This sent equities scurrying for cover with the Nikkei, Hang Seng and CSI 300 off by an average of 2.2% on the morning of Friday August 2, while gold prices approached recent highs again overnight as investors sought out havens.

- Dow Jones Industrial Average closed down by 1.05%.

- Gold prices reached a high of $1,448.80 per oz.

- All eyes on US monthly employment report for any signs of weakness.

Base metals

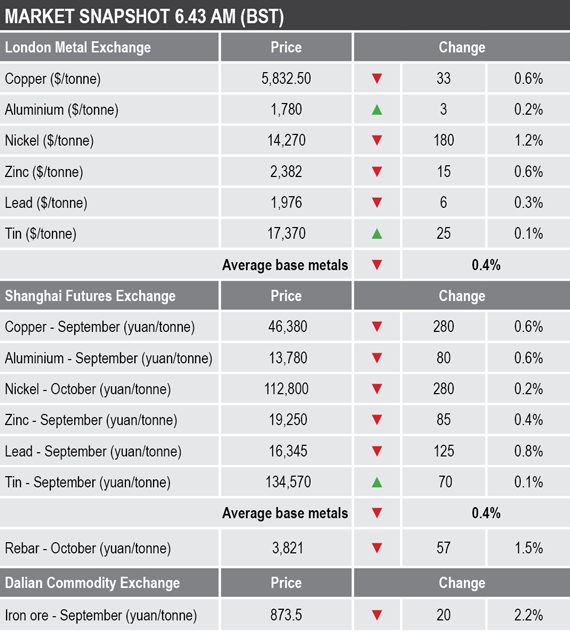

With the exception of aluminium and tin, the three-month base metals prices on the London Metal Exchange were down between 0.3% for lead and 1.2% for nickel on Friday morning, while copper and zinc were both down by 0.6%, with the former at $5,832.50 per tonne. The lows in copper in June and July were at $5,740 and $5,791 per tonne respectively. Tin and aluminium were up by 0.1% and 0.2% respectively.

In China, base metals prices on the Shanghai Futures Exchange were for the most part weaker on Friday, the exception was September tin that was up by 0.1%. The rest of the complex were down by an average 0.5%, with September copper off by 0.6% at 46,380 yuan ($6,722) per tonne.

Spot copper prices in Changjiang were down by 0.5% at 46,320-46,420 yuan per tonne and the LME/Shanghai copper arbitrage ratio was stronger at 7.95 compared with 7.89 on Thursday – the rise in the ratio suggesting LME copper prices have been harder hit than those in Shanghai.

Precious metals

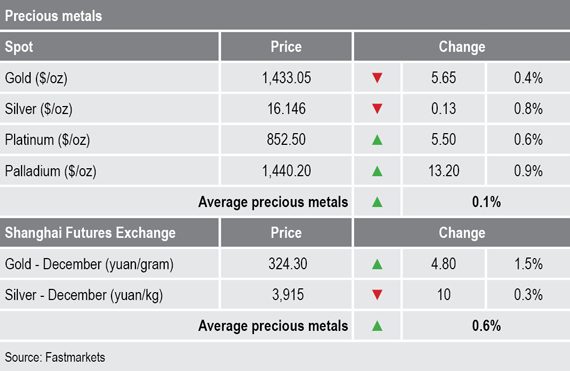

Spot gold prices suffered in the aftermath of Wednesday’s US Federal Open Market Committee (FOMC) stance that was not as dovish as the market had expected, with prices knocked to a low of $1,400.60 per oz. They shot back up to $1,448.80 per oz on Thursday evening after the latest tariff announcements – this just shy of the July high at $1,453 per oz. Silver prices rebounded, but not to the same extent as gold and the same was true for the platinum group metals.

On the SHFE, the December gold contract was up by 1.5% while the December silver contract was down by 0.3% – this highlighting that gold is up on haven demand, while the more industrial precious metals have struggled on the upside.

Wider markets

The spot Brent crude oil price has collapsed after the trade blow further threatens global growth – it was recently quoted at $61.90 per barrel, down from $64.34 per barrel at a similar time on Thursday.

The yield on benchmark US 10-year treasuries has also collapsed while haven demand increases, it was recently quoted at 1.8866% compared with 2.0522% at a similar time on Thursday. The German 10-year bund yield has continued to weaken – it was recently at -0.4840% compared with -0.4290% on Thursday morning.

In equities, Asian indices were weaker: Nikkei (-2.3%), Hang Seng (-2.2%), Kospi (-0.95%), the CSI 300 (-2.1%) and the ASX200 (-0.45%).

This follows a mixed performance in western markets on Thursday. In the United States the Dow Jones Industrial Average closed down by 1.05% at 26,583.42 and in Europe the Euro Stoxx50 closed up by 0.67% at 3,490.03. European markets closed before Trump made his tariff announcement.

Currencies

The dollar index reached a high of 98.94 on Thursday, but it has since dropped back to 98.34, the weakness in treasury yields and equites seem to be becoming a headwind for the dollar and that has seen some diversification into the Japanese yen (106.98) and euro (1.1083).

But the Australian dollar (0.6814) and sterling (1.2112) remain weak.

Key data

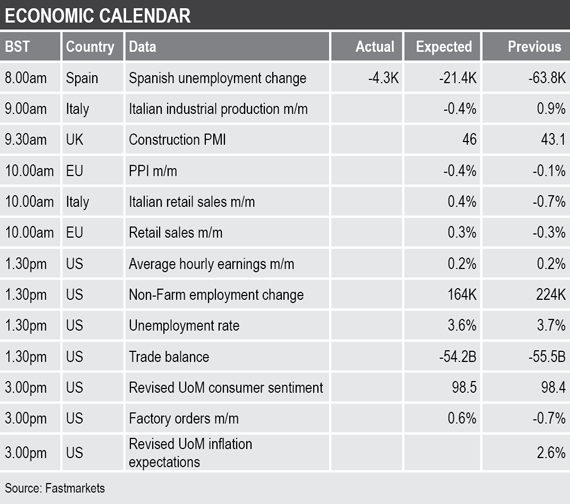

The economic agenda is busy on Friday with data on Spanish unemployment, Italian industrial production and retail sales, EU retail sales and producer price index and UK construction figures.

US data on Friday focuses mainly on the monthly employment report but other notable releases include the trade balance, University of Michigan consumer sentiment and inflation expectations and factory orders.

Data out late on Thursday showed US total vehicle sales dropped to an annualized rate of 16.8 million units in July, down from 17.3 million units in June.

Today’s key themes and views

The base metals are quite mixed; tin is in low ground and is looking particularly weak, copper, aluminium and zinc have given back a large part of their June/July gains and prices are back in areas where we would expect support, while lead and nickel are holding up considerably better. We wait to see if support levels hold.

Gold’s reaction to latest trade developments, combined with the run-up in the yen, highlight the market is nervous about the current setup. Given the uncertainty surrounding trade, Iran, Brexit, global growth and the potential for US equity corrections following their record-breaking runs, there plenty of reasons why investors may like the insurance that havens offer. In addition, the fact the dips in gold continue to be short-lived is another sign of a robust market.