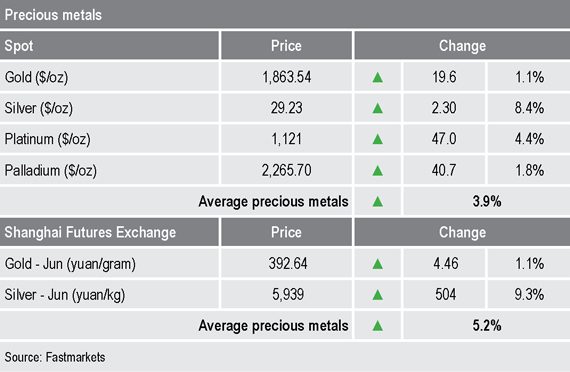

But perhaps most noteworthy has been the 8% rally in spot silver that has surpassed $29 per oz to challenge last August’s high.

- March tin lower on Shanghai Futures Exchange despite a military coup in Myanmar

- China’s manufacturing PMI fell to 51.3 in January from 51.9 December

- China’s non-manufacturing PMI fell to 52.4 in January from 55.7 in December

Base metals

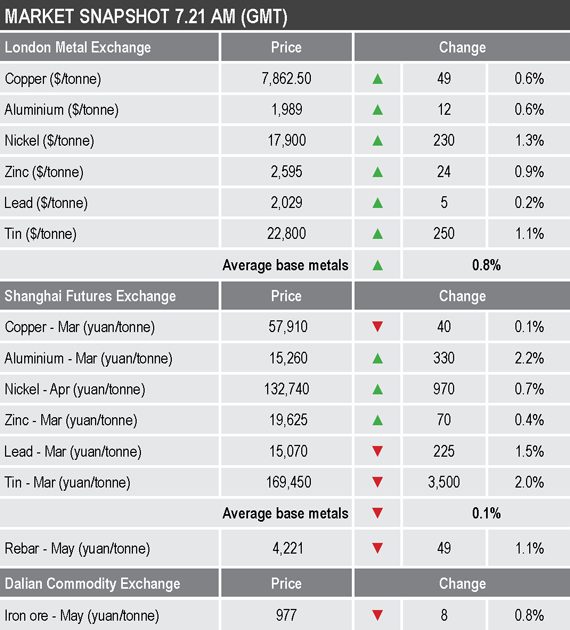

Three-month aluminium prices on the LME were up across the board by an average of 0.8%, led by a 1.3% rise in nickel ($17,900 per tonne), followed by a 1.1% rise in tin ($22,800 per tonne), while copper was up by 0.6% at $7,862.50 per tonne.

The most-traded base metals contracts on the SHFE were quite polarized with March aluminium leading on the upside with a 2.2% gain, while March tin was down by 2% and March lead was down by 1.5%. Copper was little changed at 57,910 yuan ($9,008) per tonne.

Precious metals

Spot silver ($29.23 per oz) was up by 8.4%, while retail investors target silver probably in an effort to try to unsettle shorts. Spot gold ($1,863.54 per oz) was up by 1.1%, while platinum ($1,121 per oz) and palladium ($2,265 per oz) were up 4.4% and 1.8% respectively.

Wider markets

Despite nervousness in broader markets, the yield on US 10-year treasuries has climbed to 1.08% this morning, up from 1.05% at a similar time on Friday – the recent high was at 1.18%.

Asian-Pacific equities were up across the board this morning: the Hang Seng (+2.06%), the Kospi (+2.7%), the ASX 200 (+0.84%), the CSI (+1.23%) and the Nikkei (+1.55%).

Currencies

The US Dollar Index is consolidating below recent highs and was recently quoted at 90.58, just below the 90.68 level where it was at a similar time on Friday

The other major currencies were mixed this morning: the euro (1.2122) and the Australian dollar (0.7652) were consolidating, sterling (1.3741) was just below recent highs and the yen (104.70) was weakening.

Key data

Monday has a busy economic agenda. Data already out showed Japan’s final manufacturing PMI at 49.8 in January, compared with 50 in December, and China’s Caixin manufacturing PMI fell to 51.5 in January from 53 in December. In addition, German retail sales fell by 9.6% month on month in December, after a 1.1% rise a month earlier.

Later there is manufacturing PMI out across Europe and the United States, Italian and EU unemployment rates and data on lending and money supply in the United Kingdom.

Other US releases include construction spending and data from the loan officer survey.

In addition, US Federal Open Market Committee Raphael Bostic is scheduled to speak.

Today’s key themes and views

The gains on the LME seem at odds with the slowdown in manufacturing in China, but it appears that supply concerns, firmer premiums and low treatment charges in a number of the metals are underpinning sentiment. Adverse weather in the northern hemisphere, highs seas affecting shipments from Chile and the potential for more Covid-19 supply disruptions seem to be encouraging consumers to hold more stock.

Despite the apparent support being seen this morning, the metals do seem to have lost upward momentum recently so remain vulnerable overall. While we remain long-term bullish toward the base metals on account of expecting more infrastructure spending, we would not be surprised to see further consolidation as the market adjusts to these already high prices.

Any run-up in silver prices is likely to be an aberration and turn into a spike, so we expect increased volatility. It will be interesting to see to what extent gold and the platinum group metals follow silver.