- Lithium prices in China rise on active restocking while supply remains tight

- Seaborne Asian lithium prices tick up on persisting tight availability

- European and US prices post further gains on firm prices for technical-grade material

Battery-grade lithium prices in the domestic Chinese market moved up against a backdrop of active restocking among consumers while suppliers managed to translate previous offer increases into sales of decent sized cargoes.

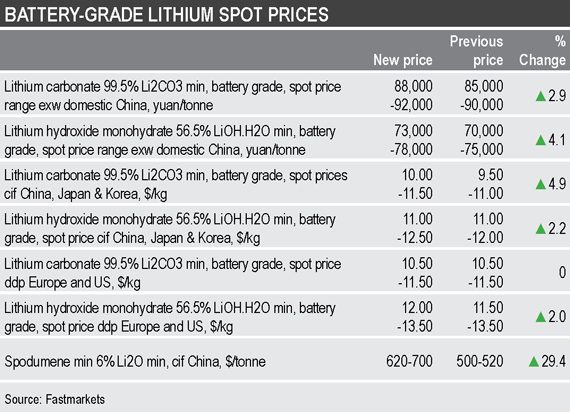

Fastmarkets assessed the lithium hydroxide monohydrate 56.5% LiOH.H2O min, battery grade, spot price range exw domestic China at 73,000-78,000 yuan ($11,114-11,418) per tonne on April 1, up by 3,000 yuan per tonne (4.1%) from 70,000-75,000 yuan per tonne a week earlier.

Fastmarkets’ assessment for the lithium carbonate, 99.5% Li2CO3 min, battery grade, spot price range exw domestic China rose to 88,000-92,000 yuan per tonne on April 1, up by 2,000-3,000 yuan per tonne (2.9%) from 85,000-90,000 yuan per tonne in the prior week.

Downstream demand remained robust while suppliers were reluctant to make large-tonnage sales, wary of rising lithium feedstock prices.

Fastmarkets’ price assessment for spodumene 6% Li2O min, cif China climbed to $620-700 per tonne on April 1, up by $120-180 per tonne (29.4%) from $500-520 per tonne on February 24.

“It is not easy to secure sizable lithium hydroxide cargoes when suppliers are reluctant to sell,” a consumer said.

“In March, producers were not willing to make large sales because supply is quite tight; moving into April, they are increasingly less willing to sell because of the rapid rally of spodumene price,” the consumer added.

Asian seaborne market underpinned on tight supply

Similarly, the Asian seaborne lithium market witnessed some fresh price gains this past week, with consumers in the region battling with tight availability.

Fastmarkets’ weekly assessment of the lithium carbonate, 99.5% Li2CO3 min, battery grade, spot price cif China, Japan and Korea was $10-11.50 per kg on April 1, up by $0.50 per kg (4.9%) from $9.50-11 per kg a week earlier.

Fastmarkets’ assessment of the lithium hydroxide monohydrate 56.5% LiOH.H2O min, battery grade, spot price cif China, Japan & Korea rose to $11-12.50 per kg on April 1, widening upward by $0.50 per kg from $11-12 per kg in the week prior.

Market participants continued to acknowledge that supply for lithium carbonate is more challenging than lithium hydroxide, while suppliers have been eyeing the rally of lithium carbonate prices in China.

“The overall supply tightness is derived from the squeezed spodumene supply from Australia,” a trader said. “Among all, supply tightness for lithium carbonate is most acute.”

While the majority of consumers in the region usually secure the supply via long-term contracts, a consumer source told Fastmarkets it was increasingly difficult to contract additional cargoes for both products at present.

European, US lithium hydroxide prices post further gains

European and US lithium battery-grade spot prices continued to rise in the week to April 1 amid ongoing firmness in the technical-grade equivalent and tight supply globally.

Fastmarkets assessed the lithium hydroxide monohydrate 56.5% LiOH.H2O min, battery grade, spot price ddp Europe and US at $12-13.50 per kg on April 1, narrowing upward by $0.50 per kg from $11.50-13.50 per kg a week earlier and recording the third consecutive weekly gain.

Technical-grade lithium spot prices remained steady while some market sources predicted the firmness will continue in the coming months.

Fastmarkets assessed the lithium carbonate 99% Li2CO3 min, technical and industrial grades, spot price ddp Europe and US at $9.50-11 per kg on April 1, unchanged for four consecutive weeks.

The assessment for the lithium hydroxide monohydrate 56.5% LiOH.H2O min, technical and industrial grades, spot price ddp Europe and US stood at $10.50-11.50 per kg on April 1, unchanged week on week.

“Availability especially for [lithium] carbonate is really bad; [there is] no product in the market and the last units could be sold at extremely high prices,” an upstream market source said.

“I don’t feel the shortage has disappeared… Prices have stabilized but they will eventually pick up again,” a distributor said.

Learn more about Fastmarkets’ lithium pricing methodology here and read the latest lithium price spotlight here.

Fastmarkets’ trade log for battery-grade lithium carbonate in China for March includes all trades, bids and offers reported to Fastmarkets.

All lithium carbonate, hydroxide and spodumene prices are available in our Battery Raw Materials Market Tracker. Get a sample of the report here.