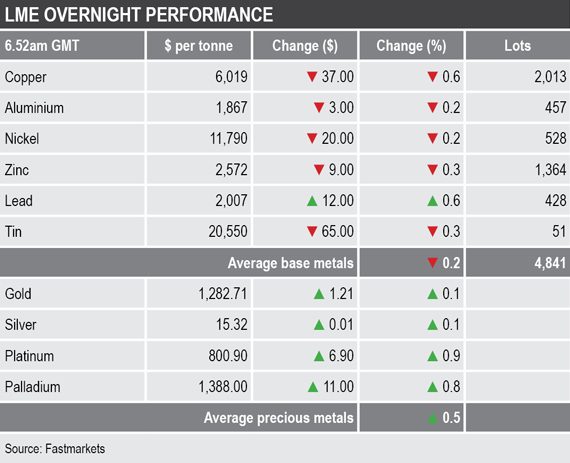

The complex posted an average loss of 0.2%, with copper showing the largest reaction; the three-month copper price fell by 0.6% to $6,019 per tonne, but the red metal had put in a strong performance in the second half of last week. Lead bucked the downward trend with a gain of 0.6% to $2,007 per tonne ¬– recently resistance above $2,000 per tonne has dominated, while the rest showed declines between 0.2% and 0.3%.

Volume across the LME base metals complex was average with 4,841 lots traded as at 6.52am London time.

Precious metals prices were split into two camps with gold and silver prices showing some weakness compared with recent weeks – they were up by just 0.1%, with gold at $1,282.71 per oz, while the more industrial platinum group metals (PGMs) of platinum and palladium were up by around 0.8%.

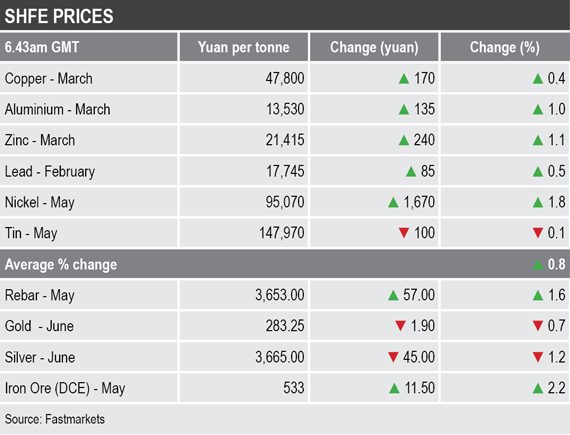

In China, base metals prices on the Shanghai Futures Exchange were up across the board, with the exception of tin that was off by 0.1% – the rest were up by an average of 1% as they played catch-up with the strong performance on Friday on the LME. The May nickel contract led the gains with a 1.8% rise, followed by the March zinc and aluminium contracts that were up by around 1%, while the March copper contract was up by 0.4% at 47,800 yuan ($7,051) per tonne.

Spot copper prices in Changjiang were up by 0.4% at 47,810-47,880 yuan per tonne and the LME/Shanghai copper arbitrage ratio was little changed at 7.94.

The ferrous-orientated metals in China were up strongly this morning; the May iron ore contract on the Dalian Commodity Exchange was up by 2.2% at 533 yuan per tonne. On the SHFE, the May steel rebar contract was up by 1.6%. These contracts were also up strongly last Friday, which suggests confidence in some parts of the Chinese economy is improving.

In wider markets, the spot Brent crude oil price was stronger by 0.25% at $62.66 per barrel – so prices are pushing higher again – the previous high being $62.51 per barrel on January 11.

The yield on US 10-year treasuries has strengthened, indicating less haven demand, it was recently quoted at 2.7841%. The yields on the US 2-year and 5-year treasuries remain in contango, they were recently quoted at 2.6097% and 2.6248% respectively. The German 10-year bund yield was also firmer at 0.2600%.

Asian equity markets were stronger across the board on Monday (as they were last Friday): Nikkei (+0.26%), Hang Seng (+0.29%), the CSI 300 (+0.55%), the ASX 200 (+0.18%) and Kospi (+0.02%).

This morning’s performance in Asia follows strength in western markets last Friday; in the United States, the Dow Jones Industrial Average closed up by 1.38% at 24,706.35, while in Europe, the Euro Stoxx 50 was up by 2.14% at 3,134.92.

The dollar index, at 96.25, is consolidating recent rebound gains, while the firmer yields and non-inverted yield curve may be providing confidence. The recent strength in dollar is prompting consolidation in the other major currencies we follow: the euro (1.1382), the Australian dollar (0.7168) are also consolidating, the yen (109.55) is weaker, while sterling (1.2872) is consolidating recent gains.

The yuan (6.7888) has weakened, no doubt not helped by the weak GDP data. The other emerging market currencies we follow are either consolidating recent strength, or showing slight weakness.

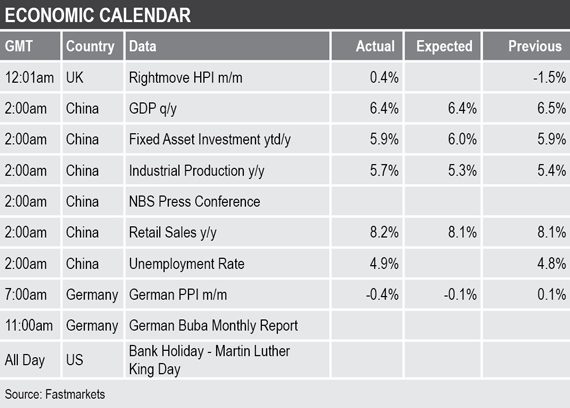

Economic data already out on Monday shows mixed Chinese data – in addition to weak GDP data, the unemployment rate edged up to 4.9%, from 4.8%, fixed asset investment was unchanged at 5.9%, while industrial production jumped to 5.7%, from 5.4% and retail sales edged up to 8.2%, from 8.1%. Elsewhere, German producer price index (PPI) dropped by 0.4%, having previously been up 0.1%. Later, there is a German Bundesbank monthly report, while there is no scheduled US data because US markets are closed for Martin Luther King Day.

While the base metals prices are consolidating this morning, the overall picture on the charts is looking constructive following a show of strength in the second half of last week. The market is optimistic on the outlook for US/China trade that could drive prices further, especially while liquidity reduces as we approach the Lunar New Year holiday that begins on February 4. In addition, a pick-up in both Chinese industrial production and retail sales, as well as oil prices, are encouraging.

We have said recently that bases seem to be in place so that should make for a good launching pad should sentiment improve – that seems to be unfolding, but like previous upside initiatives it may well be fragile, but we remain quietly confident.

Gold and silver are consolidating off recent highs but there are still enough uncertainties and risks around to provide some haven demand, but the firmer dollar, higher treasury yields and more risk-on may prove too strong a headwind for the precious metals – that is with the exception of palladium, where prices are riding their strong fundamental wave.