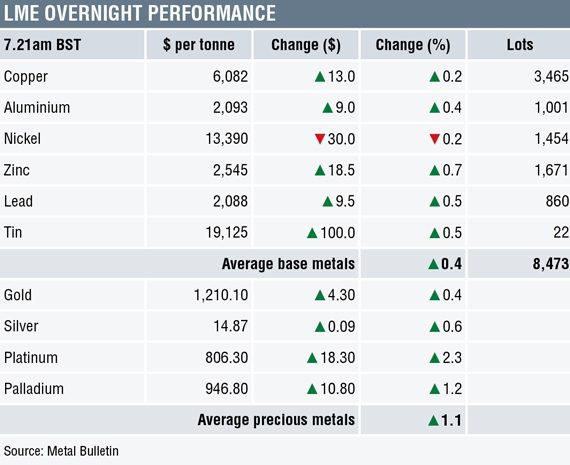

Volume has been above average with 8,473 lots traded as at 07.23am London time.

This morning’s general firmness follows a firmer performance last Friday that saw the complex close up by an average of 1.1%, with only tin ending the day in negative territory.

Precious metals prices were up across the across the board with gains averaging 1.1% – led by a 2.3% rise in platinum prices, while spot gold prices were up by 0.4% at $1,210.10 per tonne.

In China, base metals prices on the Shanghai Futures Exchange were mixed with the October contracts for copper and aluminium down by 0.4% and 0.3% respectively, while the rest of the base metals were showing gains of between 0.1% and 0.5%. The most actively traded October copper contract was recently quoted at 48,570 yuan ($7,123) per tonne.

Spot copper prices in Changjiang were down by 0.4% at 48,520-48,670 yuan per tonne and the LME/Shanghai copper arbitrage ratio was weaker at 7.99 after 8.09 last Friday.

In other metals in China, the January iron ore contract on the Dalian Commodity Exchange was down by 0.7% at 481 yuan per tonne. On the SHFE, the January steel rebar contract was down by 0.6%, while the December gold and silver contracts were up by 0.3% and 0.2% respectively.

In wider markets, spot Brent crude oil prices were up by 0.68% at $76.11 per barrel this morning. The yield on US 10-year treasuries was weaker at 2.8464%, while the German 10-year bund yield at 0.3700% was firmer.

Asian equity markets were for the most part stronger on Tuesday: Nikkei (+0.06%), Kospi (+0.17%), the ASX200 (+0.57%) and the Hang Seng (0.24%), while the CSI 300 dipped by 0.2%. This follows a stronger performance in western markets on Monday; in the United States, the Dow Jones closed up by 1.01% at 26,049.64, while in Europe the Euro Stoxx 50 closed up by 0.83% at 3,456.01.

The dollar index is on a back footing this morning and was recently quoted at 94.86, which extends last Wednesday’s low of 94.93. On the chart, the move above 95.66 on August 10 suggested the index had triggered a bullish head and shoulder pattern, so we need to be wary about how far this pullback in the index goes, as it could just be testing the validity of the breakout.

With the base metals prices trading inversely to the dollar, any resumption of the dollar’s bull market could further weigh on metals’ prices, while if the breakout fails and the dollar weakens then that could be supportive.

Despite the dollar drifting, most of the other major currencies we follow are still consolidating: sterling (1.2868), the euro (1.1670), the Australian dollar (0.7324) and the yen (111.22).

The yuan is firmer and was recently quoted at 6.8147, but most of the emerging market currencies we follow are consolidating in, or near, low ground. Despite the United States-Mexico Trade Agreement, the peso is also consolidating at around 18.8320.

On the economic agenda, data out already shows the Bank of Japan’s core consumer price index (CPI) rising 0.5%, up from 0.4% previously. Later we have the European Union’s M3 money supply and private loans data along with US releases that include goods trade balance, preliminary wholesale inventories, composite house prices, consumer confidence and Richmond Manufacturing Index.

For the most part, the base metals’ rally off the mid-August lows continues; the exceptions are nickel and tin where prices are consolidating above recent lows. The next key economic data as far as the metals are concerned is probably China’s manufacturing purchasing managers’ index (PMI), but that is not out until Friday, so we wait to see if the rebound can last until then.

Overall, on the basis of oversold prices, large short positions, relatively healthy long-term fundamentals and a pick-up in physical interest, we do favor the upside from these levels, but the market may need to build more of a base before buyers are prepared to chase prices higher.

The precious metals are following the path of the base metals, which suggests they are also following the dollar and overall market sentiment.