reported.

Fastmarkets assessed the lithium carbonate, 99.5% Li2CO3 min, battery-grade spot price at $9-11 per kg on a cif China, Japan and Korea basis, while the lithium hydroxide monohydrate, 56.5% LiOH.H2O min, battery-grade spot price stayed at $11-13 per kg cif China, Japan and Korea.

“There are no significant fluctuations in the seaborne Asian spot prices due to limited spot buying. While I think prices will be lower later as China’s prices keeping falling,” a distributor said.

European and US price unchanged amid thin activity

The European and United States’ battery-grade lithium carbonate and hydroxide spot prices remained flat during the week due to limited spot activity amid gloomy sentiment for the fourth quarter of the year. A number of consumers were reportedly in conversations for next year’s contract prices.

Fastmarkets assessed the lithium carbonate 99.5% Li2CO3 min, battery grade, spot price ddp Europe and US at $11-13 per kg, on Thursday.

Meanwhile, the lithium hydroxide monohydrate 56.5% LiOH.H2O min, battery grade, spot price ddp Europe and US stayed at $12.50-13.50 per kg.

Learn more about Fastmarkets’ lithium pricing methodology here and read the latest lithium price spotlight here.

Fastmarkets’ trade log for battery-grade lithium carbonate in China for October includes all trades, bids and offers reported to Fastmarkets.

All lithium carbonate, hydroxide and spodumene prices are available in our Battery Raw Materials Market Tracker. Get a sample of the report here.