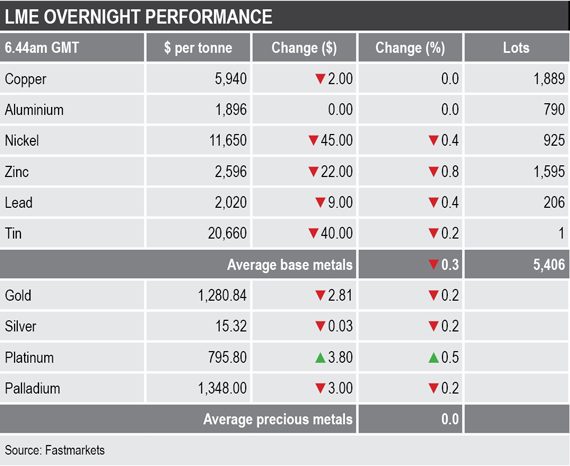

Zinc led the way with a 0.8% drop, nickel and lead prices were off by 0.4%, tin was down by 0.2%, while copper and aluminium were little changed, with copper recently quoted at $5,940 per tonne.

Volume across the LME base metals complex was average with 5,406 lots traded as at 6.44am London time.

Precious metals prices were for the most part weaker with gold, silver and palladium down by 0.2%, with gold at $1,280.84 per oz, while platinum was bucking the trend with a 0.5% rise to $795 per oz.

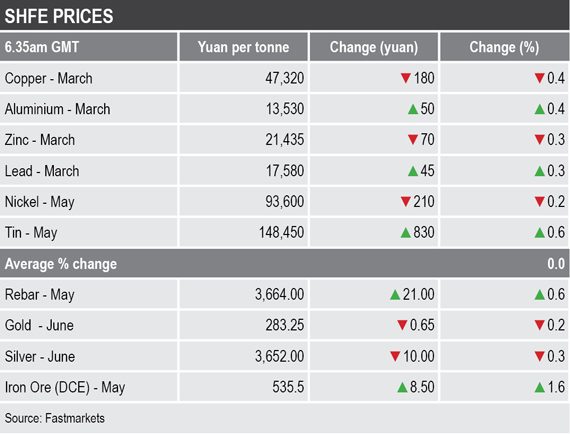

In China, base metals prices on the Shanghai Futures Exchange were split into two groups; the March copper and zinc contracts and the May nickel contract were off by an average of 0.4%, while the March aluminium and lead contracts and the May tin contract were up by an average of 0.4%. The most-traded March copper contract was down by 0.4% at 47,320 yuan ($6,965) per tonne.

Spot copper prices in Changjiang were down by 0.4% at 47,060-47,150 yuan per tonne and the LME/Shanghai copper arbitrage ratio, at 7.97, was little changed compared with roughly the same time on Wednesday.

In other metals in China, the May iron ore contract on the Dalian Commodity Exchange was stronger by 1.6% at 535.50 yuan per tonne. On the SHFE, the May steel rebar contract was up by 0.6%.

In wider markets, the spot Brent crude oil price was weaker by 0.23% at $60.66 per barrel – prices are consolidating after Monday’s push higher stalled.

The yield on US 10-year treasuries has drifted again, it was recently quoted at 2.7399%. The yields on the US 2-year and 5-year treasuries remain inverted, they were recently quoted at 2.5787% and 2.5747% respectively. The German 10-year bund yield was unchanged at 0.2200%. The weaker yields suggest less risk-on appetite.

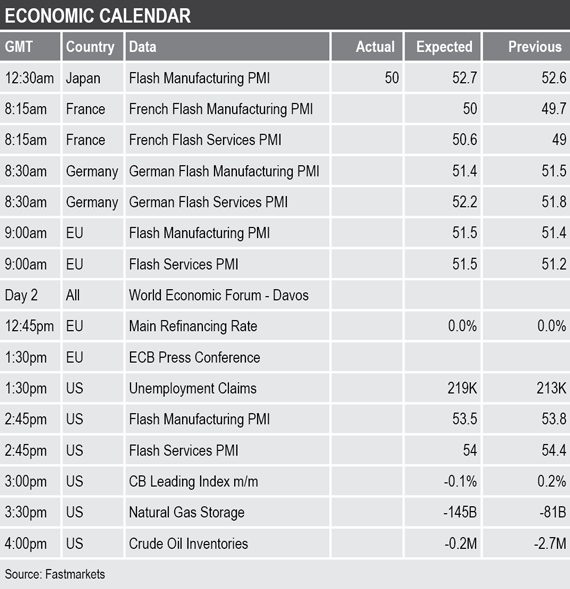

Asian equity markets were for the most part firmer on Thursday: Nikkei (-0.09%), Hang Seng (+0.24%), the CSI 300 (+0.56%), the ASX 200 (+0.38%) and Kospi (+0.81%) – the weakness in the Nikkei may well be due to the sharp drop in Japan’s flash manufacturing purchasing managers index (PMI) that fell to 50 from 52.6.

This morning’s performance in Asia follows a mixed performance in western markets on Wednesday; in the United States, the Dow Jones Industrial Average closed up by 0.7% at 24,575.62, and in Europe, the Euro Stoxx 50 was little changed, but down by 0.02% at 3,112.13.

The dollar index’s recent rebound has now paused, it was recently quoted at 96.21, this is around the lower ranges of the late-November to late-December 2018 high ground. This could be a test of the January 7 breakdown level, or the overall upward trend reasserting itself. Given the more dovish US Federal Reserve stance of late, we would not be surprised if this rebound in the dollar peters out.

The recent pause in the dollar’s rebound is prompting mixed performance in the other major currencies we follow: the euro (1.1373) is consolidating, as is the yen (109.69), while the Australian dollar (0.7097) is weaker and sterling is firmer at 1.3054.

The yuan started to weaken last week, but is now consolidating and was recently quoted at 6.7915. Most of the other emerging market currencies we follow are also consolidating, the exceptions being the ringgit that is weaker.

Economic data already out showed the weaker Japanese PMI data and later there is flash PMI data out across Europe and the US. In addition, the European Central Bank is setting interest rates and has a press conference, with additional US data covering initial jobless claims, leading indicators, natural gas storage and crude oil inventories.

The base metals are for the most part taking it in turns to edge higher, but overhead resistance is frequently encountered that is causing a stop-start upward movement. While copper, zinc, lead and nickel were leading the way last week, copper and nickel are taking a back seat this week, while aluminium now leads the way – spurred by the large warrant cancellations in LME-registered warehouses.

The overall picture therefore is quietly bullish – we wait to see if less liquidity over the Lunar New Year holidays in early February leads to a faster move higher, or whether it prompts more volatility. Overall, we feel the markets will remain nervous until a US/China trade deal is signed, but while we wait for that, the underlying fundamentals continue to tighten.

The limited pullbacks in gold and palladium prices still show underlying robustness and for gold there is still considerable uncertainty in the financial markets to warrant some haven demand. Silver and platinum remain the weaker precious metals, but they are likely to follow gold’s lead to varying degrees.