In an announcement on July 9, the exchange said it hopes by providing visibility to metal which may potentially be put on LME warrant in the future, the market will be able to trade on the basis of a more complete supply picture.

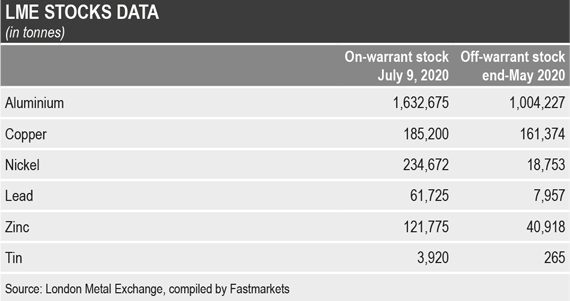

The LME’s new data, which is on a one-month delay, captured 1,239,556 tonnes of metal stored off-warrant at the end of May 2020 – 23% of which was aluminium.

The data showed 1,004,227 tonnes of aluminium available, 815,387 tonnes in Asia, 77,845 tonnes in Europe and 110,995 tonnes in the United States. The location with the largest amount of aluminium was unsurprisingly Port Klang with 443,968 tonnes reported as being off-warrant by the LME – this is on top of the 1.6 million tonnes already in LME-listed sheds.

The off-warrant stocks report also highlighted an extra 161,374 tonnes of copper – 114,314 tonnes of which are in Europe.

The fresh data comes following a new reporting rule which came into effect on February 1, 2020.

The new rule means warehouse operators must report off-warrant stocks data to the LME where the metal owner stores material under an agreement requiring the use of LME-registered warehouses, under an agreement where the owner has a right to warrant metal on the LME in the future or where the metal owner chooses to report their stock.

The LME report shows 40,918 tonnes of off-warrant zinc stock and 18,753 tonnes of off-warrant nickel, 13,527 tonnes of the nickel is held in Asia.

Going forward, the LME will publish off-warrant stocks data – on a per-warehouse location and per-metal basis – on the 10th day of every month and on a one-month-delayed basis.

“Having completed our analysis of four months’ worth of off-warrant stocks data, we are satisfied with the reporting method and confident that the data may be of use to market participants,” LME chief executive officer Matthew Chamberlain said.

“I would like to thank our warehouse companies and metal owners for their constructive approach to the new reporting regime. As we expected, there is still more work to do around increasing the voluntary reporting of stocks and we’ll be engaging with our market conduct working group to take this forward.”

The LME said it is confident data is being properly reported in respect of LME facility storage agreements and LME warranting agreement categories.

The new off-warrant stock data will not capture all warrantable material, but the exchange says it believes it does represent metal with a reasonable likelihood of being warranted over a short-term period highlight metal that is likely to affect stocks figures and, potentially, market conditions.

Voluntary reporting not working; penalties possible

When the warehouse reforms were proposed in November last year, the LME said it would also work on getting market participants to voluntarily report off-warrant stocks.

The LME said it received little data under the voluntary reporting category and therefore decided not to publish the subset of voluntarily reported data.

To incentivize voluntary reporting, the LME said it may consider placing a greater warranting fee on metal not voluntarily reported at the earliest opportunity.

The exchange added that the topic will be analyzed further in collaboration with the LME’s market conduct working group.