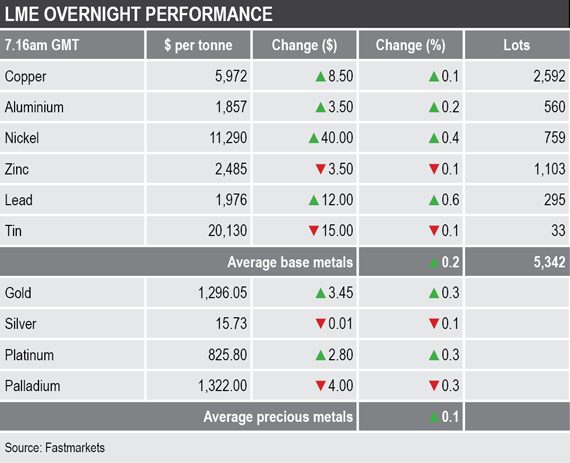

The three-month copper price was up by 0.1% at $5,972 per tonne, with the high so far on Thursday being $5,985.50 per tonne.

Volume across the complex has been average with 5,342 lots traded as at 7.16am London time.

Precious metals prices were mixed; gold and platinum prices were up by 0.3%, with the former at $1,296.05 per oz, while silver and palladium prices were down by 0.1% and 0.3% respectively.

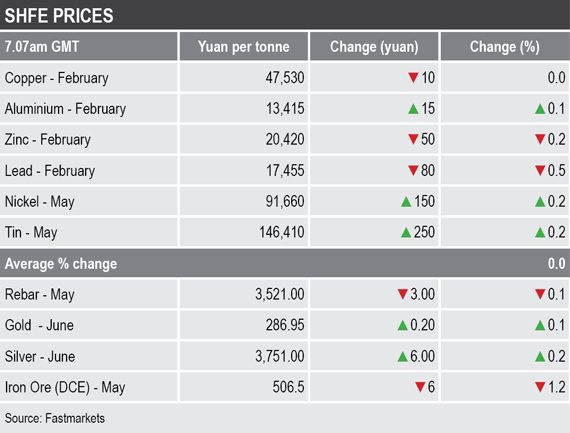

In China, base metals prices on the Shanghai Futures Exchange were also mixed and for the most part little changed. The exception was the February lead contract that was off by 0.5%. The February copper contract was little changed at 47,530 yuan ($6,958) per tonne.

Spot copper prices in Changjiang were down by 0.4% at 47,330-47,450 yuan per tonne, suggesting futures prices have climbed since the spot price was established. The LME/Shanghai copper arbitrage ratio has slipped to 7.95 from 7.99 on Wednesday.

In other metals in China, the May iron ore contract on the Dalian Commodity Exchange was off by 1.2% at 506.50 yuan per tonne. On the SHFE, the May steel rebar contract was off by 0.1%.

In wider markets, the spot Brent crude oil price was weaker by 0.87% at $60.80 per barrel compared with Wednesday’s close, but the overall trend is strongly higher considering prices were just above $50 per barrel late last month.

The yield on US 10-year treasuries has weakened again, it was recently quoted at 2.6849%. The yields on the US 2-year and 5-year treasuries remain inverted at 2.5233% and 2.5169% respectively. The German 10-year bund yield was also weaker at 0.2020%. The halt in the rebounds in the yields suggest the market is once again nervous.

Asian equity markets were mixed on Thursday: the Nikkei (-1.29%), Hang Seng (0.03%), the CSI 300 (-0.19%), Kospi (-0.07%) and the Australian ASX 200 (0.29%).

This morning’s performance in Asia follows a stronger performance in western markets on Wednesday; in the United States, the Dow Jones Industrial Average closed up by 0.39% at 23,879.12, while in Europe, the Euro Stoxx 50 was up by 0.5% at 3,070.24.

The dollar index is seeing some dip buying this morning, it was recently quoted at 95.24, having earlier been down to 95.03. The yen (107.91) is strengthening again after its recent correction from overbought levels, sterling (1.2756) is consolidating near recent high ground and the euro (1.1541) is consolidating Wednesday’s gains, as is the Australian dollar (0.7174).

The yuan is accelerating its gains and was recently quoted at 6.7903, this despite weaker-than-expected consumer and producer price data from China earlier on Thursday, which suggests the strength is related to optimism on the trade and stimulus fronts. The other emerging market currencies we follow, with the exception of the Indian rupee, are either strengthening, or are consolidating recent gains – both signs of general confidence in the emerging markets, which is encouraging.

Economic data already out on Thursday shows weakness in UK retail sales, Chinese inflation, Japan’s leading indicators and French industrial production. Data out later includes Italian retail sales, with US data including initial jobless claims and natural gas storage.

In addition, US Federal Open Market Committee members Charles Evans and James Bullard and Federal Reserve chairman Jerome Powell are speaking.

The weaker Chinese inflation data has somewhat countered the optimism from positive US/China trade talks, but poor Chinese data is also likely to spur further Chinese stimulus which should be bullish for the metals. While the markets are likely to remain nervous until a trade deal is done, there does seem to be some underlying strength in the commodities. With base metals, gold and oil prices all strengthening in recent days that could unsettle some of the shorts.

For now, gold prices seem to be taking their lead from the weaker dollar and with equities nervous and still relatively high, compared with how metals performed last year, gold may still look attractive as a haven asset for those investors who are not yet ready to buy into the more industrial commodities.