So far this week equities and bonds have been rallying on the back of expectations for looser monetary policy, while the base metals have mainly been on a back foot in line with weak economic data.

- Gold prices remain elevated highlighting increased haven demand

- Base metals subdued while economic weakness dominates

Base metals

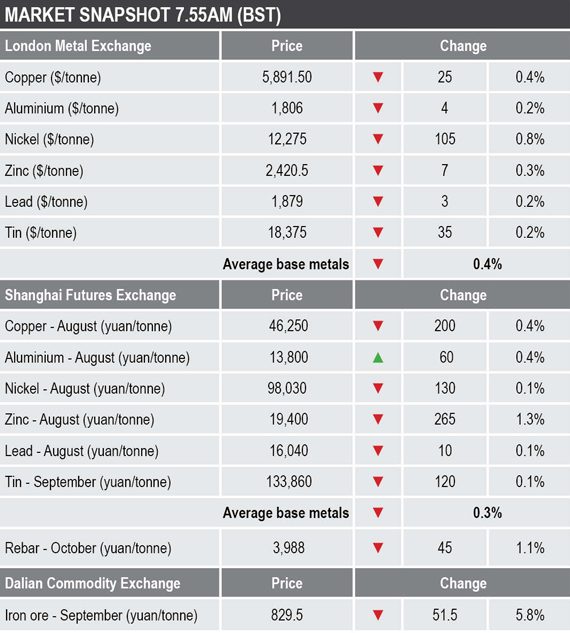

The London Metal Exchange three-month base metals prices were down across the board by an average of 0.3% on Friday morning. Nickel once again led on the downside with a 0.8% fall to $12,275 per tonne, while copper was down by 0.4% at $5,891.50 per tonne and the rest were down between 0.2% and 0.3%.

In China, the base metals prices on the Shanghai Futures Exchange were for the most part weaker; the exception was August aluminium which rose by 0.4%, while August zinc dropped by 1.3% and August copper was down by 0.4% at 46,250 yuan ($6,729) per tonne.

Spot copper prices in Changjiang were down by 0.2% at 46,300-46,410 yuan per tonne and the LME/Shanghai copper arbitrage ratio was at 7.84.

Precious metals

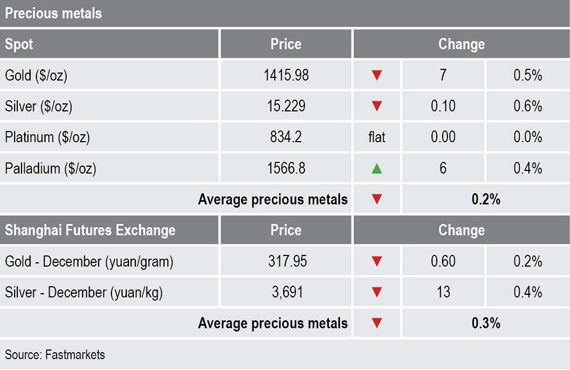

The spot gold price was down by 0.5% this morning and was recently quoted at $1,415.98 per oz, while spot silver is off by 0.6% at $15.23 per oz.

The December gold and silver contracts on the SHFE were down by 0.2% and 0.4% respectively.

Wider markets

The spot Brent crude oil price is treading water at $63.10 per barrel, unchanged from where it was at a similar time on Thursday.

The yield on benchmark US 10-year treasuries remains below the 2% mark again and was recently quoted at 1.9482%, little changed from where it was at a similar time on Thursday, 1.9489%. The German 10-year bund yield still trades in negative territory and was last seen at -0.4000%.

Equities in Asia have for the most part been firmer on Friday: ASX 200 (+0.50%), Nikkei (+0.2%), Kospi (+0.09%), the CSI 300 (+0.52%), the exception being the Hang Seng (-0.09%).

Currencies

The dollar index is challenging recent highs and was recently quoted at 96.87, this after a low last week of 95.84. The rebound has weighed on the euro (1.1266), sterling (1.2573), the Japanese yen (107.98) and the Australian dollar (0.7032).

The yuan is consolidating mid-range, it was recently quoted at 6.8764.

Key data

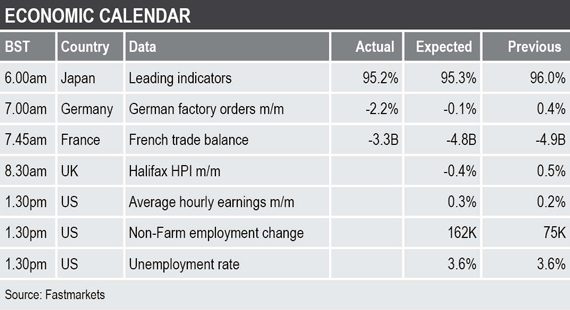

In European data on Friday, German factory orders dropped by 2%, this after two months of light growth, but orders have now fallen for five out of the past seven months. The focus today will be the US employment report, which includes data on average hourly earnings, non-farm employment change and the unemployment rate. Last month’s data release showed a disappointing 75,000 job gains, the market expects 175,000 gains in Friday’s data.

Today’s key themes and views

Most of the base metals prices are meandering sideways while the market range trades. The weakness highlights the slowing global economy that is waiting for a boost from a trade deal. Should the US jobs data show a weaker economy then that might make US President Donald Trump more eager for a US-China trade deal.

Gold prices are consolidating in relatively high ground, today’s US jobs data is likely to provide direction because it is likely to influence the US Federal Reserve’s interest rate decision.