Metal Bulletin proposes to launch a new manganese index, five years after the two main benchmarks on the manganese ore market were launched: manganese ore index 44% Mn, cif Tianjin, $/dmtu and manganese ore index 37% Mn, fob Port Elizabeth, $/dmtu, both assessed weekly.

Metal Bulletin is proposing to add a manganese ore 37% content cif China index to its existing offering.

The international manganese ore markets have undergone a large change in the last year and a half.

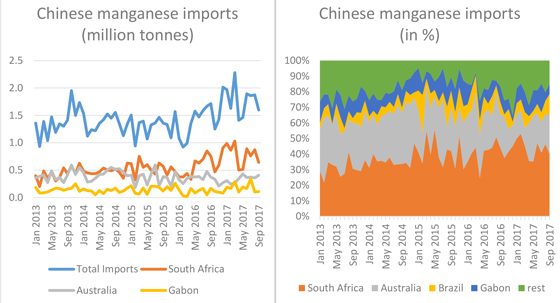

The South African market, for example, has become more competitive internationally. For many years prior to 2016, South African manganese ore exports into China (the world’s major importer) remained relatively stable at around 500,000 tonnes per year. This represented 30% of total Chinese imports from South Africa in 2013, increasing to around 35% in 2015.

From January 2016 to January 2017, Chinese imports from South Africa increased 300%, representing almost 50% of China’s total imports. Between May 2016 and September 2017, however, the South African share of Chinese imports has been 40%.

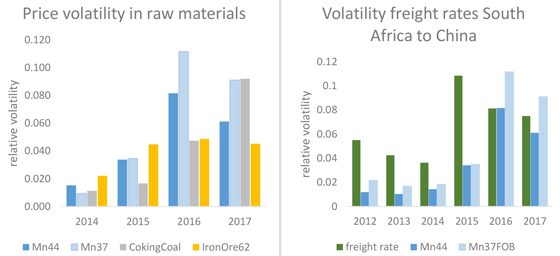

This change was driven by China’s strong domestic steel market, which affected steel raw materials prices and Metal Bulletin’s iron ore and coking coal indices. For example, raw materials prices tripled in 2017 compared to 2014.

Manganese ore prices, however, were especially volatile. Particularly, the manganese ore 37% fob index, which went from being the least volatile in 2016 to the most volatile in 2017. This kind of market behavior, where South Africa is dominant, was likely due to market fundamentals, political instability and unexpected economic setbacks.

On the other hand, South African manganese ore dominates the semi-carbonate market, and most of the transactions are settled on a cif China basis. According to data collected by Metal Bulletin, around 90% of South African deals are settled on a cif China basis.

Market dynamics drive liquidity and determine how markets are priced. Moreover, when volatility is persistently high, markets require additional information in order to make more informed decisions regarding hedging and risk management.

This is where transaction-based indices – prepared by an impartial third-party such as Metal Bulletin – become paramount to provide a determination as to the market level at that point in time.

As a consequence, Metal Bulletin is proposing a new delivered price in order to capture this value.

Metal Bulletin is offering the market a new manganese ore 37% content cif China index to increase its coverage on the manganese ore market and provide more tools for participants to identify risks.

Metal Bulletin is encouraging market participants to provide their view on the specifications, normalizations and methodology of the new index.

Metal Bulletin is also proposing that to ensure the index captures the market as accurately as possible, the new index will apply the standard data processing and normalizations in line with Metal Bulletin’s existing robust index methodologies.

Specifically, the 37% manganese ore cif China index specifications will be used as reference except for the delivery window where a nine week period will be used, in line with the current 44% cif index and the delivery port, which will be Tianjin, China. The data will be normalized for origin, brand, and manganese content. The final index will be calculated to incorporate a 10% outlier filter, a tonnage-weighted average within buyers and sellers sub-index and a simple average of the two sub-indices.

The consultation period for this proposed launch will end one month from the date of the original pricing notice, on Wednesday December 6, 2017.

To see all Metal Bulletin’s pricing methodology and specification documents go to www.metalbulletin.com/prices/pricing-methodology