The buoyancy seems to stem from expectations that central banks will continue to pump liquidity into their economies to cushion the economic blow that the novel coronavirus (2019-nCoV) outbreak is causing.

- The yield on benchmark United States 10-year treasuries was recently quoted at 1.09%.

- China official non-manufacturing PMI drops to 29.6 from 54.1.

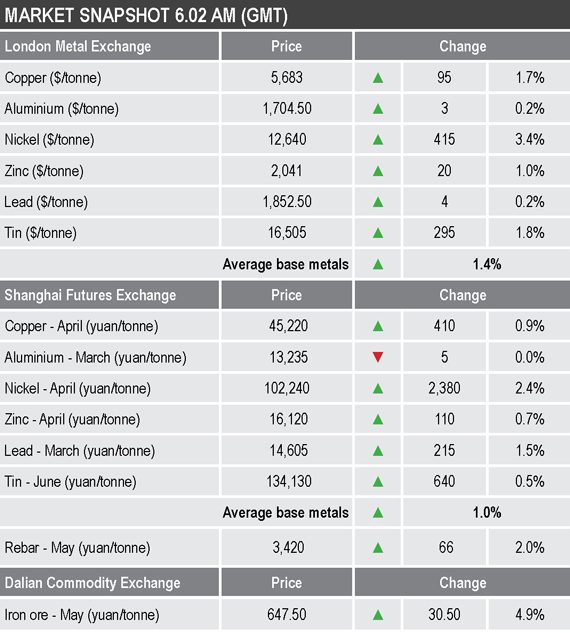

Base metals

The three-month base metals prices on the London Metal Exchange were up across the board by an average of 1.4% this morning, led by a 3.4% rise in nickel to $12,640 per tonne. Copper was up by 1.7% at $5,683 per tonne, this after a low of $5,533 per tonne on Friday, which just held above the February 3 low at $5,523 per tonne and last September’s low at $5,518 per tonne. So for now good support seems evident above the $5,500-per-tonne level.

Trading volume remains high, with 12,553 lots traded as at 6:02 am London time.

The most-traded base metals contracts on the Shanghai Futures Exchange were for the most part stronger, the exception was April aluminium that was marginally down, while the rest were up by an average of 1.2% – led by a 2.4% rise in April nickel. April copper was up 0.9% at 45,220 yuan ($6,467) per tonne.

The spot copper price in Changjiang was up by 0.3% at 44,640-44,900 yuan per tonne, while the LME/Shanghai copper arbitrage ratio was at 7.95, compared with 8.02 on Friday, suggesting LME copper prices are rising more than SHFE prices.

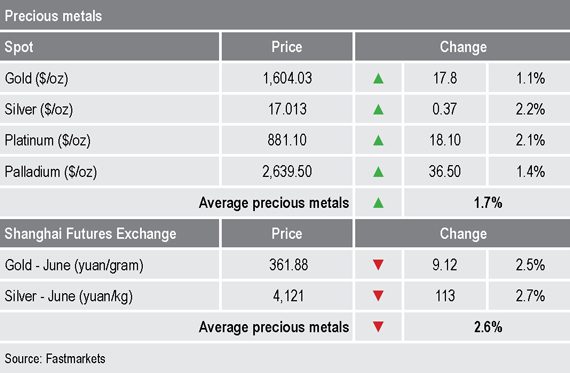

Precious metals

Gold prices are rebounding this morning with the spot gold price up by 1.1% at $1,604.03 per oz, this after Friday’s low of $1,565.30 per oz. Silver, platinum and palladium prices were up by an average of 1.9%.

Wider markets

The yield on benchmark US 10-year treasuries was recently quoted at 1.09%, earlier this morning it set a fresh record low at 1.0347%.

Asian equities were for the most part rebounding this morning: Nikkei (+0.95%), China’s CSI 300 (+3.72%), the Kospi (+0.78%), but the ASX 200 bucked the trend with a fall of 0.77%.

Currencies

Weaker treasury yields are weighing on the dollar, with the dollar index recently quoted at 98.02, compared a peak on February 20 of 99.91, earlier this morning it was as low as 97.86.

The other major currencies we follow are mixed with the euro (1.1041) consolidating recent gains, the yen (108.27) giving back some recent gains, sterling (1.2837) and the Australian dollar (0.6525), consolidating recent weakness.

Key data

Monday’s economic data is focused on PMI data; Japan’s manufacturing PMI edged higher to 47.8 in February from 47.6 and China’s Caixin manufacturing PMI dropped to 40.3 from 51.1 over the same period. Later there is manufacturing PMI out across Europe and the US.

In addition, there is data from the United Kingdom on M4 money supply and lending as well as US releases on construction spending and manufacturing prices from the Institute for Supply Management.

Today’s key themes and views

The rebound in metal prices in the face of extremely weak Chinese PMI data suggests prices had already discounted the extent of the bad news, while at the same time seeing the bad news is likely to prompt an even bigger supporting response from government agencies. But, the bad news does mean weak demand for metals for a while, at least until traders start to anticipate supply lines being restocked. Given the time delays between when exports in China were first disrupted and when shipments stop arriving at destinations, we expect the hit to manufacturing around the world still lies ahead and that will further damage demand. As such, we expect any rebound to be limited.

The extent of the fall in gold prices last week seemed overdone, but if the distressed selling has now run its course then the secondary reaction, one of haven buying, may now dominate. Especially, because the opportunity cost of holding gold is falling given weak treasury yields, a weaker dollar and jittery equity markets.