- United States 10-year treasuries yields strong at 1.64%, showing risk-on

- China’s industrial production and retail sales climb more than expected…

- …but unemployment also rises

Base metals

Three-month base metals prices on the London Metal Exchange were more negative than positive this morning, with aluminium ($2,180.50 per tonne) showing a minor gain and zinc ($2,812.50 per tonne) little changed, while the rest of the complex were down by an average of 0.6%, led by 0.8% falls in copper ($9,061.50 per tonne) and nickel ($15,880 per tonne).

Conversely, on the Shanghai Futures Exchange there were more winners than losers, with June nickel off by 2.1% and May tin down by 2.4%, while the rest of the complex were up by an average of 0.6%, with May copper up by 0.6% at 67,470 yuan ($10,363) per tonne.

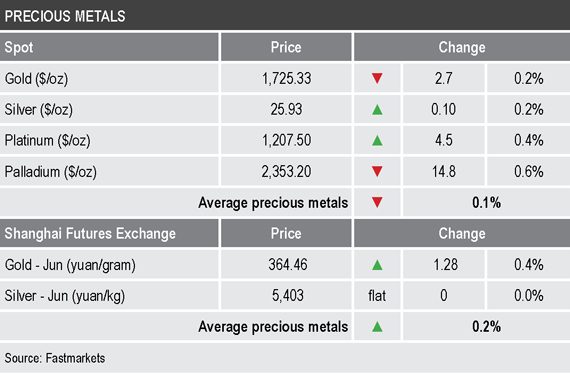

Precious metals

Precious metals were also mixed this morning, with spot gold ($1,725.33 per oz) and palladium ($2,353.20 per oz) lower by 0.2% and 0.6% respectively, while spot silver ($25.93 per oz) and platinum ($1,207.50 per oz) were up by 0.2% and 0.4% respectively.

Wider markets

The yield on US 10-year treasuries has climbed back to the 1.64% level, the highest it has been since February last year, which has lifted the dollar.

Asian-Pacific equities were mixed this morning following record highs on Wall Street on Friday: the ASX 200 (+0.09%), the Nikkei (+0.17%), the CSI 300 (-2.84%), the Kospi (-0.28%) and the Hang Seng (-0.28%). The focus being the weaker CSI and concerns that regulators may step in to prevent runaway prices in some asset classes.

Currencies

The US Dollar Index is firmer this morning and was recently at 91.80, this after pulling back to 91.36 last week.

The other major currencies were slightly weaker: the euro (1.1932), the Australian dollar (0.7733), sterling (1.3919) and the yen (109.24).

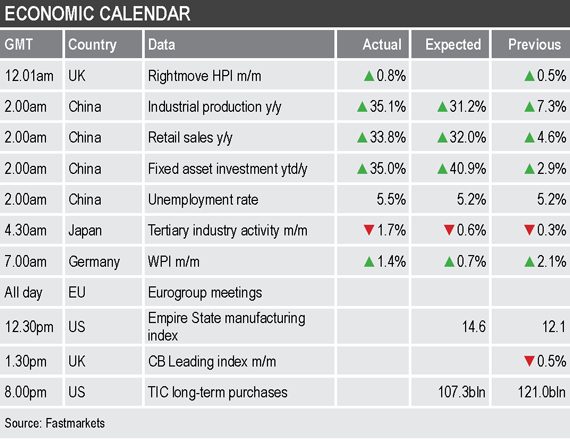

Key data

Key data already out on Monday showed strong year-on-year recovery growth in China’s industrial production, retail sales and fixed asset investment , which was unsurprising given last year’s lockdown in February – see table below for details. The country’s unemployment rate climbed to 5.5% in February, from 5.2% in January. Japan’s tertiary industry activity fell by 1.7% month on month in January, after a 0.3% decline in December.

Later there is data on German wholesale prices (WPI), US Empire State manufacturing index, United Kingdom leading indicators and US long-term capital purchases.

In addition, there are Eurogroup meetings scheduled for today.

Today’s key themes and views

The base metals seem to be consolidating after recent pullbacks. Most of the metals have either held up well, or have recovered well from the early March weakness, the exceptions are nickel and lead that sold off considerably and prices have held down.

The market is wary that all the extra stimulus will be inflationary and whether that will force central banks to tighten monetary policy sooner rather than later, but the messages from central banks seem to be that they are in no hurry to tighten monetary policy. With this in mind, the markets are expected to get more nervous ahead of Wednesday’s Federal Open Market Committee meeting, announcements and press conference.

Gold prices found some support below $1,700 per oz, if the market does become more nervous about inflation and higher bond yields spook equity markets, then with gold prices down by some $350 per oz from their highs, gold may start looking like a cheap safe-haven.