- Chinese prices solidify, underpinned by upstream tightness

- European prices continue to catch up with Asia while cheaper offers fade

- Activity in the US slows for the Thanksgiving holiday

Chinese vanadium export prices climbed up over the past week, catching up with rising input costs while the domestic market strengthened.

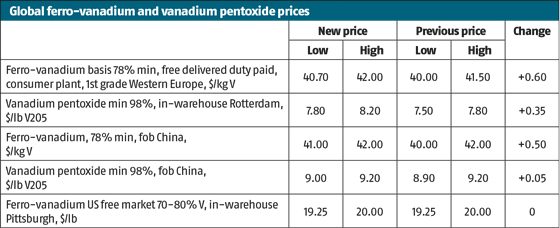

Metal Bulletin’s price assessment for Chinese V2O5 narrowed to $9-9.20 per Ib fob China on Thursday November 23, from $8.90-9.20 one week earlier, reflecting a firmly tight but steady Chinese market.

“Domestic supply is still tight with closing prices roughly at 132,000-135,000 yuan ($20,061-20,517) per tonne, equivalent to $9.10-9.30 per Ib. Seldom buyers outside China can accept these levels now,” an exporter told Metal Bulletin.

The exporter has not quoted for cargoes in the export market for around one month due to the firm premium for domestic sales versus the international market.

“We are quoting $9.10-9.20, in line with domestic closing prices of 132,000-134,000 yuan per tonne, but no deal has been sealed in the past week. As the domestic tightness cannot be eased in the short run, several suppliers here quoted 140,000 yuan for the cargo,” a second exporter said.

In Europe, V2O5 prices continued to firm in response to the tight supply situation, albeit still lagging behind Chinese material with alternative sources available on the ground.

V2O5 prices rose to $7.80-8.20 per lb, in-warehouse Rotterdam last week, up from $7.50-7.80 per lb previously, according to Metal Bulletin’s assessment.

In the ferro-vanadium market, Chinese prices gained $1 on the low side of the range on November 23, with the high end unchanged week on week. Metal Bulletin’s latest price assessment for ferro-vanadium stands at $41-42 per kg, fob China.

“Our offers stayed at $41 over the past two weeks with no deals at this level til now,” a third exporter said.

“No inquiries came to us recently, and I did not quote in the export market. But my sales prices in China are around 138,000 yuan per tonne [for ferro-vanadium], equivalent to $42 [per kg V],” a fourth exporter told Metal Bulletin.

Alloy prices in Europe continued to draw strength from upstream tightness in China last week, with sellers’ persistence in offering at $42 per kg paying off. Ferro-vanadium traded in a wide range while the market moved sharply in the second half of the week.

Metal Bulletin assessed ferro-vanadium prices at $40.70-42 per kg on Friday November 24, up from $40-41.50 per kg previously.

The bulk of data points reported to Metal Bulletin came in within the new range kg, while two data points below $40 were discarded as outliers.

“There is still a feeling we are nearer the bottom of the cycle than the top. The price had dropped below $40 earlier in the week but those prices have gone now,” a trader told Metal Bulletin.

US ferro-vanadium prices were last assessed at $19.25-20 per lb, in-warehouse Pittsburgh on Thursday November 16.

The US market was not assessed last week due to the Thanksgiving Holiday.