- Asian equities are firmer led by a 1.2% rise in the Hang Seng.

- European equities open firmer too – suggesting virus scare may not be a headwind for now.

Base metals

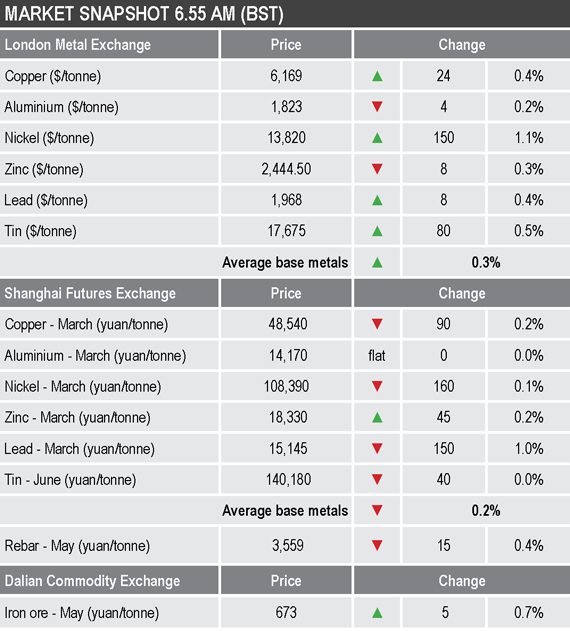

Three-month base metals prices on the LME were mixed this morning, with aluminium and zinc prices off by 0.2% and 0.3% respectively, while the rest were up by an average of 0.6% – led by a 1.1% rise in nickel to $13,820 per tonne. Copper was up by 0.4% at $6,169 per tonne.

Trading volume has been above average with 7,798 lots traded as of 6.55am London time.

In China, the most-traded base metals contracts on the Shanghai Futures Exchange were also mixed. March lead was down the most with a 1% fall, March nickel and copper were off by 0.1% and 0.2% respectively, with copper recently quoted at 48,540 yuan ($7,033) per tonne, while June tin was little changed. March aluminium was unchanged, while March zinc was up by 0.2%.

The spot copper price in Changjiang was down by 0.4% at 48,150-48,320 yuan per tonne and the LME/Shanghai copper arbitrage ratio was at 7.88, compared with 7.85 on Tuesday – the increase in LME copper stocks no doubt weighing on LME copper.

Precious metals

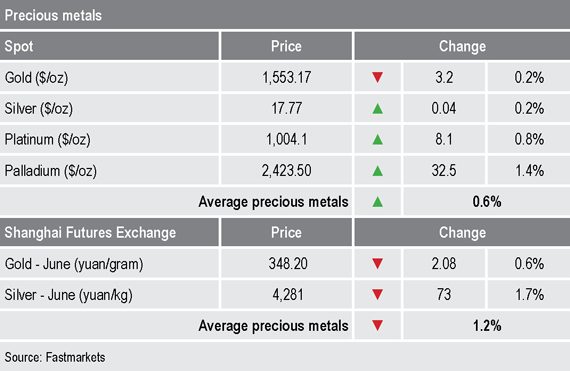

Spot gold prices are drifting and were recently quoted at $1,553.17 per oz, highlighting the market has avoided getting too worried over the fallout from the coronavirus scare. Silver, platinum and palladium all pulled back on Tuesday, but are rebounding this morning.

Wider markets

The yield on benchmark US 10-year treasuries was recently quoted at 1.78%, down from 1.80% compared with a similar time on Tuesday, and the German 10-year bund yield was recently quoted at -0.24%, compared with -0.22% at a similar time on Tuesday.

Asian equities were up across the board this morning: the Nikkei (0.7%), the Kospi (1.23%), China’s CSI 300 (0.43%), the ASX 200 (0.94%) and the Hang Seng (1.33%).

This follows a weak performance in Western markets on Tuesday, where in the United States, the Dow Jones Industrial Average closed down by 0.52% at 29,196.04; in Europe, the Euro Stoxx50 closed down by 0.26% at 3,789.12.

Currencies

The dollar index has run into resistance at around 97.60, this after a low of around 96.20 at the start of the year, although the medium term trend remains downward. While the dollar is firm, most of the other major currencies we follow are on a back footing: the euro (1.1085) the yen (109.99) and the Australian dollar (0.6839), although sterling (1.3050) is working higher.

The Chinese yuan (6.9005) is consolidating after two days of virus-related weakness.

Key data

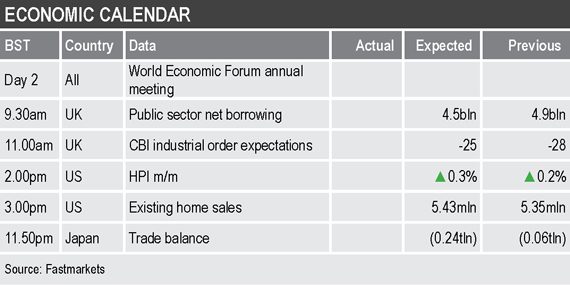

The main economic releases today include data on United Kingdom industrial order expectations, US house prices and US existing home sales, followed by Japan’s trade balance data late this evening.

In addition, it is day two of the World Economic Forum in Switzerland.

Today’s key themes and views

The base metals are looking quite mixed. Copper was hit on Tuesday by the stock rise, before that it was consolidating recent months’ gains. Aluminium is attempting to push higher, as are zinc and tin, while nickel is drifting and lead is attempting to rebound after its latest pull-back. We expect choppy trading ahead of and during the Lunar New Year holiday, but there after there could well be room for some optimism post the signing of the phase-one US-Sino trade deal if economic data shows a recovery.

Gold prices have held up well, but they may struggle to continue doing so if optimism for a stronger global economy unfolds after the Lunar New Year holiday. That said, the trend remains upward, the US Federal Reserve is on hold and with many equity indices at, or near, record, or multi-year highs, gold holdings may remain elevated as an insurance against a broader market correction.