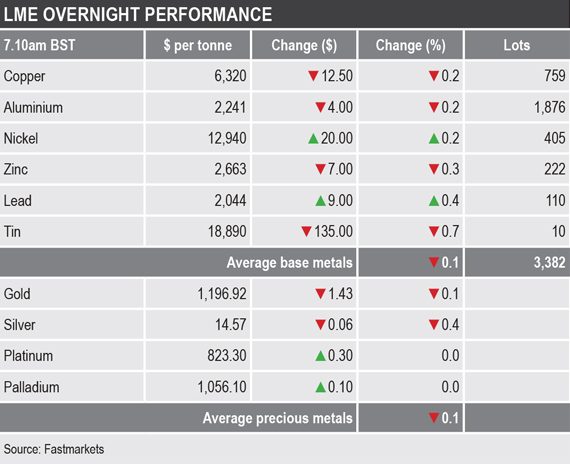

The exception was lead where prices were up by 0.4%. The rest were down between 0.2% for copper, aluminium and nickel and 0.7% for tin, with zinc off by 0.3%. Copper prices were recently quoted at $6,320 per tonne.

Although Chinese markets are still closed for the country’s weeklong break to mark National Day, volume has picked up to 3,382 lots as at 7.10am London time, compared with an average of 1,500 lots seen at roughly the same time on Monday and Wednesday.

This follows another day of strength on Wednesday when the LME base metals complex closed up by an average of 1.8%, led by a 6.4% rise in aluminium prices – the latter up in news of a full closure of Norsk Hydro’s alumina operations in Brazil.

In the precious metals this morning, spot gold prices were down by 0.1% at $1,196.92 per oz, silver prices were off by 0.4%, while the platinum group metals were little changed. This follows a day of weakness for all but palladium on Wednesday, when gold, silver and platinum closed down by an average of 0.6%, while palladium prices closed up by 0.2%.

In wider markets, spot Brent crude oil prices were off by 0.07%, but remain at a high level and were recently quoted at $85.93 per barrel. The yield on US 10-year treasuries has pushed higher to 3.2123%, as has the German 10-year bund yield that was recently quoted at 0.5400%. The rise in US bonds was on the back of strong US data on Wednesday with a larger-than-expected rise in employment and better-than-expected readings for services purchasing managers’ indices (PMI).

The rise in US yields seems to be weighing on Asian equity markets that were for the most part weaker on Thursday: Nikkei (-0.56%), Kopsi (-1.52%), India’s Sensex (-2.13%), but the ASX200 is up 0.49%. This follows a stronger performance in western markets on Wednesday; in the United States, the Dow Jones closed up by 0.20% at 26,828.39, while in Europe, the Euro Stoxx 50 was up by 0.49% at 3,405.48.

The dollar index climbed to 96.13 on Wednesday – it was recently quoted at 95.98. US monetary policy and stronger data suggests the dollar can rise further.

With the dollar’s strength, the other currencies were weaker: the euro (1.1483), sterling (1.2946), the yen (114.31) and the Australian dollar (0.7086).

The offshore yuan has weakened to 6.9170, the onshore rate was quoted at 6.8679 before the holiday. The emerging currencies we follow were for the most part weaker, even the Brazilian real that has been strengthening, has started to correct. The weakness in the emerging market currencies suggests markets are taking risk off the table.

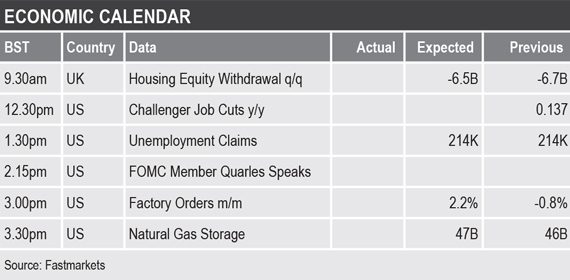

The economic agenda is generally focused on the US, but there is also data on UK house equity withdrawals. US releases include Challenger job cuts, initial jobless claims, factory orders and natural gas storage. In addition, US Federal Open Market Committee member Randal Quarles is speaking.

The base metals prices are for the most part looking stronger, with lead and tin prices the laggards. For now the risk off in Asia and in emerging currencies does not seem to be troubling the base metals, which suggests the metals’ fundamentals, combined with short-covering are driving prices. There may well be more short-covering ahead of next week’s LME Week.

The precious metals are all consolidating – gold and platinum are holding is sideways ranges, while silver and palladium are consolidating recent gains.