- Asian equities are weaker, led by a 2.7% decline in the Hang Seng.

- Hong Kong’s credit rating was cut one position to Aa3 by ratings agency Moody’s for its handling of the unrest in the country.

Base metals

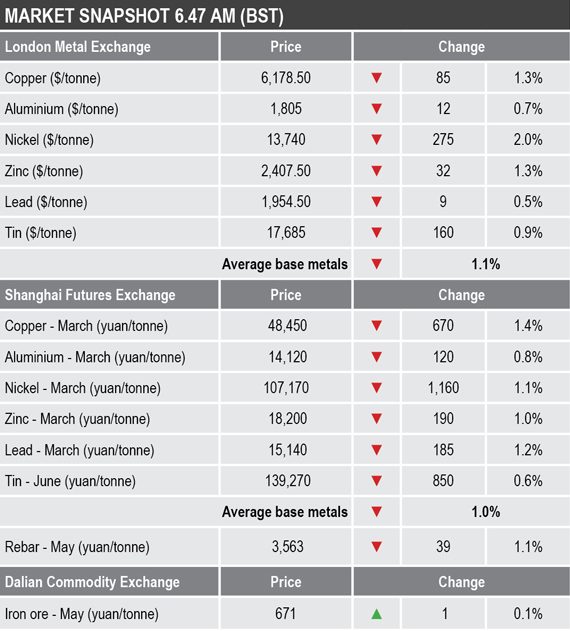

Three-month base metals prices on the London Metal Exchange were down across the board by an average of 1.1% this morning, led by a 2% fall in nickel to $13,740 per tonne, while copper was down by 1.3% at $6,178.50 per tonne.

Trading volume has been high with 10,285 lots traded as of 6.47am London time, compared with 4,452 lots at a similar time on Monday.

In China, the most-traded base metals contracts on the Shanghai Futures Exchange were also down across the board by an average of 1%, led by a 1.4% fall in March copper to 48,450 yuan ($7,058) per tonne.

The spot copper price in Changjiang was down by 0.9% at 48,150-48,700 yuan per tonne and the LME/Shanghai copper arbitrage ratio was at 7.85, compared with 7.80 at a similar time on Monday.

Precious metals

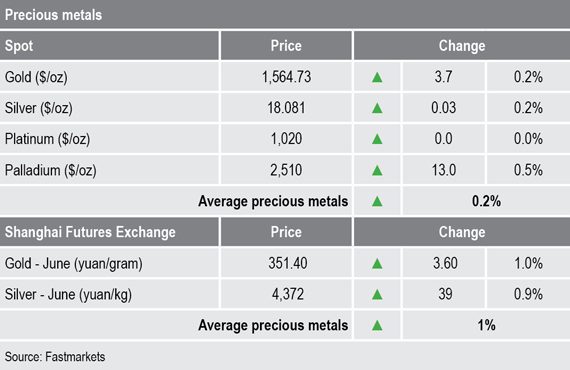

Spot gold prices are holding up well and were recently quoted at $1,564.73 per oz, silver is firm at $18.08 per oz, as is platinum at $1,020 per oz, while palladium continues with its strong advance – it was recently quoted at $2,510 per oz.

Wider markets

The yield on benchmark US 10-year treasuries was recently quoted at 1.8000%, while the German 10-year bund yield was recently quoted at -0.2200%.

Asian equities were down across the board this morning: the Nikkei (-0.91%), the Kospi (-1.01%), China’s CSI 300 (-1.71%), the ASX 200 (-0.19%) and the Hang Seng (-2.72%).

This follows a weaker performance in Western markets on Monday, where in Europe, the Euro Stoxx50 closed down by 0.24% at 3,799.03.

Currencies

The dollar index is firmer at 97.60, this after a low of around 96.20 at the start of the year, although the medium term trend remains downward. While the dollar is firm, the other major currencies we follow are consolidating near recent lows: sterling (1.3001), the euro (1.1093) the yen (109.94) and the Australian dollar (0.6855).

The Chinese yuan (6.9049) has weakened today, in line with nervousness over the virus.

Key data

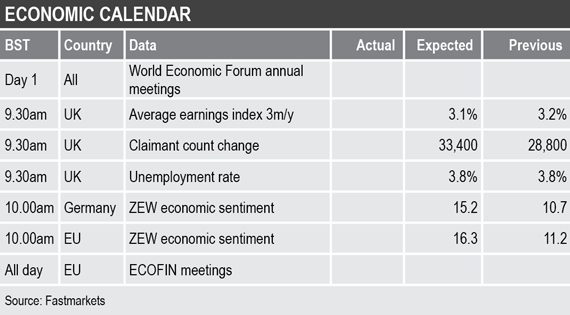

The main economic releases today include data on German and European Union economic sentiment from Germany-based think tank Zentrum fur Europaische Wirtschaftsforschung (ZEW) and the United Kingdom’s employment report.

In addition, at the World Economic Forum’s annual meeting in Davos, Switzerland, United States President Donald Trump is scheduled to speak at around 10.30am London time.

Today’s key themes and views

The combination of book squaring ahead of the Lunar New Year holidays (January 24-30) and the uncertainty surrounding the virus outbreak in China, has unnerved the market. Key now will be how unsettled the market becomes in this period when liquidity is likely to get thinner ahead of and during the Lunar New Year celebrations.

Gold prices are holding up well, but it is interesting that prices have not rallied further given the virus outbreak – this suggests that a good part of today’s price weakness may just be profit-taking rather than positioning for a health crisis.