The weakness in copper – at $6,202 per tonne as at 06.15am London time – comes despite the union at Chile’s Escondida copper mine, the world’s largest, rejecting BHP’s final contract offer and agreeing to vote on whether to go on strike.

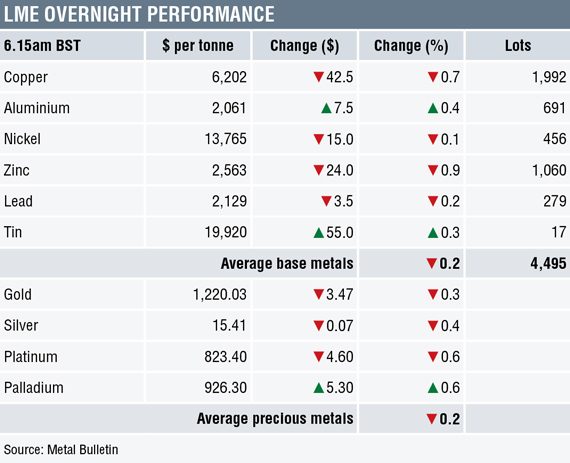

Volume has been below average with 4,495 lots traded across the complex as at 6.15am London time.

Precious metals were for the most part weaker this morning with spot gold, silver and platinum down by 0.3%, 0.4% and 0.6% respectively, while palladium prices were up 0.6%. Spot gold was recently quoted at $1,220.03 per oz.

In China, base metals prices on the Shanghai Futures Exchange were mixed, but with more of an upside bias. Lead prices led on the downside with a 2% drop, while the most-actively traded September copper contract was off by 0.2% at 49,920 yuan ($7,327) per tonne. The rest were up between 0.3% for zinc prices and 1.7% for tin prices.

Spot copper prices in Changjiang were down by 0.2% at 49,740-49,910 yuan per tonne and the LME/Shanghai copper arbitrage ratio has climbed to 8.04.

In other metals in China, the September iron ore contract on the Dalian Commodity Exchange was up by 0.4% at 487.50 yuan per tonne. On the SHFE, the October steel rebar contract was up by 1.6%, while the December gold and silver contracts were unchanged.

In wider markets, spot Brent crude oil prices were down by 0.1% at $74.25 per barrel this morning. The yield on US 10-year treasuries was easier at 2.9607%, while the German 10-year bund yield was also weaker at 0.4019%.

Asian equity markets were weaker on Monday: Nikkei (-0.68%), Hang Seng (-0.78%), CSI 300 (-0.50%), ASX200 (-0.43%) and the Kospi (-0.16%). This follows a mixed performance in western markets on Friday; in the US, the Dow Jones closed down by 0.3% at 25,451.06, while in Europe the Euro Stoxx 50 closed up by 0.51% at 3,527.18.

The dollar index at 94.66 is firmer within its recent 93.71-95.66 range. On the chart, it looks like the dollar is building the right shoulder of a large inverse head-and-shoulder formation. The other major currencies we follow are consolidating in what is going to be a heavy week for central bank decisions with the Bank of Japan, the US Federal Reserve and the Bank of England, all setting policy this week: sterling (1.3113), the euro (1.1664), the yen (111.06) and the Australian dollar (0.7397).

The yuan remains on a back footing and was recently quoted at 6.8280. The other emerging market currencies we follow are slightly firmer, which may well indicate a gradual return to risk-on.

On the economic agenda, data out already shows a 1.8% gain in Japan’s retail sales, after a previous rise of 0.6%. Data out later includes German and Spanish consumer price indices (CPI), a variety of UK lending and money supply data, as well as US data that includes pending home sales and a loan officer survey. Tuesday and Wednesday are going to be very data-heavy days, which should help provide an update on the start of the global economy.

The base metals, after having seen some improvement in recent weeks, are looking weaker again, which suggests that although some support had been found there was limited follow-through buying. The fact that copper prices are down this morning despite an increased risk of a strike at Escondida, suggests that sentiment remains weak.

As mentioned above, given all the data and central bank meetings this week, traders should get a clearer view on how the global economy is operating in the face of the trade wars. So we expect choppy trading to continue – that said, we would not be surprised to see a positive, albeit delayed, reaction to the Escondida development.

The precious metals are performing in a similar way to the base metals, the show of some strength in recent weeks has faded and prices are slipping again. For now, at these price levels, we are neither bullish, nor bearish on gold and expect the precious metals to follow the lead of the metals complex as a whole.