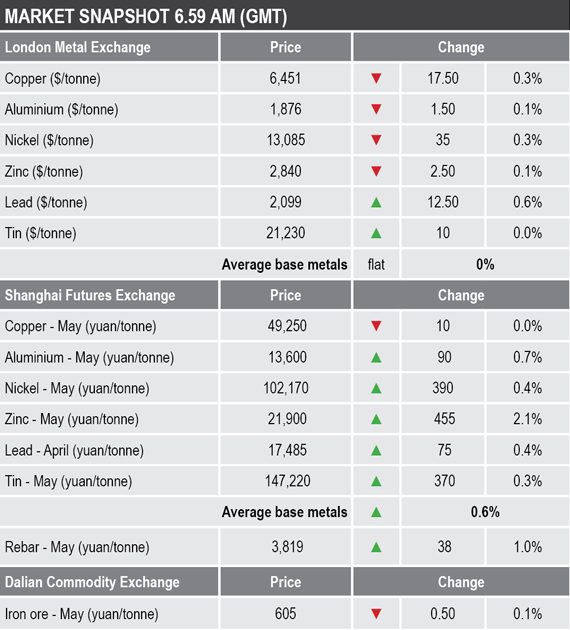

Three-month copper was recently quoted at $6,451 per tonne, off by 0.3% compared with Tuesday’s close at $6,468 per tonne.

Volume was slightly below average with 6,482 lots traded on LME Select as at 06.20am London time, compared with an average across last week of 7,516 lots at a similar time.

This morning’s performance follows a generally strong day on Tuesday when the LME three-month base metals closed with average gains of 1.3%.

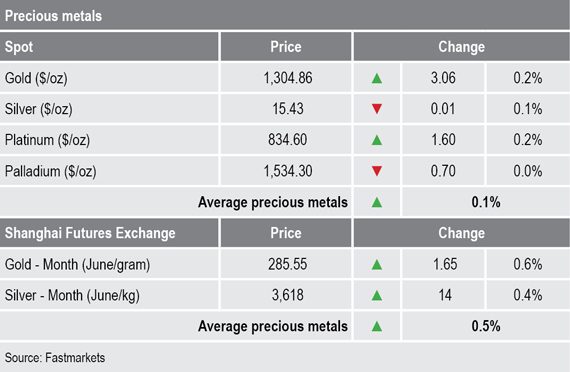

Spot gold prices were up by 0.2% at $1,304.86 per oz, compared with Tuesday’s close of $1,301.80 per oz, silver and palladium prices were slightly weaker, while the price of platinum was up by 0.2% at $834.60 per oz, compared with $833 per oz at the close on Tuesday.

In China, base metals prices on the Shanghai Futures Exchange have mainly followed Tuesday’s stronger tone on the LME, the exception being the May copper contract that is little changed at 49,250 yuan ($7,336) per tonne, while the rest of the May contracts (April for lead) are up by an average of 0.8%.

The spot copper price in Changjiang was up by 0.3% at 49,850-50,030 yuan per tonne this morning, compared with 49,720-49,900 yuan per tonne on Tuesday, while the London/Shanghai copper arbitrage ratio was once again weaker at 7.63 after 7.64 at a similar time on Tuesday.

In other metals in China, the May iron ore contract on the Dalian Commodity Exchange was down by 0.1% at 605 yuan per tonne, compared with 605.50 yuan per tonne at the close on Tuesday. On the SHFE, the May steel rebar contract was up by 1% at 3,819 yuan per tonne, compared with 3,781 yuan per tonne at Tuesday’s close.

In wider markets, the spot Brent crude oil price was little changed at $66.89 per barrel, compared with $66.88 per barrel at the close on Tuesday.

The yield on US 10-year treasuries was weaker again this morning, suggesting a pick-up in risk-aversion on the back of another step-back in the United Kingdom’s plan to exit from the European Union in the process known as Brexit and while US-China trade talks are at a sticking point. The yield on US 10-year treasuries was recently quoted at 2.6105% after 2.6638% at a similar time on Tuesday, while the yields on the US 2-year and 5-year treasuries remain inverted and were recently quoted at 2.4608% and 2.4186% respectively. The German 10-year bund yield was also weaker at 0.0600%, after 0.0850% on Tuesday morning.

In yet another sign of risk-off, Asian equity markets were weaker across the board on Wednesday: Nikkei (-0.99%), Hang Seng (-0.54%), the CSI 300 (-0.87%), the Kospi (-0.41%) and the ASX 200 (-0.22%).

This follows a weaker performance in western markets on Tuesday; in the United States, the Dow Jones Industrial Average closed down by 0.38% at 25,554.66, and in Europe, the Euro Stoxx 50 was little changed, down by 0.01% at 3,303.96.

The dollar index is consolidating after its recent pull back from multi-month highs and was recently quoted at 96.99, the high on March 7 was 97.72, which just overcame the 2018 peaks from November 2018 at 97.70 and December 2018 at 97.71. Weaker US core consumer price index (CPI) data that came in at 0.1% against 0.2% previously has reduced pressure on US monetary policy, which could well weigh on the dollar.

The other major currencies we follow are mixed; the euro (1.1284 is firmer, the Australian dollar (0.7052) and the Japanese yen (111.31) are consolidating and sterling is not surprisingly volatile, it was recently quoted at 1.3105 having been in a range so far this week of 1.2960 to 1.3288 – this on the back of Brexit uncertainty.

The yuan is edging lower again and was recently quoted at 6.7095 – this after a recent low of 6.7298 on March 11. Most of the other emerging market currencies we follow are mixed and are trading within recent ranges, although the Indian rupee has been trending higher of late.

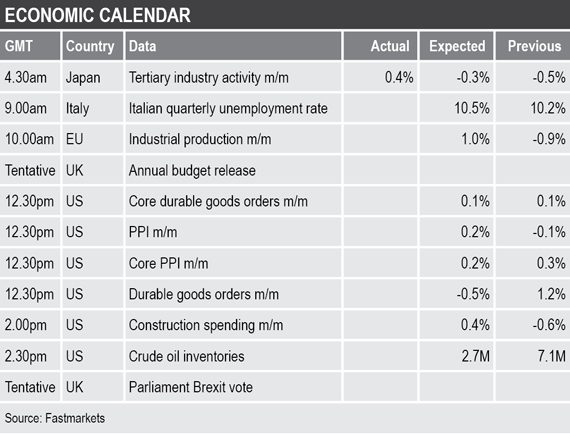

On the economic agenda, data out already showed Japan’s tertiary industrial activity rose 0.4% in January, after a 0.5% decline in December 2018. Key data out later includes Italian unemployment rate, EU industrial production and the UK annual budget. US releases include the producer price index (PPI), durable goods orders, construction spending and crude oil inventories. In addition, the UK Parliament is expected to hold another Brexit vote on Wednesday, this time on whether to leave the EU without a deal.

For now the base metals are holding up well, this despite considerable risk in Europe over Brexit, US-China trade talks that may or may not succeed and global economic data that is showing a continued slowdown. The fact the metals are holding up despite these headwinds and the fact copper is doing so despite the market expecting a significant pick-up in LME stocks, all suggest demand is firm.

In turn that suggests, that after a long drawn out period of weak sentiment that has been caused by the US trade disputes, the supply chain may have destocked to an extent that it now needs to be buying hand-to-mouth, which in turn is giving apparent demand a boost. This suggests the metals’ fundamentals are firm, but that is not to say that prices would not have a setback if there was a geopolitical shock.

Gold prices are heading higher again, helped by a pause in the dollar’s advance and weaker government bond yields, but also while investors take out insurance against the risk of a negative development over US trade, Brexit, or some other event, such as a stock market correction.