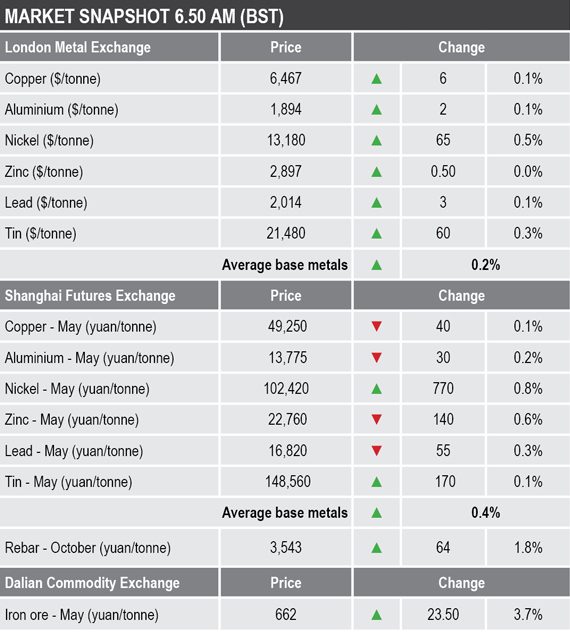

Nickel once again led the way with a 0.5% rise, this after a 0.9% rise on Monday, with the metal’s three-month price recently quoted at $13,180 per tonne, up from Monday’s close at $13,115 per tonne.

Copper, aluminium and lead were up by 0.1%, zinc was little changed and tin was up by 0.3%. The three-month copper price was recently quoted at $6,467 per tonne, up from $6,461 per tonne at Monday’s close.

Volume was average with 5,961 lots traded on LME Select as at 6.50 am London time. This compares with the 9,614 lots traded at a similar time on Monday.

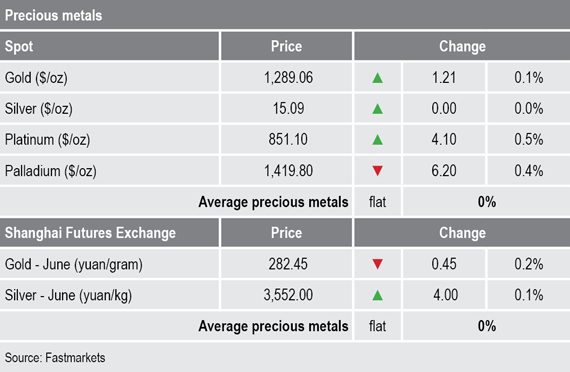

Spot gold and silver prices were little changed on Tuesday morning, with the former recently quoted at $1,289.06 per oz after a close on Monday of $1,287.85 per oz. The spot platinum price was up by 0.5% and the palladium equivalent was down by 0.4% at $1,419.80 per oz after closing Monday at $1,426 per oz.

In China, base metals prices on the Shanghai Futures Exchange were for the most part weaker on Tuesday. The exceptions were May nickel that was up by 0.8% and May tin that was up by 0.1%, while the rest were down between 0.1% for May copper and down 0.6% for May zinc. May copper was recently quoted at 49,250 yuan ($7,339) per tonne, compared with Monday’s close of 49,290 per tonne.

While most of the base metals prices in China have not held the gains seen following Monday’s better Chinese economic data, the steel-oriented metals have; the May iron ore contract on the Dalian Commodity Exchange was up by 3.7% at 662 yuan per tonne, from 638.50 yuan per tonne at the close on Monday. On the SHFE, the October steel rebar contract was up by 1.8% at 3,543 yuan per tonne compared with 3,479 yuan per tonne at Monday’s close.

In wider markets, the spot Brent crude oil price was slightly weaker by 0.09% at $69.10 per barrel from $69.16 per barrel at the close on Monday.

The yield on US 10-year treasuries was firmer and recently quoted at 2.4792% from 2.4433% at a similar time on Monday. The yields on the US 2-year and 5-year treasuries remain inverted – they were recently quoted at 2.3124% and 2.2939% respectively. The German 10-year bund yield was recently quoted at minus 0.0300% after minus 0.0392% at a similar time on Monday morning.

Asian equity markets were mixed on Tuesday: the Nikkei (-0.02%), the CSI 300 (-0.04%), the Hang Seng (+0.13%), the Kospi (+0.41%) and the ASX 200 (+0.41%).

This follows a stronger performance in western markets on Monday: in the United States, the Dow Jones Industrial Average closed up by 1.27% at 26,258.42, and in Europe, the Euro Stoxx 50 was up by 1% at 3,385.38.

The dollar index has edged higher and was recently at 97.37, compared with 97.16 at a similar time on Monday. The stronger dollar is weighing on the other major currencies: the euro (1.1200), the Japanese yen (111.35), sterling (1.3047) and the Australian dollar (0.7072).

The yuan remains rangebound but slightly weaker – it was recent quoted at 6.7177, compared with 6.7083 at a similar time on Monday. The other emerging market currencies we follow are consolidating and are not providing much insight.

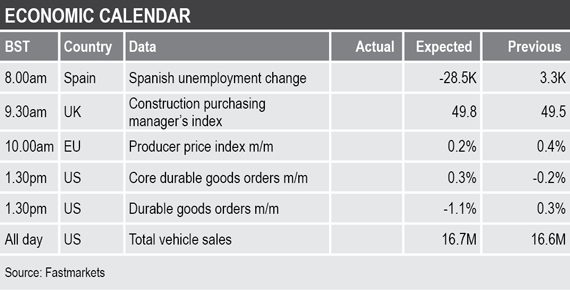

Tuesday’s economic agenda contains data on Spanish unemployment, UK construction, EU producer price index, US durable goods orders and US total vehicle sales – the latter being all important for the metals market.

The base metals ran up initially on Monday on the back of the stronger Chinese data, but once again the higher prices attracted selling. This suggests buyers are in no hurry to restock to any great extent, especially while a US-China trade deal has not emerged yet. We expect a positive trade deal will be the trigger for stronger metal prices because it will remove one big uncertainty that has been overhanging the market for a long time.

The precious metals are under pressure, the stronger dollar, better Chinese data and optimism for a trade deal, all seem to be reducing the need for haven assets.