This after strong gains in recent weeks and likely reflects some caution ahead of the United States Federal Open Market Committee (FOMC) meeting and US President Joe Biden’s address to Congress.

- US 10-year treasury yields climb…

- …US Dollar Index’s fall arrested

Base metals

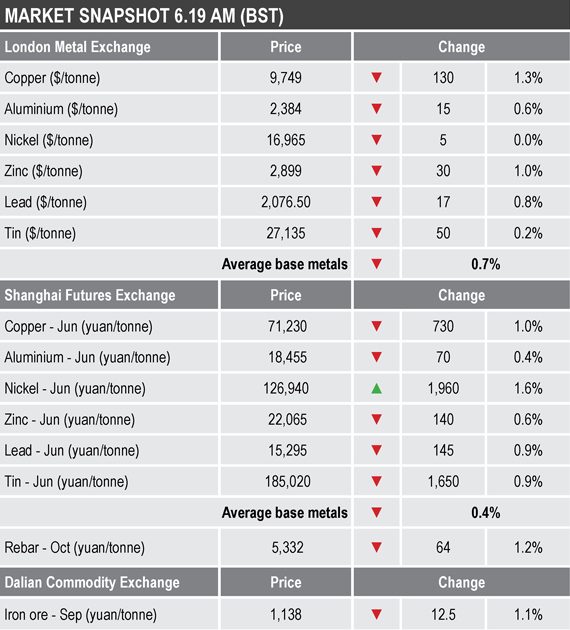

The base metals on the London Metal Exchange were all lower to varying degrees this morning, led by a 1.3% fall in copper to $9,749 per tonne, while nickel was little changed at $16,965 per tonne, but its price only started to rally on April 23.

Volume traded on the LME has not been that high; 6,713 lots had traded by 6.19am London time, compared with an average of 8,380 lots at a similar time on Monday and Tuesday.

The most-active base metals contracts on the SHFE were weaker, the exception was June nickel that was up 1.6%, while the rest were down by an average of 0.8%. June copper led the decline with 1% fall to 71,230 yuan ($10,980) per tonne.

Precious metals

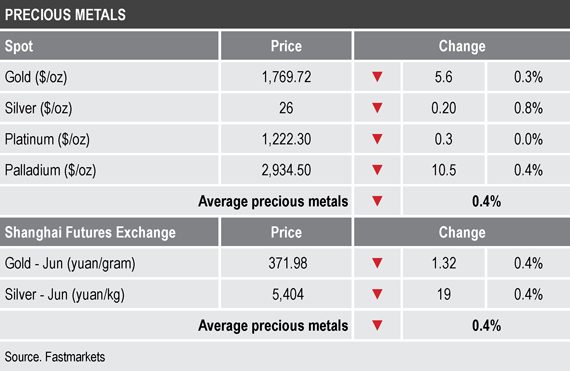

Most of the precious metals were also weaker this morning; the exception was spot platinum that was up slightly at $1,222.30 per oz, while the rest were down by an average of 0.5%, led by a 0.8% fall in silver ($26 per oz). Palladium was off by 0.4% at $2,934.50 per oz and gold was off by 0.3% at $1,769.72 per oz.

Wider markets

The yield on US 10-year treasuries was firmer again this morning and was recently quoted at 1.64%, this after 1.58% at a similar time on Tuesday. The rise suggests markets may be expecting the Federal Reserve’s rhetoric to highlight stronger growth that the market may see as inflationary, even if the US central bank shows little concern.

Asian-Pacific equities were mainly stronger on Wednesday, having been slightly weaker on Tuesday: the ASX 200 (+0.44%), the CSI 300 (+0.16%), the Nikkei (+0.23%), and the Hang Seng (+0.14%), while the Kospi (-1%) weakened.

Currencies

The US Dollar Index was working higher and was recently quoted at 91.04, this after putting in its latest low at 90.67 on Monday.

With the dollar’s slide halted for now, the other major currencies were generally consolidating after recent strength: the euro (1.2067), sterling (1.3882) and the Australian dollar (0.7743), although the yen at 108.95 was notably weaker, compared with last Friday’s peak at 107.34.

Key data

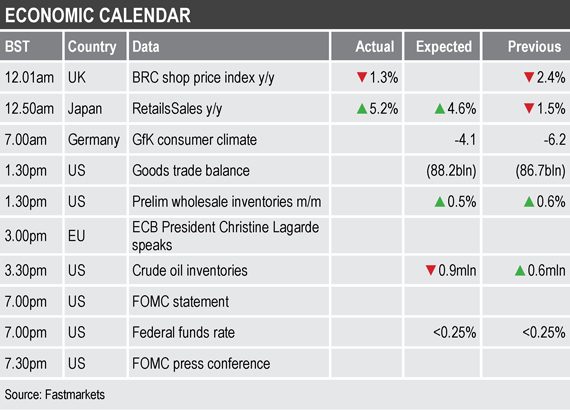

Key economic data already out on Wednesdays showed Japan’s retail sales climbed by 5.2% year on year in March, after a 1.5% decline in February.

Later there is data on German GfK consumer climate and US data on goods trade balance and crude oil and wholesale inventories.

In addition, European Central Bank President Christine Lagarde is also scheduled to speak and the FOMC will update on its monetary policy stance.

Today’s key themes and views

The recent show of strength in the LME metals, that even started to drag nickel prices off the floor, has run out of steam and prices are now consolidating. Overall the path of least resistance remains to the upside, but at these levels a correction can never be ruled out. We expect the catalyst for that would be a correction in the equity markets. Market participants are likely to be nervous today until they have heard from the Fed and US President.

The fact gold prices are also consolidating, the yen is weakening and bond yields are firmer suggests there is less haven demand around, which probably means gold is also seeing some profit-taking ahead of what could be market-moving events.