- Tuesday’s US consumer price index (CPI) reading climbed by 0.6% in March, slightly higher than the 0.5% expected…

- …this avoided spooking the bond market, enabling yields to slip and equities to rally

Base metals

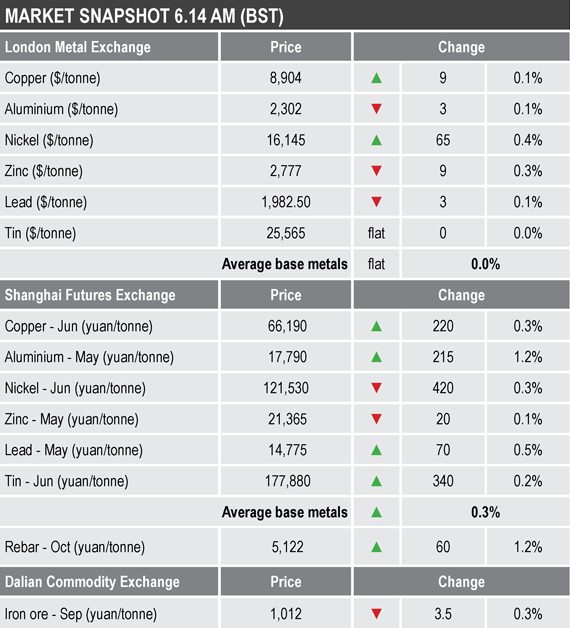

LME three-month base metals prices were mixed this morning and for the most part were little changed with the movements in copper, tin, aluminium and lead lying between -0.1% and +0.1%, while nickel ($16,146 per tonne) was up by 0.4% and zinc ($2,777 per tonne) was down by 0.3%. Copper was recently trading at $8,907 per tonne.

The most-active base metals contracts on the SHFE were more positive than negative, with June nickel and May zinc down by 0.3% and 0.1% respectively, while the rest were up by an average of 0.6%, skewed by a 1.2% rise in May aluminium. Aluminium being lifted by concerns Chinese production might be constrained to meet pollution targets. June copper was up by 0.3% at 66,190 yuan ($10,106) per tonne.

Precious metals

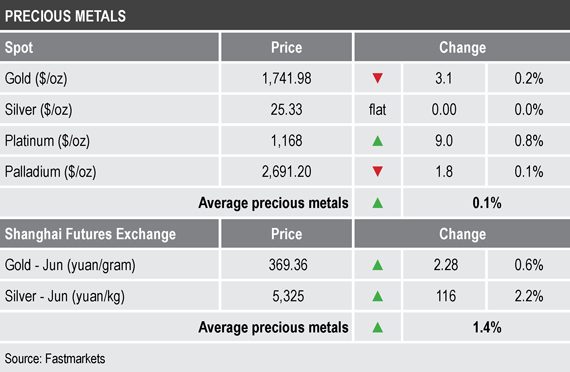

Spot gold prices were down by 0.2% at $1,741.98 per oz this morning, this after a 0.7% rise on Tuesday. Silver ($25.33 per oz) and palladium ($2,691.20 per oz) were little changed, while platinum ($1,168 per oz) was up by 0.8%.

Wider markets

The yield on US 10-year treasuries has slipped to 1.62% this morning, compared with 1.69% at a similar time on Tuesday – the recent high was just shy of 1.78% on March 30.

Asian-Pacific equities were mainly stronger on Wednesday: the CSI 300 (+0.79%), the ASX 200 (+0.69%), the Hang Seng (+1.44%) and the Kospi (+0.5%), while the Nikkei (-0.41%) bucked the trend.

Currencies

In line with the drop in bond yields, the US Dollar Index was weaker this morning and was recently at 91.70, compared with 92.19 at a similar time on Tuesday.

On the back of the weaker dollar, the other major currencies were firmer: the euro (1.1966), sterling (1.3783), the yen (108.85) and the Australian dollar (0.7673).

Key data

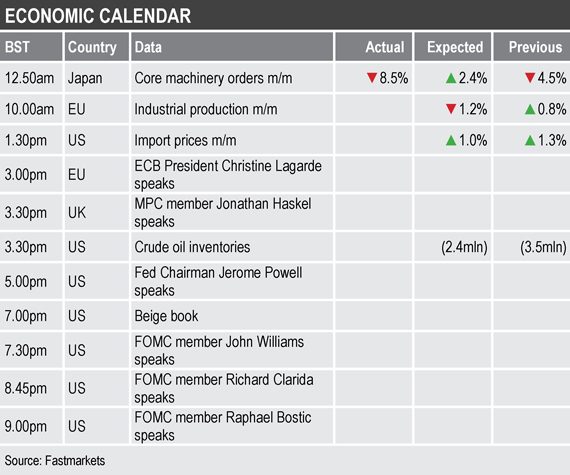

Key data out today includes industrial production from the European Union and US releases on import prices, crude oil inventories and the Beige book.

In addition, many central bankers are scheduled to speak including European Central Bank President Christine Lagarde, UK Monetary Policy Committee member Jonathan Haskel, US Federal Reserve Chairman Jerome Powell and Federal Open Market Committee members John Williams, Raphael Bostic and Richard Clarida.

Today’s key themes and views

Little has changed for the metals; as we said in Tuesday’s Morning View, aluminium looked well place to extend gains and it has now reached a multi-year high of $2,313.50 per tonne, the highest since June 2018. The rest of the metals are stuck in consolidation ranges. After strong runs over the past year, a long drawn-out period of consolidation could follow. While we see potential downside risks on the back of credit tightening in China, or as a result of a broader based equity correction, our overall view remains bullish.

Gold’s rebound on Tuesday looks quite constructive – a weaker dollar and easier bond yields no doubt providing some support, so too maybe the record-setting Bitcoin price.