- Asian-Pacific equities and major western pre-market equity index futures were weaker this morning

- US Dollar Index firmed on Wednesday while equities sold-off

Base metals

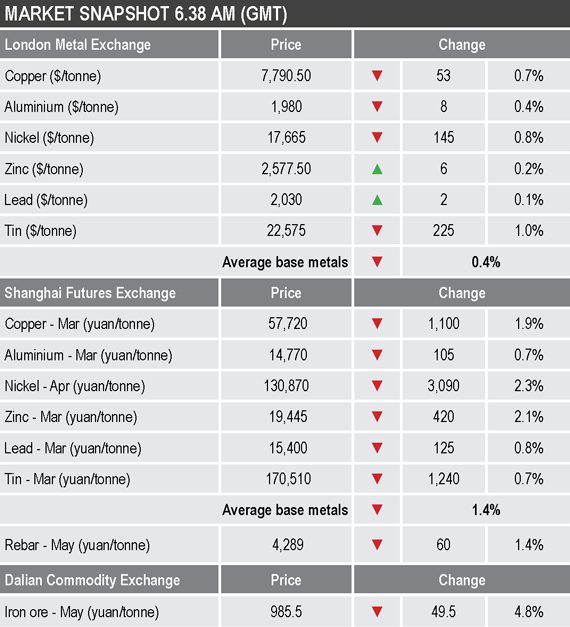

There were more fallers than risers among the base metals on the LME this morning, with prices across the complex down by an average of 0.4%. Three-month lead and zinc prices bucked the trend with 0.2% and 0.1% gains, while the rest were down by an average of 0.7%, led by a 1% fall in tin ($22,575 per tonne). Copper was down by 0.7% at $7,790.50 per tonne – see price table for more details.

Volume traded on the LME has been average with 6,307 lots traded by 6.38am London time, compared with an average across last week, at a similar time of day, of 6,591 lots.

The most-traded base metals contracts on the SHFE were down across the board by an average of 1.4%, while they adjusted for the weakness in LME prices on Wednesday. April nickel and March zinc led on the downside with losses of 2.3% and 2.1% respectively, while March copper was down by 1.9% at 57,720 yuan ($8,915) per tonne.

Precious metals

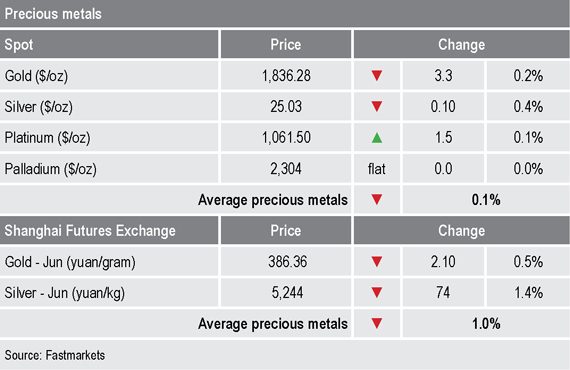

Spot gold and silver were both weaker this morning, with gold off by 0.2% at $1,836.28 per oz and silver down by 0.4% at $25.03 per oz – neither suggesting a pick-up in haven demand. Platinum was up by 0.1% at $1,061.50 per oz and palladium was unchanged at $2,304 per oz.

Wider markets

The yield on US 10-year treasuries is suggesting some haven demand; it was recently quoted at 1.01%, down from 1.04% at a similar time on Wednesday and after a recent high of 1.18%.

Asian-Pacific equities were weaker this morning: the Hang Seng (-2.22%), the Kospi (-1.71%), the ASX 200 (-1.93%), the CSI (-2.73%) and the Nikkei (-1.53%).

Currencies

The US Dollar Index started to edge higher on Monday, paused on Tuesday, but pushed higher on Wednesday and is firmer this morning, too. It was recently quoted at 90.84 – this after being at 90.23 at a similar time on Wednesday.

The other major currencies were weaker this morning: the euro (1.2083), the yen (104.37), the Australian dollar (0.7600) and sterling (1.3639).

Key data

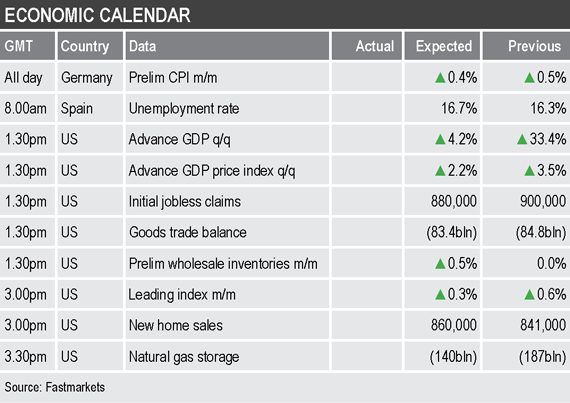

Thursday has a busy economic agenda with German preliminary consumer price index (CPI) and Spanish unemployment.

US data includes readings on advanced gross domestic product (GDP), advanced GDP price index, initial jobless claims, goods trade balance, preliminary wholesale inventories, leading indicators, new home sales and natural gas storage.

Today’s key themes and views

We wondered whether the weakness in zinc that started to emerge last week would flow into the other metals and it seems to have done so, although the weaker tone on Wednesday seems more tied into the pullback in the equities and a general pick-up in nervousness having seen various assets start to trade very irrationally, starting with Bitcoin a few weeks back and then more recently in the likes of GameStop.

We have been expecting a countertrend move, one seems to be getting underway now and we should get a feel for how strong underlying bullish sentiment is by seeing how far any pullback goes and how long it lasts. Overall, we remain long-term bullish toward the base metals on account of expecting more infrastructure spending, but a correction could be quite a constructive development after such long rallies.

Gold prices have eased in line with the general weakness in markets, but prices are still above the $1,820 per oz level – in recent weeks we have seen dip-buying emerge below that level. If a broader sell-off does unfold then we would not be surprised to see gold prices initially weaken as investors dash-for-cash, before later strengthening as realized cash is then put into havens.