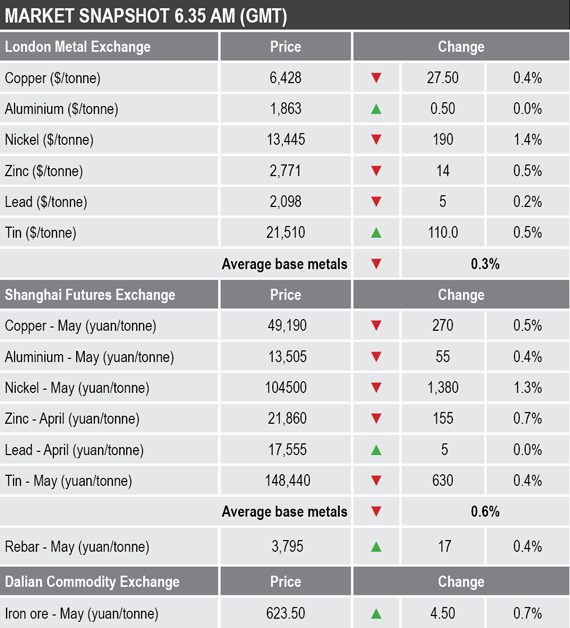

With the exception of tin that was up by 0.5% and aluminium that was little changed, the rest of the complex were down between 0.2% for lead and 1.4% for nickel.

Copper was off by 0.4% at $6,428 per tonne, compared with $6,455 per tonne at Wednesday’s close, while nickel has pulled back from yesterday’s fresh high for the year of $13,765 per tonne and was recently quoted at $13,445 per tonne.

Volume was above average with 6,915 lots traded on LME Select as at 06.35am London time, compared with 4,798 lots at a similar time on Wednesday.

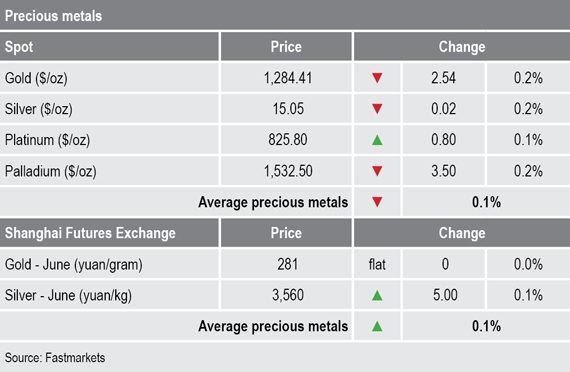

Spot precious metals prices were for the most part weaker with gold, silver and palladium all down by 0.2%, while platinum was up by 0.1%. Gold was recently quoted at $1,284.41 per oz, compared with $1,284.72 per oz at Wednesday’s close and down by 4.6% from the February 20 high at $1,346.75 per oz.

In China, base metals prices on the Shanghai Futures Exchange were for the most part weaker, with May copper, May aluminium, April zinc and May tin all off by an average of 0.7%, while April lead was little changed. May copper was off by 0.5% at 49,190 yuan ($7,328) per tonne recently, compared with 49,460 per tonne at Wednesday’s close.

The spot copper price in Changjiang was down by 0.2% at 49,660-49,930 yuan per tonne this morning, compared with 49,770-50,040 yuan per tonne on Wednesday, while the London/Shanghai copper arbitrage ratio was little changed at 7.65 after 7.64 at a similar time on Wednesday.

In other metals in China, the May iron ore contract on the Dalian Commodity Exchange was up by 0.7% at 623.50 yuan per tonne, compared with 619 yuan per tonne at the close on Wednesday. On the SHFE, the May steel rebar contract was up by 0.4% at 3,795 yuan per tonne, compared with 3,778 yuan per tonne at Wednesday’s close.

In wider markets, the spot Brent crude oil price was up by 0.29% at $66.12 per barrel, compared with $65.93 per barrel at the close on Wednesday.

The yield on US 10-year treasuries was weaker suggesting a pick-up in risk-off sentiment, it was recently quoted at 2.6861% after 2.7067% at a similar time on Wednesday. The yields on the US 2-year and 5-year treasuries remain inverted and were recently quoted at 2.5090% and 2.4907% respectively. The German 10-year bund yield was at 0.1200%, after 0.1400% on Wednesday morning.

Asian equity markets were mainly weaker on Thursday: Nikkei (-0.65%), Hang Seng (-.82%), the CSI 300 (-1.02%)and the Kospi (-0.45%), but the ASX 200 was firmer(+0.29%).

This follows a weaker performance in western markets on Wednesday; in the United States, the Dow Jones Industrial Average closed down by 0.52% at 25,673.46, and in Europe, the Euro Stoxx 50 closed down by 0.08% at 3,324.67.

The dollar index is firm and was recently quoted at 96.87. The stronger dollar is keeping the other major currencies we follow rangebound: the euro (1.1306), sterling (1.3176), the Japanese yen (111.70) and the Australian dollar (0.7040).

The yuan is consolidating off recent highs and was recently quoted at 6.70823. Most of the other emerging market currencies we follow are consolidating, the exceptions are the Indian rupee that is stronger and the Brazilan real that is weaker.

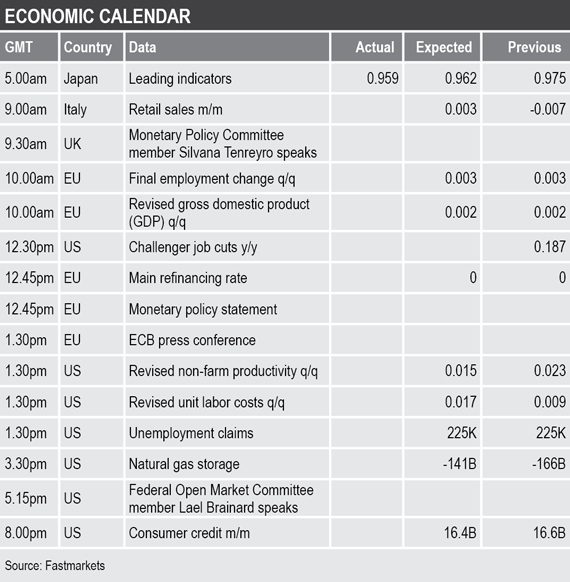

The economic agenda is busy today with the focus on the European Central Bank interest rate decision, monetary policy statement and press conference as well as further US employment data with initial jobless claims and Challenger job cuts. Other important data includes Italian retail sales, EU final employment change, EU revised gross domestic product (GDP) and US revised non-farm productivity and unit labor costs.

In addition, there are several central bankers speaking on Thursday including UK Monetary Policy Committee members Silvana Tenreyro and US Federal Open Market Committee member Lael Brainard.

The recent rallies in the base metals have run into resistance and without concrete evidence of a US-China trade deal the rallies may well have gone as far as they can on simple optimism about a trade deal. We still feel we are in a race against time before weakening economic data tips a larger part of the global economy into a deeper slowdown, or will a trade deal come about soon enough to instill growth back into the global economy. For now, we watch the extent to which prices can hold up at these relatively high levels, if they struggle then consolidation may turn into another sell-off. Any sudden rise in copper stocks could act as a catalyst.

The stronger tone in gold and silver is reversing, the stronger dollar may have prompted that and those long on the precious metals may be wary in case a US-China trade deal is forthcoming as that could reduce the need for haven assets. Platinum prices are following gold’s lead, while palladium prices are holding up relatively well as they are supported by tight fundamentals.