- Battery-grade lithium carbonate and hydroxide prices down on short-term negative sentiment and ample stock inventory.

- Technical and industrial-grade lithium carbonate prices in China also declined.

- Low market activity keeps rest of the world’s prices stable.

China’s domestic battery-grade lithium carbonate and hydroxide prices decreased this week on high levels of inventories, while small-sized producers and traders dropped prices to conclude deals.

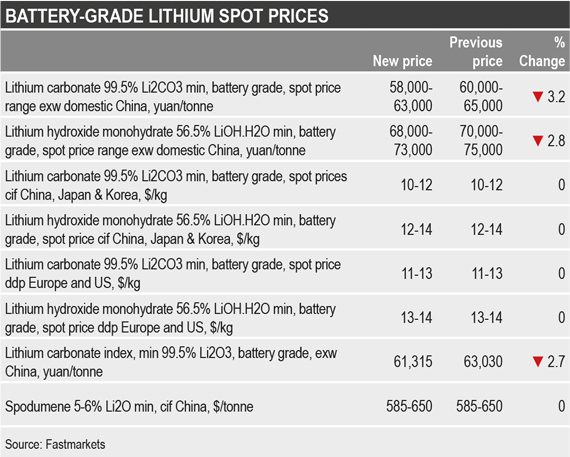

Fastmarkets last assessed the lithium carbonate, 99.5% Li2CO3 min, battery grade, exw domestic China, spot price at 58,000-63,000 yuan ($8,189-8,895) per tonne on Thursday August 22, down from 60,000-65,000 yuan per tonne the previous week.

“Some small-sized producers and traders were eager to decrease prices to boost cash flow this week and conclude sales. Our prices remain stable but haven’t concluded any deal this week,” a lithium producer told Fastmarkets.

“We have a negative outlook in the short-term due to the current high level of lithium inventories among producers in China and we are waiting for prices to hit the bottom before going back to the market,” a cathode maker told Fastmarkets.

Technical and industrial-grade lithium carbonate prices followed the falling battery-grade price trend due to the lithium inventory levels and slow buying activity.

Fastmarkets last assessed the lithium carbonate, 99% Li2CO3 min, technical and industrial grade, exw domestic China, spot price at 51,000 to 56,000 yuan per tonne on Thursday, down from 54,000-58,000 yuan per tonne the week before.

Battery-grade lithium hydroxide prices also declined on ample lithium stocks in China, while lower-than-expected demand remains the main constraint to price improvement.

Fastmarkets last assessed the lithium hydroxide monohydrate, 56.5% LiOH.H2O min, battery grade, ex-works, spot price at 68,000-73,000 yuan per tonne on Thursday August 22, down from 70,000-75,000 yuan per tonne from the previous week.

“The market is anticipated to improve some point at the end of the third quarter because battery and cathode makers are set to increase production, however, high levels of battery-grade lithium hydroxide and carbonate inventories could slow the pace market recovery, everything depends on demand,” a lithium supplier told Fastmarkets.

“We have heard that one producer is currently holding over 800 tonnes of standard battery-grade lithium hydroxide material in their warehouse, which is quite concerning,” the supplier added.

Seaborne Asian lithium market flat

The seaborne Asian battery-grade lithium spot market remained flat week on week on slow market activity, with several market participants away or currently negotiating long-term contacts.

Fastmarkets last assessed the lithium carbonate, 99.5% Li2CO3 min, battery-grade spot price at $10-12 per kg on Thursday, while the lithium hydroxide monohydrate, 56.5% LiOH.H2O min, battery-grade spot price was at $12-14 per kg on the same date, both on a cif China, Japan and Korea basis and unchanged from the previous week.

“Our customers told us that they have received offer prices below $10 per kg on a cif China, Japan and Korea basis and these lower prices are mostly from new suppliers in China,” a distributor in Asia told Fastmarkets. “They haven’t purchased this material yet due to quality concerns.”

“We keep on receiving lower prices week on week but have decided not to purchase material for the time being,” a second distributor told Fastmarkets. “We are currently negotiating long-term contract prices.”

Flat European and United States prices

The European and US battery-grade lithium carbonate and hydroxide spot prices were unchanged week on week due to the seasonal summer holiday period.

Fastmarkets assessed the lithium carbonate 99.5% Li2CO3 min, battery grade, spot price at $11-13 per kg and the lithium hydroxide monohydrate 56.5% LiOH.H2O min, battery grade, spot price at $13-14 per kg, both on August 22, on a ddp Europe and US basis and unchanged from the previous week.

“We are currently negotiating long-term contract prices and not very active on spot,” a second lithium producer told Fastmarkets. “We keep receiving bids and have put some offers out but this is mainly to monitor where the market is heading.”

“The market is very slow globally speaking and on a spot basis so I would expect more activity some time during the fourth quarter, but nothing really new until then,” a third lithium producer told Fastmarkets.

Fastmarkets’ trade log for battery-grade lithium carbonate in China for August includes all trades, bids and offers reported to Fastmarkets.

Learn more about Fastmarkets’ lithium pricing methodology here and read the latest lithium price spotlight here.

All lithium carbonate, hydroxide and spodumene prices are available in our Battery Raw Materials Market Tracker. Get a sample of the report here.