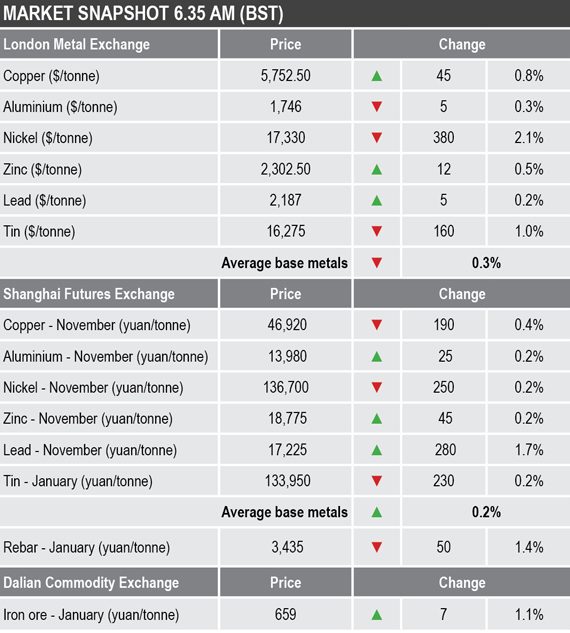

On the LME, three-month copper, zinc and lead prices were firmer by an average of 0.5%, while nickel, tin and aluminium were down by an average of 1.1% – led by a 2.1% decline in nickel to $17,345 per tonne.

Risk-on seems to be a feature across broader markets, where Asian equities are stronger and havens are weaker.

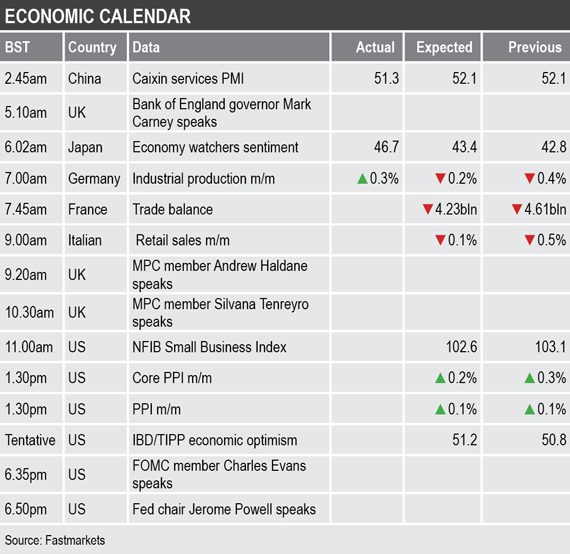

- China’s Caixin services purchasing managers’ index (PMI) dropped to 51.3 in September, from 52.1 in August – marking the lowest since February.

- US President Donald Trump does not sound too optimistic about a US-China trade deal, saying “Can something happen? I guess, maybe. Who knows. But I think it’s probably unlikely”.

Base metals

Nickel has been one of the stronger three-month LME base metals prices of late, but it is leading on the downside this morning with prices down, the cash/three-month spread narrower at $77-93 per tonne backwardation, compared with more than $200 per tonne a week ago, and premiums also softening.

Considering, Indonesia’s ore producers and exporters have a three-month window to maximize ore exports, quotas permitting, China is likely to see a wave of nickel ore arrive, so perhaps it is not surprising that nickel prices are showing some weakness now that China has reopened.

The three-month copper price on the LME was up by 0.8% at $5,753 per tonne this morning compared with Monday’s close, but it is lead that is taking the spotlight. The heavy metal’s three-month price was recently quoted at $2,187 per tonne – the highest since July 2018 – at a time when supply disruptions, a supply deficit and the start of the battery season all seem to be underpinning the metal’s price. This is not bad considering how washed out the auto industry is, especially in China.

Speaking of China, the most-traded base metals contracts on the Shanghai Futures Exchange were similarly mixed this morning, the outperformer being the November lead contract that was up by 1.7% from Monday’s close. The November copper contract was down by 0.4% at 46,920 yuan ($6,563) per tonne, while the November aluminium and zinc contracts were up by 0.2% and November nickel and January tin were down by 0.2%.

The spot copper price in Changjiang was down by 0.6% at 46,960-47,110 yuan per tonne and the LME/Shanghai copper arbitrage ratio was 8.15.

Precious metals

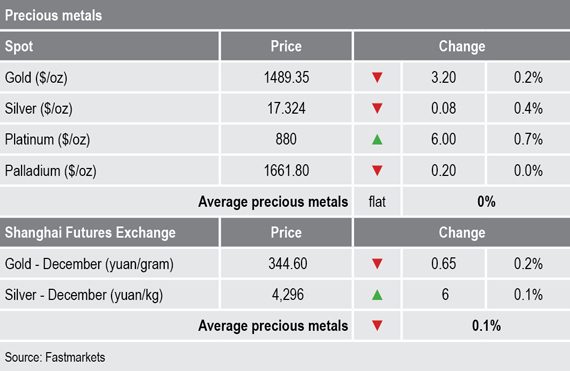

Spot gold prices have been drifting again and were recently quoted at $1,489.35 per oz, which makes them look vulnerable. That said, we expect they will be driven by the direction that US-China trade talks go on Thursday and Friday – this morning’s weaker haven prices suggest optimism over the talks, but Trump’s comments do not sound optimistic.

Silver, platinum and palladium spot prices were consolidating.

Wider markets

Weaker economic data had been weighing on oil, causing the spot Brent crude oil price to fall to a low of $56.13 per barrel on October 3 – it was recently quoted at $58.82 per barrel.

The yield on benchmark US 10-year treasuries has rebounded because there has been a slight increase in risk-on – it was recently quoted at 1.5736%, compared with 1.5138% at a similar time on Monday. The German 10-year bund yield is firmer too, it was recently quoted at -0.5630%, compared with -0.5980% at a similar time on Monday.

Asian equities were stronger on Tuesday: the Nikkei (+0.99%), the Hang Seng (+0.6%), the Kospi (1.21%), the CSI 300 (+0.78%) and the ASX 200 (+0.46%)

This follows a mixed performance in Western markets on Monday, where in the United States, the Dow Jones Industrial Average closed down by 0.36% at 26,478.02; in Europe, the Euro Stoxx50 closed up by 0.71% at 3,471.24.

Currencies

The dollar index is consolidating and was recently quoted at 98.93, the recent range being 98.63 to the multi-year peak at 99.38.

While the dollar consolidates the other major currencies are mixed: the euro (1.0981) and the Australian dollar (0.6752) are firmer, while the yen (107.36) and sterling (1.2277) are weaker.

Key data

As well as China’s Caixin PMI data mentioned above, Tuesday’s economic agenda contains data on sentiment in Japan that climbed to 46.7, from 42.8 – this was the second month-on-month improvement after a steady deterioration since the start of the year. Germany’s industrial production climbed 0.3% in August, after showing a 0.4% decline in July. Later there is data on France’s trade balance and Italian retail sales.

US data out on Tuesday includes the National Federation of Independent Business index, producer price index and IBD/TIPP economic optimism reading.

In addition, US Federal Open Market Committee member Charles Evans and Federal Reserve chair Jerome Powell are speaking.

Today’s key themes and views

The LME base metals appear to be in wait-and-see mode, waiting for developments on trade talks that is likely to set the next direction. But within that general theme, lead and nickel seem to be doing their own thing as discussed above. Overall, we expect some volatile trading around the trade talks.

Gold prices have been consolidating and while they have been doing that, they have looked vulnerable, but like the base metals, the next direction is likely to be driven by how the trade talks go.