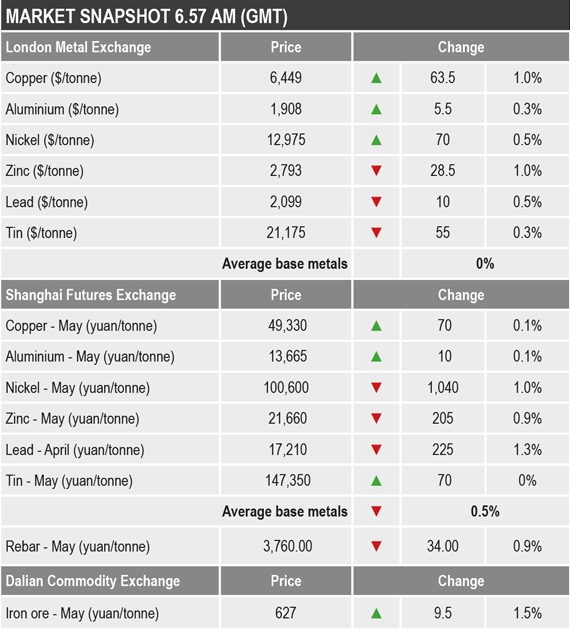

Three-month copper was recently quoted at $6,449 per tonne, up by 1% compared with Thursday’s close at $6,385 per tonne.

Volume was significantly above average, with 19,661 lots traded on LME Select as at 7.02am London time, compared with an average across last week of 7,516 lots at a similar time.

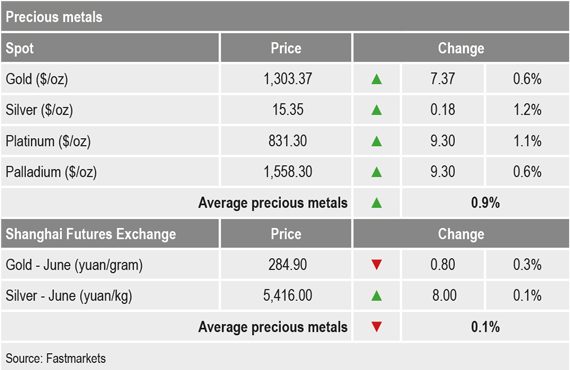

Spot precious metals prices were up across the board by an average of 0.9% on Friday, with silver up by 1.2%, platinum up by 1.1%, while palladium and gold prices are both up by 0.6%. The gold price was recently at $1,303.37 per oz from Thursday’s close of $1,296 per oz.

In China, base metals prices on the Shanghai Futures Exchange were also mixed this morning, with the May contracts for copper, aluminium and tin all little changed. Copper was up 0.1% at 49,330 yuan ($7,342) per tonne from 49,260 yuan per tonne at Thursday’s close. May nickel, zinc and April lead are all weaker, down an average of 1.1%.

The spot copper price in Changjiang was down by 0.4% at 49,410-49,840 yuan per tonne this morning from 49,625-50,055 yuan per tonne on Thursday, while the London/Shanghai copper arbitrage ratio was firmer at 7.67 after 7.62 at a similar time on Thursday.

In other metals in China, the May iron ore contract on the Dalian Commodity Exchange was up by 1.5% at 627 yuan per tonne from 617.50 yuan per tonne at the close on Thursday. On the SHFE, the May steel rebar contract was down by 0.9% at 3,760 yuan per tonne compared with 3,794 yuan per tonne at Thursday’s close.

In wider markets, the spot Brent crude oil price was 0.4% stronger at $67.44 per barrel than $67.17 per barrel at the close on Thursday.

The yield on US 10-year treasuries has weaker this morning – it was recently quoted at 2.6183% after 2.6278% at a similar time on Thursday. The yields on the US 2-year and 5-year treasuries remain inverted – they were recently quoted at 2.4594% and 2.4211% respectively. The German 10-year bund yield was also weaker at 0.0750% after 0.0800% on Thursday morning.

Asian equity markets were for the most part firmer on Friday: Nikkei (+0.77%), Hang Seng (+0.78%), the CSI 300 (+1.26%), the Kospi (+0.95%), while the ASX 200 is weaker (-0.07%).

This follows a stronger performance in western markets on Thursday: in the United States, the Dow Jones Industrial Average closed up by 0.03% at 25,709.94; and in Europe, the Euro Stoxx 50 was up by 0.66% at 3,342.03.

The dollar index is consolidating, it was recently quoted at 96.61, compared with 96.55 at a similar time on Thursday. The other major currencies we follow are mixed; the euro (1.1327) and the Australian dollar (0.7091) are slightly firmer while the yen (111.67) and the sterling (1.3226) are slightly weaker.

The yuan is flat – it was recently quoted at 6.7148 compared with 6.7158 at a similar time on Thursday. Most of the other emerging market currencies we follow are mixed, providing no concerted signal, although the Indian rupee continues to strengthen and was recently quoted at 69.129, the strongest since august 2018.

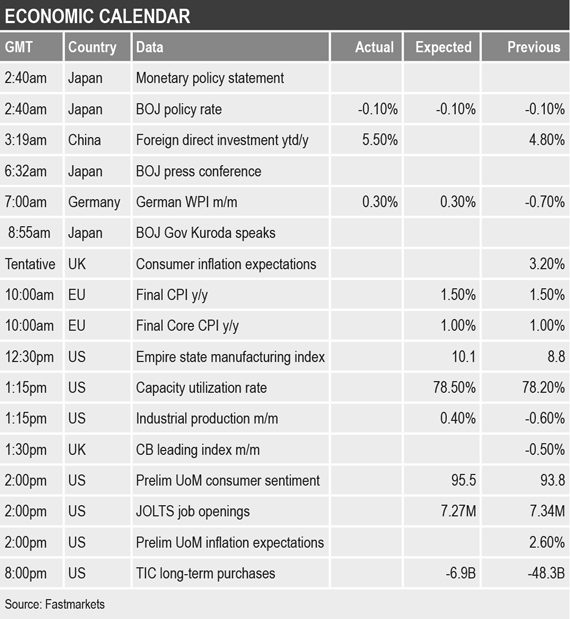

Economic data out already on Friday shows another piece of positive data from China where foreign direct investment climbed 5.5%, compared with 4.8% previously. Out of the other data being released today, the market is likely to focus on EU consumer price index (CPI) data, US manufacturing and industrial production data, the University of Michigan consumer sentiment and inflation expectations, job opening and treasury international capital long-term purchases (TIC) data.

The metals are looking quite mixed today with aluminium working higher, zinc tried higher on high volume and set a fresh high for the year at $2,882 per tonne, but has since reversed, while the rest are consolidating. The much-expected stock inflow on copper appeared yesterday so the market will be waiting to see whether more material shows up in LME data today. Given yesterday’s inflow, the fact copper prices are up ahead of today’s stock data shows an underlying strong sentiment. The fact prices are generally holding up well despite the many headwinds is noteworthy.

Gold, silver and platinum prices have become quite choppy as they consolidate, while palladium prices remain strong in line with their fundamentals and are perched just below the highs.