- United States stimulus and European Central Bank support for a continued low interest rate environment are underpinning sentiment

Base metals

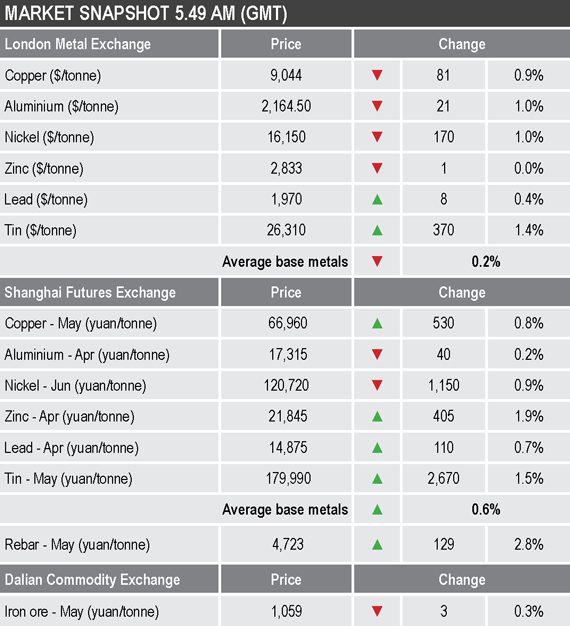

LME three-month base metals prices were mixed this morning with aluminium ($2,164.50 per oz) and nickel ($16,150 per tonne) leading on the down side with losses of 1%, with copper down by 0.9% at $9,044 per tonne. Conversely, tin ($26,310 per tonne) was up by 1.4%, lead ($1,970 per tonne) was up by 0.4% and zinc was little changed at $2,833 per tonne.

The most-traded base metals contracts on the SHFE were more bullish than bearish with June nickel off by 0.9% and April aluminium down by 0.2%, while the rest were in positive territory with gains averaging 1.2%, with May copper up by 0.8% at 66,960 yuan ($10,307 per tonne).

Precious metals

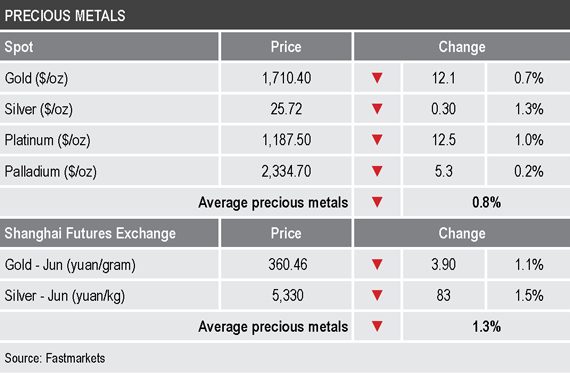

Precious metals were weaker across the board, down by an average of 0.8%, with spot gold down by 0.7% at $1,710.40 per oz. This after Monday’s low at $1,677 per oz.

Wider markets

The yield on US 10-year treasuries has climbed back to the 1.6% level, suggesting a risk-on appetite.

Asian-Pacific equities were mainly bullish this morning following record highs on Wall Street: the ASX 200 (+0.79%), the Nikkei (+1.73%), the CSI 300 (+0.35%) and the Kospi (+1.35%), the exception was the Hang Seng (-1.26%).

Currencies

The US Dollar Index is firmer this morning and was recently at 91.73, this after pulling back to 91.36 from 92.51 earlier in the week.

The other major currencies were weaker after recent days of strength: the euro (1.1946), the Australian dollar (0.77590), sterling (1.3946) and the yen (108.98).

Key data

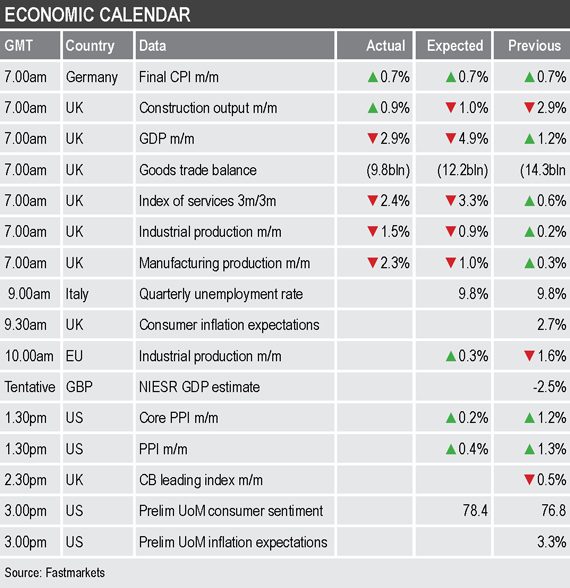

Data already out on Friday showed Germany’s final consumer price index (CPI) rose by 0.7% month on month in February, after a 0.8% increase in January, and data from the United Kingdom showed construction output rose by 0.9% month on month in January, while a host of other UK data, including gross domestic product, trade, manufacturing and industrial production were all weak – see table below.

Later there is data on Italian unemployment, industrial production from the European Union, UK inflation expectations and leading indicators, with US data on producer prices and preliminary data from the University of Michigan on consumer sentiment and inflation expectations.

Today’s key themes and views

The pullbacks have been quite varied across the base metals on the LME, but for the most part prices seem to be consolidating, with lead and nickel looking the weakest and tin rebounding the most.

The market is wary that all the extra stimulus will be inflationary and whether that will force central banks to tighten monetary policy sooner rather than later, but the messages from central banks seem to be that they are in no hurry to tighten monetary policy. For the metals, inflation should be supportive as indeed should the stimulus spending, so if equity markets avoid a sell-off then the overall bull market may have further to run.

Gold’s downward trend dominates and with optimism for a broad-based economic recovery improving, the need for a haven may be dwindling. But that is likely to change when broader markets do finally correct.