Base metals face numerous cross currents with demand expected to recover in China but fall further in the world ex-China, while the Covid-19 virus and lower prices lead to supply restraints.

- Markets now focusing on magnitude of containment measures and how long they will last.

- Texas light sweet crude oil prices have traded as low as $20.18 per barrel recently.

Base metals

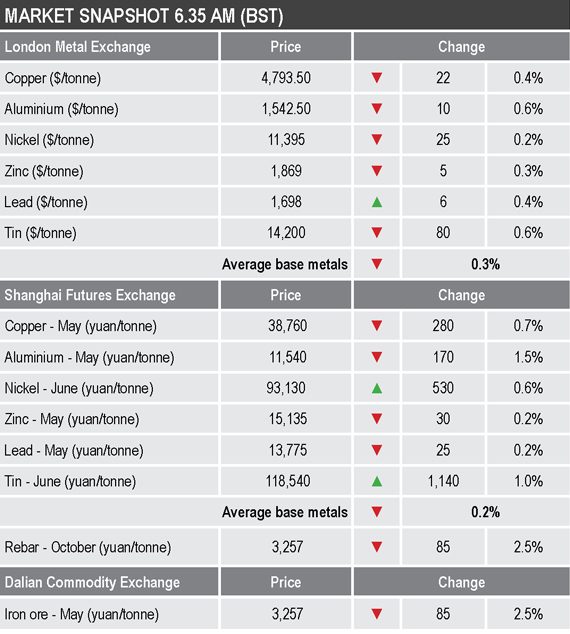

Three-month base metals prices on the London Metal Exchange were mainly lower this morning, the exception being lead that was up by 0.4%, while the rest were down by an average of 0.4% – led by 0.6% declines in aluminium ($1,542.50 per tonne) and tin ($14,200 per tonne). Copper was off by 0.4% at $4,793.50 per tonne.

The most-traded base metals contracts on the Shanghai Futures Exchange were also mixed with June nickel and June tin both up by 0.6%, while the rest were down by 0.6%. May copper was down 0.7% at 38,760 yuan ($5,461) per tonne.

Precious metals

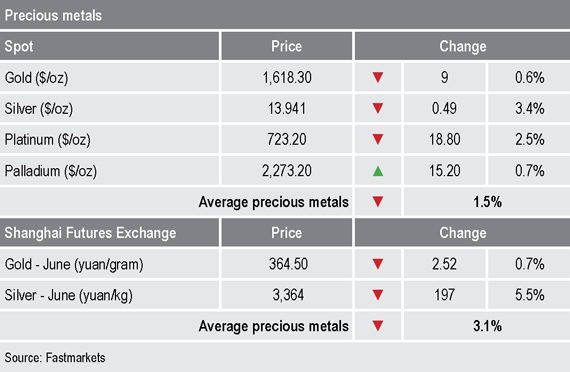

Spot gold prices were consolidating after last week’s gains and were recently trading around $1,618.30 per oz, while silver was under pressure at $13.94 per oz. The gold/silver ratio has climbed again and was recently at 1:116.

Platinum and palladium prices were consolidating this morning, just below recent rebound highs.

Wider markets

The yield on benchmark United States 10-year treasuries has eased slightly and was recently quoted at 0.68%, compared with 0.78% at a similar time on Friday.

Asian-Pacific equities were for the most part weaker this morning: the Hang Seng (-0.93%), the Kospi (-0.04%), the CSI 300 (-1.3%) and the Nikkei (-1.57%), the exception being the ASX 200 that was up by 7%, but this follows a similar decline on Friday.

Currencies

The dollar index is rebounding this morning and was recently quoted at 98.80, this after falling from 103 to 98.20 last week.

The other major currencies we follow are consolidating after last week’s gains: the euro (1.1077), the yen (108.01), the Australian dollar (0.6140) and sterling (1.2370).

Key data

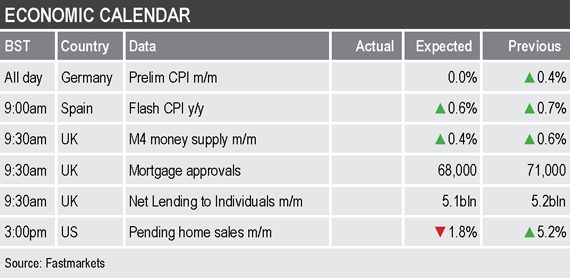

Monday’s economic agenda contains data on German and Spanish consumer price index (CPI), UK lending and US pending home sales.

Today’s key themes and views

As the Covid-19 virus spreads rapidly across Europe, the US and in other regions outside of China, the markets are focusing on how long the lockdowns will last – the longer they do the more damage will be done. But the combinations of lockdowns and low prices are expected to prompt more production cutbacks which should provide some support, as will the recovery in China.

While the crisis unfolds further in the world ex-China, we expect there will be more demand for haven assets, which should benefit gold.