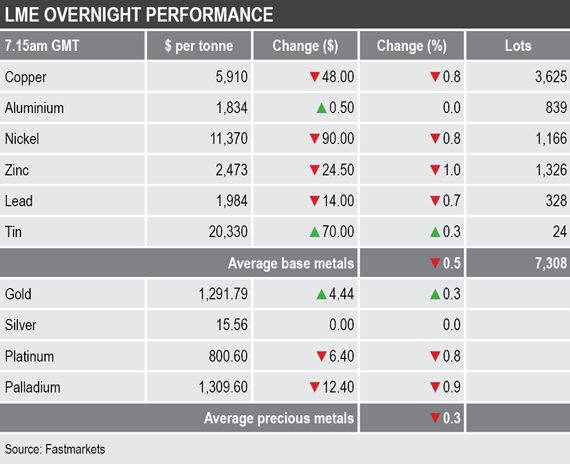

Three-month tin was the only LME base metal in positive territory with a 0.4% gain, while aluminium was little changed and the rest were down between 0.7% for nickel and 1% for zinc – with copper off by 0.8% at $5,911 per tonne.

Volume across the complex has been above average with 7,308 lots traded as at 7.15am London time.

In the precious metals, prices were split with the more industrial platinum group metals (PGMs) down by around 0.8%, while gold was up by 0.3% at $1,291.79 per oz and silver was flat.

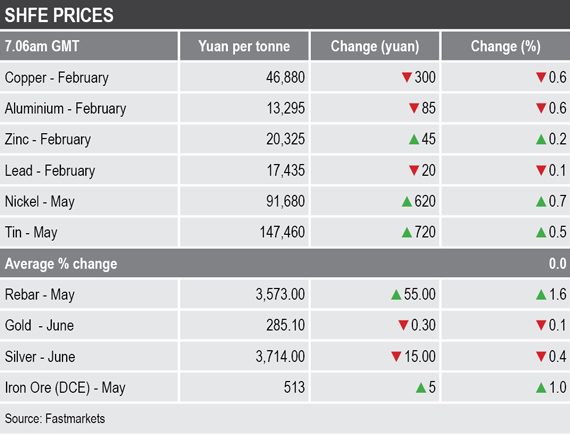

In China, base metals prices on the Shanghai Futures Exchange were mixed; the February copper and aluminium contracts were down by 0.6%, the February lead and zinc contracts were little changed, while the May tin and nickel contracts were up by 0.5% and 0.7% respectively. The February copper contract was recently quoted at 46,880 yuan ($6,932) per tonne.

Meanwhile, spot copper prices in Changjiang were little changed at 47,090-47,230 yuan per tonne and the LME/Shanghai copper arbitrage ratio has edged up to 7.93 from 7.92 last Friday.

In other metals in China, the May iron ore contract on the Dalian Commodity Exchange was up by 1% at 513 yuan per tonne. On the SHFE, the May steel rebar contract was also up by 1.6% – neither contract spooked by the trade data.

In wider markets, the spot Brent crude oil price was weaker by 1.35%% at $59.78 per barrel – so a correction seems to be emerging after the strong rally to $62.51 per barrel last Friday, from $50.27 per barrel on December 26, 2018. The weaker Chinese trade data pointing to slow economic activity may well be weighing on prices.

The yield on US 10-year treasuries has strengthened again, suggesting risk-off, it was recently quoted at 2.6681%. The yields on the US 2-year and 5-year treasuries remain inverted at 2.5130% and 2.4909% respectively. The German 10-year bund yield was also stronger at 0.2300%.

Asian equity markets were mixed on Monday: Hang Seng (-1.42%), the CSI 300 (-0.87%), Kospi (-0.53%) and the Australian ASX 200 (-0.02%).

This morning’s performance in Asia follows weakness in western markets last Friday; in the United States, the Dow Jones Industrial Average closed off by 0.02% at 23,995.95, while in Europe, the Euro Stoxx 50 was down by 0.18% at 3,070.04.

The dollar index is consolidating recent gains and was recently quoted at 95.58 – the recent low being 95.03 on January 10. The other major currencies we follow are mixed: the Australian dollar (0.7186), the euro (1.1478), sterling is firmer (1.2843), as is the yen (108.10).

The yuan is consolidating recent gains and was recently quoted at 6.7628, this no doubt due to the weak trade data. The other emerging market currencies we follow are also consolidating recent gains, suggesting a degree of risk-off.

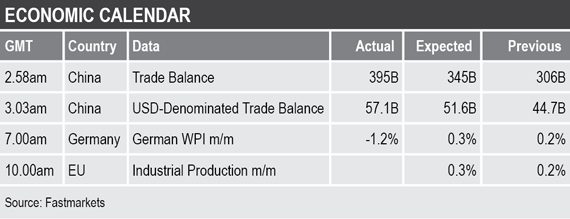

In economic data on Monday, focus is on the disappointing Chinese trade data that showed weakening imports and exports. Also out earlier, Germany’s wholesale price index fell 1.2%, this follows a 0.2% rise previously. Later, there is data on EU industrial production that is expected to climb by 0.3%.

Copper prices hesitated last week about becoming more bullish, unlike prices for lead, nickel and tin, and copper prices have moved out of their sideways trading range toward the downside this morning. This suggests sentiment has once again turned weaker, which on the back of the Chinese trade data in unsurprising. That said, with some optimism on trade talks, the poor data might be able to be shrugged off as it is backward-looking, while positive steps on the trade talks would be forward-looking. For now the markets seem stuck in a pessimistic tone; we expect it will take more concrete evidence of a trade agreement before confidence returns and that may still be some way off.

The more industrial precious metals are either showing weakness, as is the case with the PGMs, in line with the base metals, or are stuck in the middle, as is the case in silver, while the pick-up in risk-off has once again supported gold prices that are managing to hold up in high ground.