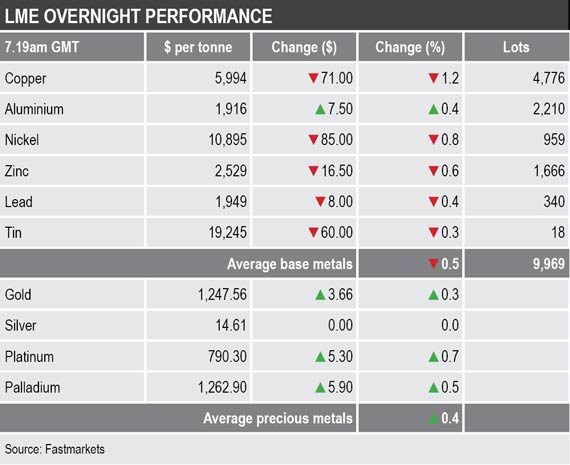

Copper was down the most with a 1.2% drop to $5,994 per tonne, this after rebounding 1.8% on Tuesday. Today’s low at $5,946 per tonne once again breached the October low, threatening a return to the August/September lows that were either side of $5,800 per tonne.

Volume across the complex has been high with 9,969 lots traded as at 7.19am London time.

The precious metals were firmer this morning, with prices up by an average of 0.4% – gold was recently quoted at $1,247.56 per oz.

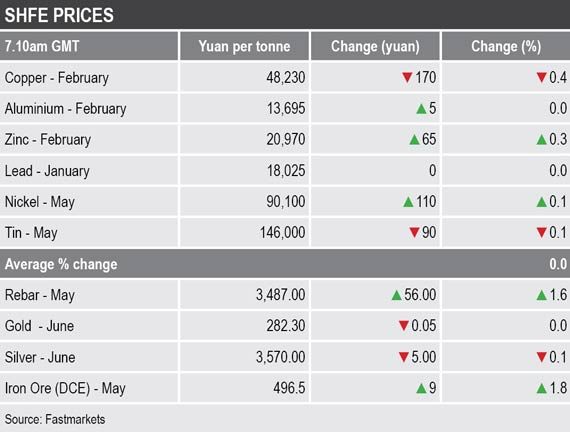

In China this morning, the base metals prices on the Shanghai Futures Exchange were mixed and mostly little changed; the February copper contract price was down by 0.4% at 48,230 yuan ($6,994) per tonne and the February zinc contract price was up by 0.3% – the rest were either side of unchanged.

Spot copper prices in Changjiang were unchanged at 48,030-48,420 yuan per tonne and the LME/Shanghai copper arbitrage ratio was stronger at 8.05.

The yield on US 10-year treasuries has weakened again and was recently quoted at 2.7631%, this despite the US Federal Open Market Committee (FOMC) raising the Federal funds rate by 25 basis points to 2.25-2.50%, which suggests further risk-off and more haven buying. The yields on the US 2-year and 5-year treasuries also became more inverted again at 2.6479% and 2.6261% respectively. The German 10-year bund yield was also weaker at 0.2100%.

Asian equity markets have also reacted negatively on Thursday to the FOMC decision: the Nikkei (-2.84%), the Kospi (-0.90%), the ASX 200 (-1.34%), the CSI 300 (-0.77%) and the Hang Seng (-1%).

This morning’s performance follows a mixed performance in western markets on Wednesday, where participants reacted negatively to the FOMC statement, which was not as dovish as expected; in the US, the Dow Jones Industrial Average closed down by 1.49% at 23,323.66, while in Europe, the Euro Stoxx 50 was up by 0.37% at 3,051.38.

The dollar index has continued to ease, this despite the FOMC rate hike. The index was recently quoted at 96.73. Out of the other major currencies we follow, most are firmer: euro (1.1414), sterling (1.2645) and the yen (111.88). The exception to this firmer tone is the Australian dollar (0.7108) that is on a back footing. The relative strength of the yen also suggests a pick-up in haven buying.

The yuan is rangebound above recent lows and was recently quoted at 6.8988. The emerging market currencies we follow are not showing too much concern, suggesting the US rate rise was discounted.

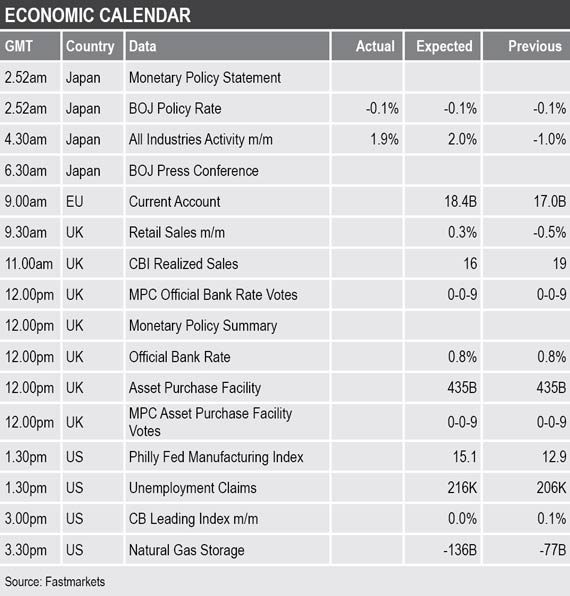

On the economic agenda on Thursday, data already out shows a 1.9% gain in Japan’s all industries activity, this after a 1% drop previously. In the United Kingdom, there is data out on retail sales as well as the Bank of England’s interest rate decision and statement. US data out later includes the Federal Bank of Philadelphia’s manufacturing index, initial jobless claims, leading indicators and natural gas storage.

With copper and aluminium both extending lower in recent days, the mood in the market remains depressed and the path of least resistance is sideways to lower while the market waits for some concrete progress on trade. The concern is that the longer the wait for a trade agreement, and it has already been a long wait, the greater the risk of global growth slowing as businesses hold-off making capex decisions.

The risk-off climate, lower yields and a FOMC statement that foresees fewer rate rises ahead, are all positive for gold, especially with global equity markets also under pressure.