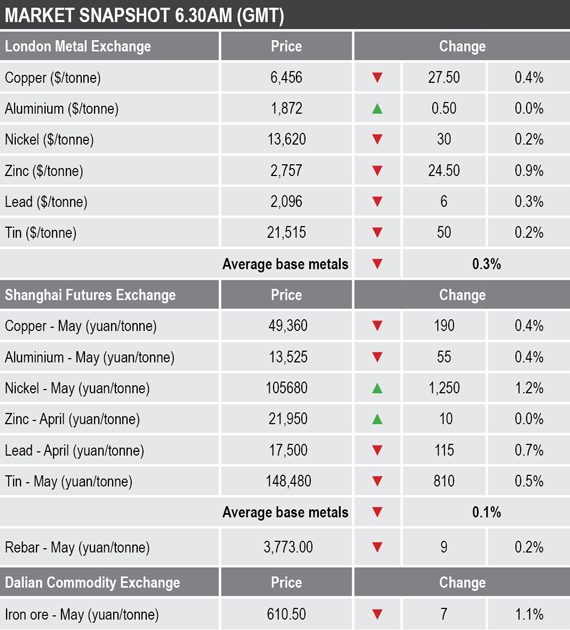

Copper was off by 0.4% at $6,456 per tonne, compared with $6,483 per tonne at Tuesday’s close, while nickel has edged back from yesterday’s fresh high for the year of $13,725 per tonne and was recently quoted at $13,620 per tonne.

Volume was below average with 4,708 lots traded on LME Select as at 06.37am London time, compared with 12,645 lots at a similar time on Tuesday.

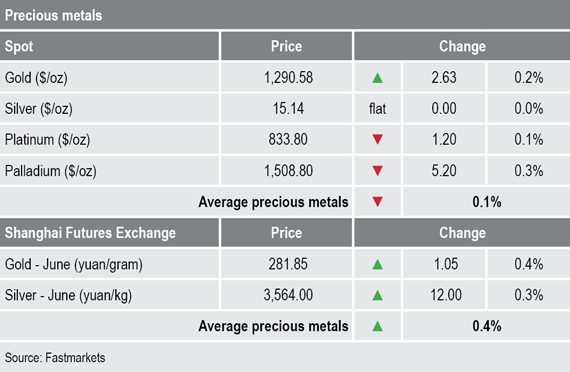

Spot precious metals prices were mixed this morning; gold was up by 0.2% at $1,290.58 per oz, compared with a previous close of $1,287.95 per oz, silver was unchanged at $15.14 per oz, while the platinum group metals were down either side of 0.2%.

In China, base metals prices on the Shanghai Futures Exchange were for the most part weaker, with May copper, May aluminium, April lead and May tin all off by an average of 0.5%. May copper was off by 0.4% at 49,360 yuan ($7,360) per tonne recently, compared with 49,550 per tonne at Tuesday’s close. April zinc was little changed, while May nickel bucked the trend with at 1.2% gain to 105,680 yuan per tonne, compared with Tuesday’s close of 104,430 yuan per tonne.

The spot copper price in Changjiang was down by 0.4% at 49,760-50,050 yuan per tonne this morning, compared with 49,965-50,255 yuan per tonne on Tuesday, while the London/Shanghai copper arbitrage ratio was weaker again at 7.64 after 7.67 at a similar time on Tuesday. The weaker ratio shows a softer tone in China compared with the LME. Given there are rumors that copper is being shipped from China to LME warehouses to take advantage of the backwardation on the LME, you would expect Chinese copper prices to be holding up better than LME prices.

In other metals in China, the May iron ore contract on the Dalian Commodity Exchange was down by 1.1% at 610.50 yuan per tonne, compared with 617.50 yuan per tonne at the close on Tuesday. On the SHFE, the May steel rebar contract was off by 0.2% at 3,773 yuan per tonne, compared with 3,782 yuan per tonne at Tuesday’s close.

In wider markets, the spot Brent crude oil price was down by 0.14% at $65.48 per barrel, compared with $65.57 per barrel at the close on Tuesday.

The yield on US 10-year treasuries was recently quoted at 2.7067% after 2.7254% at a similar time on Tuesday. The yields on the US 2-year and 5-year treasuries remain inverted and were recently quoted at 2.5334% and 2.5159% respectively. The German 10-year bund yield was at 0.1400%, after 0.1700% on Tuesday morning. The weaker yields imply a pick-up in risk-off.

Asian equity markets were mixed on Wednesday: Nikkei (-0.60%), Hang Seng (+0.22%), the CSI 300 (+0.84%), the Kospi (-0.17%) and the ASX 200 (+0.75%). We note that Chinese equities prices have increased following the recent announcements to lower the gross domestic product (GDP) growth target and announced tax cuts.

This follows a mixed performance in western markets on Tuesday; in the United States, the Dow Jones Industrial Average closed down by 0.05% at 25,806.63, and in Europe, the Euro Stoxx 50 closed up by 0.30% at 3,327.19.

The dollar index is firm and was recently quoted at 96.89. The stronger dollar is keeping downward pressure on the other major currencies we follow: the euro (1.1302), sterling (1.3147), the yen (111.77) and the Australian dollar (0.7035).

The yuan is consolidating off recent highs and was recently quoted at 6.7086. Most of the other emerging market currencies we follow are either consolidating, or on a slightly weaker footing, the Malaysian ringgit in particular.

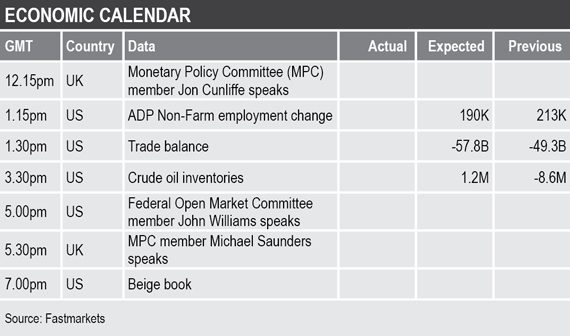

The economic agenda is focused on US data on Wednesday and in the run-up to Friday’s US employment report there is data out on ADP non-farm employment change, as well as the US trade balance, crude oil inventories and the Federal Reserve’s Beige book.

In addition, there are several central bankers speaking on Wednesday including UK Monetary Policy Committee members Jon Cunliffe and Michael Saunders and US Federal Open Market Committee member John Williams.

For the most part the rallies in the base metals have halted while economic headwinds and lack of clarity on a US-China trade deal weigh on sentiment. Copper, nickel and zinc are generally holding up well and not giving back too much ground as prices consolidate, while aluminium, lead and tin are drifting more. Key will be the extent to which prices can hold up at these relatively high levels. The focus in copper is the low level of metal on warrant in the LME warehouse system, but rumors that shorts may deliver metal against their shorts positions is something to watch out for because that could weaken sentiment for a while.

The stronger tone in gold and silver is reversing, the stronger dollar may have prompted that and those long of the precious metals may be wary in case a US-China trade deal is forthcoming as that could reduce the need for havens. Platinum prices are following gold’s lead, while palladium prices are holding up relatively well as they are supported by tight fundamentals.